IPO - SSF Home Group Berhad (Part 1)

MQTrader Jesse

Publish date: Wed, 13 Sep 2023, 10:26 AM

Company Background

The Company was incorporated in Malaysia under the Companies Act 1965 on 24 April 2015, as a private limited company under the name of Smart APP Outlet Sdn Bhd. On 18 November 2019, they changed the name to SSF Home Living Sdn Bhd and subsequently on 19 December 2022, the company assumed the name of SSF Home Group Sdn Bhd. On 18 January 2023, they converted into a public limited company and adopted its present name.

The Company is principally an investment holding company. The Group structure as at LPD is as follows:

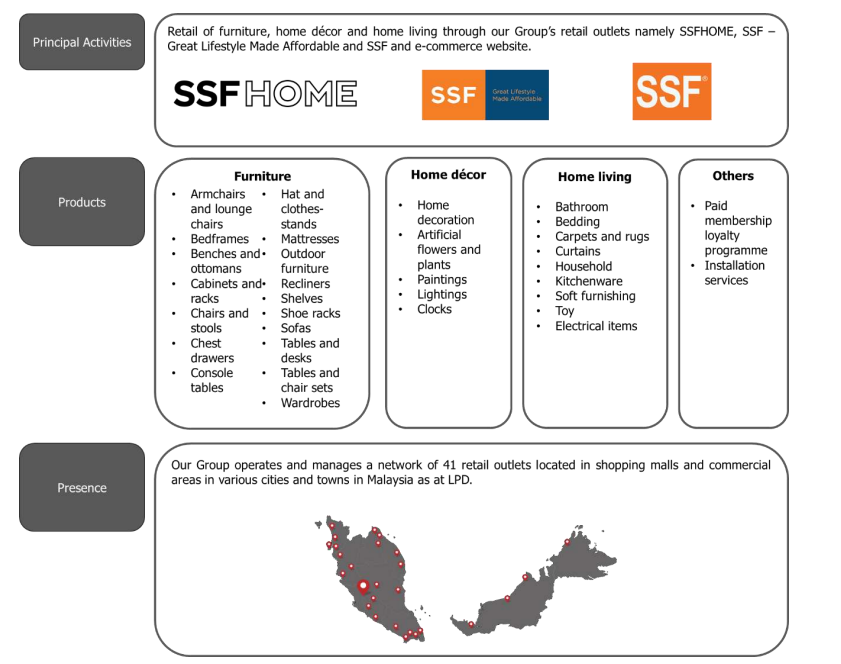

Through the subsidiaries, the company is principally involved in the retail of furniture, home décor and home living products via its retail channel (retail outlets) and online channel (ecommerce website). They offer a comprehensive range of furniture, home décor and home living products for use in various applications and settings.

Use of proceeds

- Set-up new retail outlets

- Capital expenditure - 28.5% (within 36 months)

- Start-up costs - 41.9% (within 48 months)

- Repayment of bank borrowings - 10.0% (within 3 months)

- Marketing activities - 3.0% (within 24 months)

- General working capital - 8.0% (within 12 months)

- Estimated listing expense - 8.6% (Immediately)

Set-up new retail outlets - 70.4% (within 36 - 48 months)

The company manages and operates 41 retail outlets nationwide with a total retail

space of approximately 1,026,504 sq ft. The company intends to strengthen its market presence by expanding the network of retail outlets throughout Malaysia. The company plans to utilise RM35.19 million to set-up 18 new retail outlets nationwide to increase the brand visibility and customer base, details of which are as follows:

The company strategy is to rent and set up new retail outlets at convenient and high foot traffic locations which include shopping malls and individual retail outlets located in commercial areas. The company plans to set up 6 retail outlets within first year of the Listing, another 6 retail outlets in the second year and lastly another 6 retail outlets in the third year.

(a) Capital expenditure - 28.5% (within 36 months)

The proceeds of RM14.22 million will be used as capital expenditure for renovation and purchase of equipment for the new retail outlets, details of which are as follows:

