IPO - Feytech Holdings Berhad (Part 1)

MQTrader Jesse

Publish date: Mon, 06 May 2024, 12:14 PM

Company Background

The Company was incorporated in Malaysia under the Act on 11 April 2023 as a private limited company under the name of Feytech Holdings Sdn Bhd. On 24 August 2023, the Company was converted into a public company and assumed its present name. The Company became the investment holding company of Gosford Malaysia, Feytech SB, Trimex Malaysia, Gosford Singapore and Trimex Australia following the completion of the Acquisitions on 11 March 2024.

Through its Subsidiaries, the company is principally an automotive cover manufacturer and automotive seat manufacturer based in Malaysia. The Group structure is as follows:

Use of proceeds

- Acquisition of land - 10.1% (within 6 months)

- Construction of a new corporate office with manufacturing plant and warehouse - 18.4% (within 24 months)

- Construction of new Kulim Plant 2 - 16.4% (within 24 months)

- Purchase of new machineries - 2.6% (within 12 months)

- Working capital - 45.5% (within 12 months)

- Estimated listing expenses - 7.0% (Immediate)

Acquisition of land - 10.1% (within 6 months)

The company has earmarked RM11.6 million from the gross proceeds of the Public Issue for the acquisition of a piece of land to be identified to construct its new corporate office with manufacturing plant and warehouse in Klang Valley area.

The Group currently rents the PJ Hub (which is a factory with 2-storey office block having an approximate built-up area of 12,667.5 sq ft) from a third party as sales and installation hub. The PJ Hub mainly comprises the offices for its Sales and Marketing department for REM and PDI segments for central region and Business Development department for OEM segment as well as installation hub for repair and/or replacement of customised automotive seat covers that are sold to PDI and REM market segments.

The current PJ Hub has been fully utilised and does not have sufficient space for the company to increase their headcount and storage space. As part of the Group’s expansion plan to better serve its customers in the central region of Malaysia, the Group intends to acquire a piece of land with an approximate land area of 3 acres or 130,680 sq ft to construct the new corporate office with manufacturing plant and warehouse.

The company intends to procure bank borrowings to finance approximately 70% of the purchase consideration for the land (i.e. approximately RM22.9 million based on the estimated land cost of RM32.7 million) while the remaining purchase consideration for the land of RM9.8 million and the relevant transaction costs such as stamp duty and legal fees shall be funded via the proceeds of RM11.6 million from its IPO allocated to fund part of the land cost.

Construction of a new corporate office with manufacturing plant and warehouse - 18.4% (within 24 months)

The company has earmarked approximately RM21.1 million from the gross proceeds of the Public Issue for the construction of its new corporate office with manufacturing plant and warehouse on the land to be acquired in the Klang Valley area.

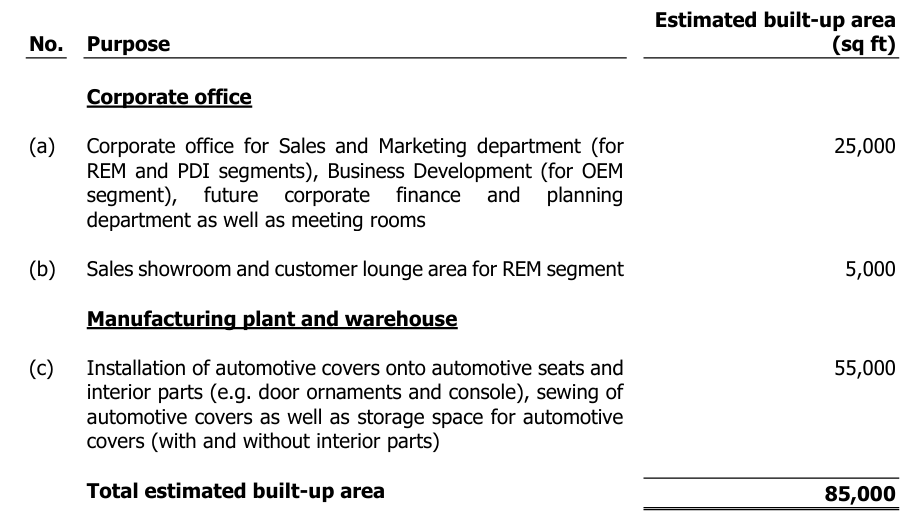

In conjunction with its plan to expand the customer base which are mainly headquartered in central region of Malaysia, the company intends to construct and set up its new corporate office with manufacturing plant and warehouse in Klang Valley with an approximate build-up area of 85,000 sq ft which will be used for:

The new corporate office with manufacturing plant and warehouse will enable the company to increase its Group’s headcount in the Business Development department for OEM segment and Sales and Marketing department for REM and PDI segments and ease of conduct of meetings at its premises (as compared to the current headquarters at Tampoi Plant in Johor Bahru, Johor) in order to serve the existing customers better and tap into the new customer base in the central region of Malaysia where most of the automotive companies’ headquarters are located. The company will also set up the new corporate finance and planning department at the new corporate office.

The new manufacturing plant and warehouse will have a larger area space for installation of automotive covers onto automotive seats and installation of automotive covers with interior parts (e.g. door ornaments and console). Currently sewing of automotive cover material cut pieces to form complete automotive covers is only undertaken at Tampoi Plant. The company's new manufacturing plant in Klang Valley will have up to 15 new sewing machines to be purchased. This will enable them to carry out sewing of automotive cover material cut pieces to form complete automotive covers at both the new manufacturing plant in Klang Valley and Tampoi Plant. This would in turn improve the lead time and delivery schedule to better meet the requirements of its customers.

