YTL Power Rallies to Fresh High as Analysts Bullish on PowerSeraya’s Robust Earnings

edgeinvest

Publish date: Wed, 31 Jan 2024, 01:43 PM

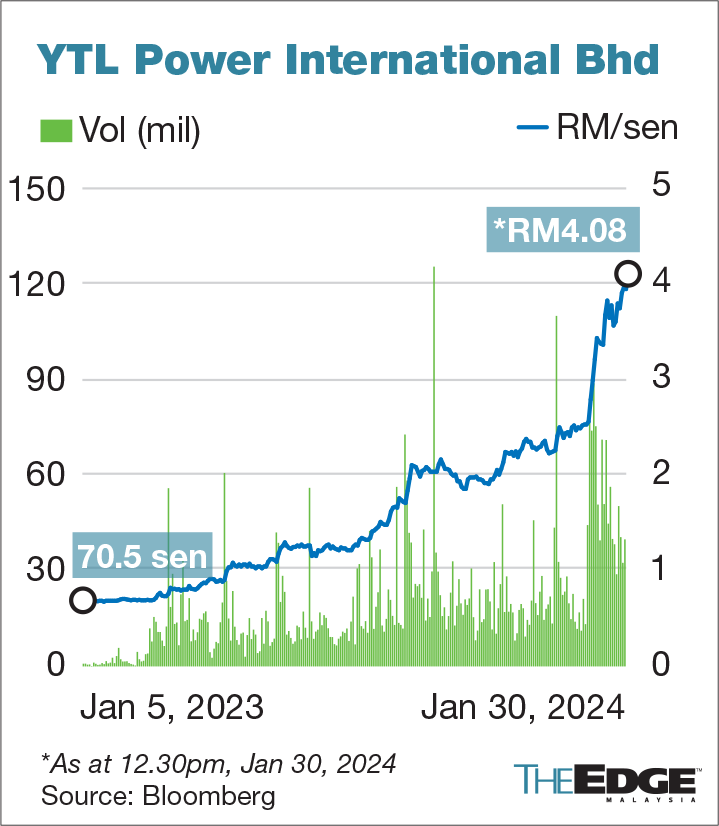

KUALA LUMPUR (Jan 30): Shares of YTL Power International Bhd climbed to a fresh high of RM4.22 on Tuesday morning as analysts are upbeat on robust earnings from its Singapore business PowerSeraya and gradual improvements from its UK division, Wessex Water.

YTL Power, which was among the top 10 gainers and most active stocks at the time of writing, pared its gains at RM4.08 — 13 sen or 3.29% higher than the previous day’s close of RM3.95 — giving it a market capitalisation of RM33.29 billion.

Trading volume rose 12.95% to 32.67 million compared to Monday’s trading volume and was 41.49% higher than the 200-day average volume of 23.09 million.

The counter has risen over 58% year-to-date and 458% in the past year.