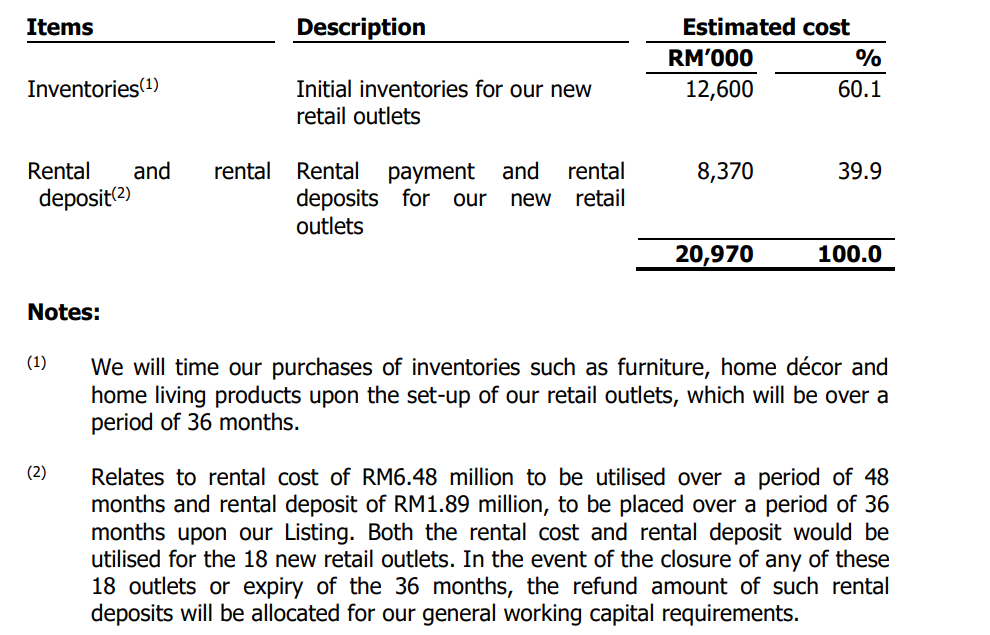

(b) Start-up costs - 41.9% (within 48 months)

The proceeds of RM20.97 million will be used as start-up costs for the 18 new retail outlets, details of which are as follows:

Repayment of bank borrowings - 10.0% (within 3months)

The company has allocated RM5.00 million to partially repay the bankers’ acceptance which was mainly drawn down to finance the general working capital requirements. The details of its bankers’ acceptance as at LPD are set out as follows:

The company intends to utilise up to RM5.00 million from the IPO proceeds to repay these loans. The expected interest savings from the repayment of the bankers’ acceptance based on a revolving tenure of 150 days are approximately RM0.09 million based on the interest rate of 4.3% to 4.6% per annum as tabulated above. However, the actual interest savings may vary depending on the then-applicable interest rates. The repayment of bank borrowings is to improve the cash flow position of the Group.

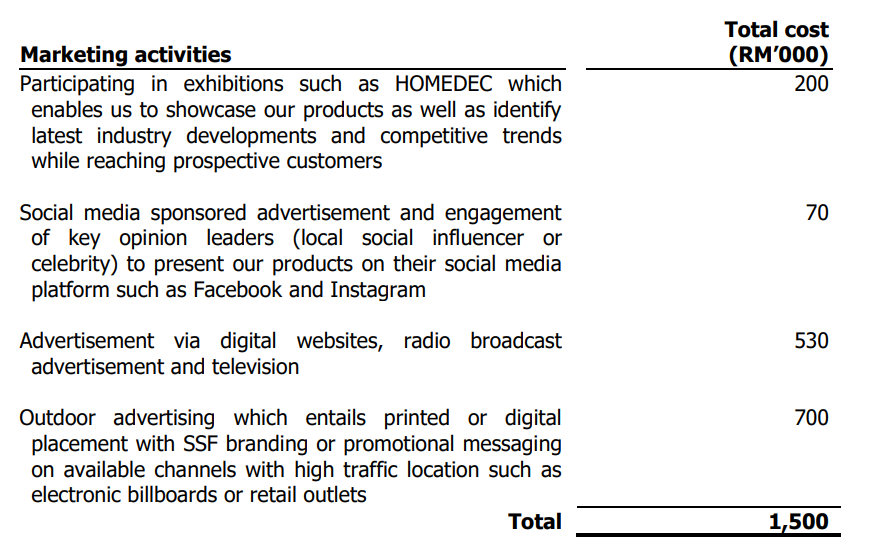

Marketing activities - 3.0% (within 24 months)

The company had allocated RM1.50 million for marketing activities to increase its brand visibility and enhance product awareness throughout Malaysia, as follows:

General working capital - 8.0% (within 12 months)

A total of RM4.01 million of the proceeds has been earmarked to replenish the existing inventories such as furniture, home décor and home living products to support its business growth. For FYE 2020 to 2023, the company purchases of inventories amounted to RM78.00 million, RM97.81 million, RM80.19 million and RM65.57 million respectively.

Business model

The company is principally involved in the retail of furniture, home décor and home living products available via its retail channel (retail outlets) and online channel (e-commerce website). The company offers a comprehensive range of furniture, home décor and home living products for use in various applications and settings.

The company manages and operates all 41 retail outlets under 3 retail brands, namely “SSFHOME”, “SSF – Great Lifestyle Made Affordable” and “SSF”, with a total retail space of approximately 1,026,504 sq ft located in shopping malls, shop lots and standalone outlets in commercial areas. There is no differentiation in the target market for each of the 3 retail brands, as the different retail brand serves to increase the Group’s market presence. All the retail outlets will eventually be rebranded to “SSFHOME” by 4th quarter of 2024. The company has established its presence in cities and towns nationwide which include Johor, Kedah, Kelantan, WP, Melaka, Negeri Sembilan, Pahang, Penang, Perak, Sabah, Selangor, Sarawak and Terengganu.

The company adopts visual merchandising strategies such as window displays, house displays, concept displays and eye-level displays in the retail outlets to present its wide range of products across various designs, styles, themes and in-store displays. This enables the customers to envision how to apply the products in their homes with interior design inspirations. The retail outlets incorporate forced-path layout, where customers are guided through a pre-determined path at the retail outlet to maximise their exposure to its products.

Click here to continue the IPO - SSF Home Group Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)