Construction of new Kulim Plant 2 - 16.4% (within 24 months)

The company plans to increase the manufacturing space for additional offline processes or workstations to improve output for processes which have been identified as bottleneck on the main production/assembly line and storage space for both finished goods and incoming materials and supplies for the manufacturing of automotive seats as well as to operate at its own manufacturing plant, the company has acquired a piece of land in Padang Serai, Kulim, Kedah with an approximate land area of 8.1 acres or 353,400.7 sq ft (which is in the vicinity of Kulim Plant 3) which is located close to the appointed assembly plant of their automotive seat customers to set up Kulim Plant 2. The Kulim Plant 2 is envisaged to comprise a manufacturing plant, warehouse, annex office building and staff hostel, with a total estimated built-up area of 84,000 sq ft.

With the completion of the Kulim Plant 2, the Group intends to relocate 1 unit of its double conveyor lines for the manufacturing of automotive seats from Kulim Plant 3 to the manufacturing plant at the Kulim Plant 2 which will enable both the Kulim Plant 3 and Kulim Plant 2 to have additional manufacturing space and storage space to cater for increasing volume of automotive seats manufactured by the Group and input materials and supplies, as follows:

With the relocation of 1 unit of the Group’s double conveyor lines to the Kulim Plant 2, it is expected that the Group’s combined manufacturing space for its manufacturing of automotive seats at both Kulim Plant 3 and Kulim Plant 2 will increase from 63,974 sq ft to 77,974 sq ft while the combined storage space for automotive seats and automotive seat parts at both Kulim Plant 3 and Kulim Plant 2 will increase from approximately 46,139 sq ft to approximately 87,139 sq ft. Such expansion of the manufacturing space and storage space for automotive seats and automotive seat parts will enable the Group to cater for higher order volume from both existing and new customers as the additional offline processes or workstations are required to improve output to minimise bottleneck amidst the higher production volume expected and to cater for increasing volume of input materials and supplies as well as finished goods which are large in size. Further, the company can also serve its customers better with availability of buffer stocks for materials and supplies required as well as finished goods to ensure short lead time to delivery can be achieved.

Purchase of new machineries - 2.6% (within 12 months)

The company has earmarked approximately RM3.0 million from the gross proceeds of the Public Issue to purchase new machineries for its manufacturing of automotive covers as follows:

Working capital - 45.5% (within 12 months)

The company has earmarked approximately RM52.2 million from the gross proceeds of the Public Issue for the working capital:

A total of approximately RM39.0 million out of the proceeds allocated for working capital will be used to finance purchase of materials and supplies for the automotive cover division and automotive seat division.

The materials and supplies used by them for the automotive cover division include automotive cover materials, interior parts and parts, accessories and other supplies such as zippers, plastic strips and hooks.

The materials and supplies used by them for the automotive seat division include padding, seatbelts, buckles, electrical parts, frames, side airbags and automotive covers.

The Group plans to utilise the balance RM13.2 million working capital for its day-to-day operations, which include, among others, defrayment of administrative expenses such as staff cost, and selling and marketing expenses.

The Group’s working capital requirement is expected to increase in tandem with its production activities in line with the growth of the Group’s businesses. Therefore, while the Group continues to generate positive cash inflows from its operations, the allocated proceeds from its IPO for the Group’s working capital provide flexibility to its Group in managing its cash flows to support the expected growth in the scale of operations or businesses while reducing the reliance on bank borrowings.

Business model

The Group’s business model can be illustrated as follows:

Through its Subsidiaries, the company is principally an automotive cover manufacturer and automotive seat manufacturer based in Malaysia.

Automotive covers refer to the covers installed on automotive seats and interior parts. Automotive seats are seats specially designed and built for automotive vehicles. Meanwhile, interior parts refer to components found in the interior of an automotive vehicle such as door ornaments, steering wheels, gear knobs, handbrake handles and consoles. Automotive covers provide comfort and enhance the attractiveness of the vehicle, while ensuring the functionality of the components is not affected.

The Group’s products under its automotive cover division include both automotive covers (which are covers sold without the automotive seats and interior parts) and automotive covers sold with interior parts. For avoidance of doubt, the interior parts which form part of the automotive covers sold with interior parts by the Group, are procured by the Group from suppliers appointed by automotive vehicle OEMs and not manufactured by the Group.

The company mainly manufactures automotive covers for the OEM market segment. Revenue from the automotive covers from the OEM market segment comprised between 84.6% and 88.6% of the Group’s revenue for the automotive cover division during the FY Under Review. Customers in the OEM market segment comprises automotive vehicle OEMs such as Mazda Malaysia (for Mazda 3, CX-5, CX-8 and CX-30 car models) and Kia Malaysia (for Kia Carnival and Sorento car models), as well as Tier 1 automotive seat and/or interior part manufacturers which serve automotive vehicle OEMs for brands such as Local OEM, Mazda and Hyundai. Examples of Tier 1 automotive seat and/or interior part manufacturers include APM companies, Adient companies and Delloyd companies.

The company also manufactures automotive covers for the PDI and REM market segments. The customer base for these market segments comprises automotive distributors, car owners, used car dealers, importers, automotive dealers, car accessory retailers and automotive cover installers.

Meanwhile, the Group’s automotive seats are manufactured for automotive vehicle OEMs as Feytech SB is a Tier 1 automotive seat and/or interior part manufacturer.

Click here to continue the IPO - Feytech Holdings Berhad (Part 2)

Eager to explore more trading opportunities?Apply margin account now! https://bit.ly/mqatamargin

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)