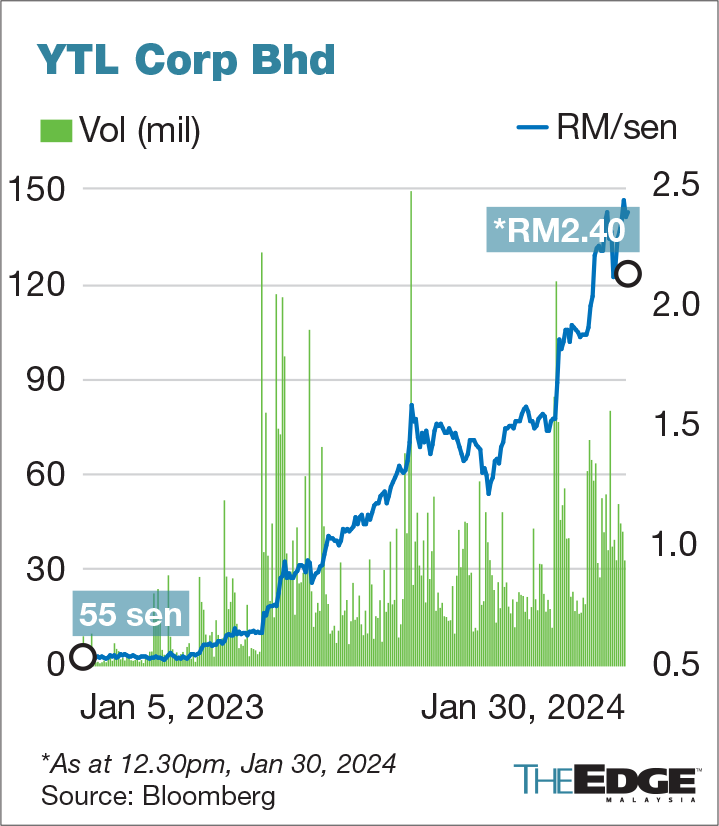

The rally in YTL Power is also boosting the share price of its parent company YTL Corp Bhd, the 14th active stock on the local bourse.

YTL Corp’s share price climbed to a high of RM2.50 on Tuesday before trimming its gains to RM2.41. At the current price, the group was valued at RM26.57 billion while trading volume stood at 29.03 million.

On Monday, YTL Power, through its wholly owned Singapore unit PowerSeraya secured the first request for proposal under Energy Market Authority’s centralised process to build a 600MW hydrogen-ready combined cycle gas turbine (CCGT) at its Pulau Seraya Power Station site.

The CCGT will be at least 30% volume hydrogen-ready and is estimated to cost S$800 million (RM2.82 billion) and targeted to be completed by December 2027.

In a note on Tuesday, Kenanga Research said it was positive on the latest development of the power plant, saying it will boost PowerSeraya’s earnings and improve its environmental, social and governance (ESG) score.

“Assuming S$800 million capex with 80:20 debt-to-equity ratio, 21-year concession period and IRR [internal rate of return] of 10%, it would add 13 sen to YTL Power’s SOP [sum-of-parts] valuation”.

“Separately, we revisit our valuation for YTL Power’s data centre investment, benchmarking it against SGX-listed Keppel DC REIT. At present, the market values Keppel DC REIT with a capacity of 300MW in its entirety at an enterprise value of S$4.27 billion or RM14.9 billion, translating to RM49.7 million/MW.

“Based on RM49.7 million/MW, YTL Power’s entire 500MW data centre carries a gross value of RM24.91 billion. Having deducted the development cost of RM15.0 billion and discounted to net present value, we arrive at a valuation of RM7.02 billion (versus our previous DCF [discounted cash flow] valuation of RM2.65 billion based on 150MW capacity at a discount factor of 7.8%),” said Kenanga.

Kenanga, which maintained its ‘outperform’ rating on YTL Power, upgraded its SOP-derived target price (TP) by 34% to RM4.10 from RM3.06 as the research house upgraded its data centre valuation to 86 sen a share from 33 sen a share.

“[We also] added 13 sen/DCF share for the new CCGT plant, and imputed a new YES valuation of 24 sen based on actual book value of RM1.95 billion as per FY2023,” it added.

Meanwhile, RHB Research also maintained a ‘buy’ rating on YTL Power and raised its TP to RM4.69 from RM2.95 as the research house is positive on the group given PowerSeraya's robust earnings and gradual improvements at Wessex Water.

The research house has raised its earnings forecasts for YTL Power by 14% to 56% for the financial year ending June 30, 2024 (FY2024) to FY2026, mainly due to higher contributions from PowerSeraya.

“Our TP is also lifted to RM4.69 with the incorporation of higher PowerSeraya and AI-DC [artificial intelligence-data centre] valuations (12x EV/Ebitda [enterprise value/earnings before interest taxes depreciation and amortization]). We also incorporated a 2% ESG discount based on YTL Power’s ESG score of 2.9 vis-à-vis the 3.0 country median,” it said in a separate note dated Jan 29.

“As for the recent Nvidia AI-DC collaboration, our preliminary estimates suggest a full ramp-up in the 100MW AI-DC could generate average gross annual net earnings of S$130 million (60% attributable to YTL Communications),” RHB added.

Source: TheEdge - 31 Jan 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on CEO Morning Brief

Created by edgeinvest | May 09, 2024

Created by edgeinvest | May 09, 2024

Created by edgeinvest | May 09, 2024

Created by edgeinvest | May 09, 2024