IPO - Feytech Holdings Berhad (Part 2)

MQTrader Jesse

Publish date: Mon, 06 May 2024, 12:14 PM

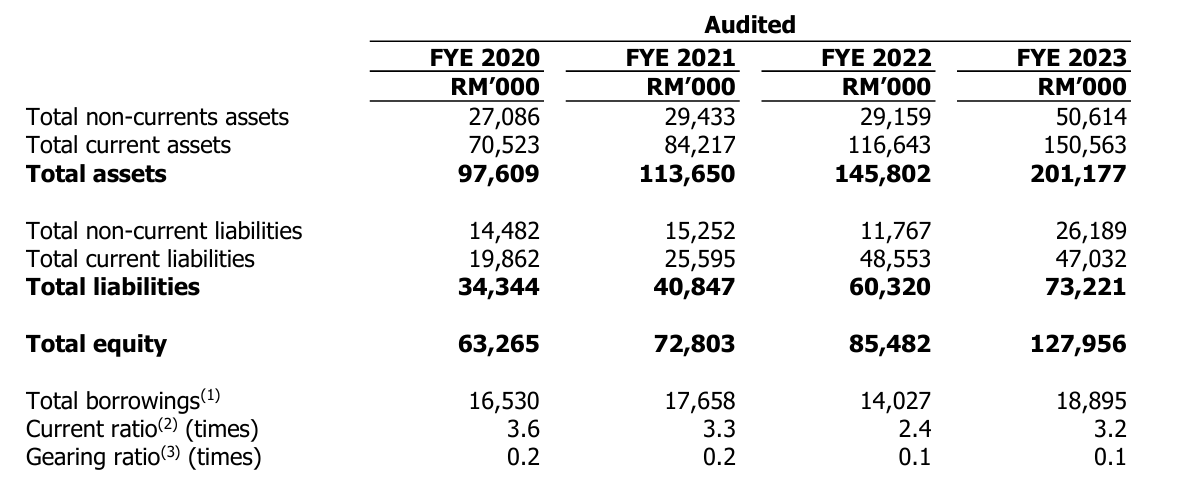

Financial Highlights

The key financial highlights of the Group’s historical financial information for the FY Under Review are set out below.

- The revenue grew from RM 79 million in FYE 2020 to RM 211 million in FYE 2023. The increase in revenue is mainly due to the increase in the sales of automotive seats and interior parts. This also shows that the company is expanding its market share in this industry.

- The gross profit margin was maintained within the range of 36% to 40%. The high gross profit margin can be maintained mainly due to the improvement in production efficiency, which has led to reduced wastage of raw materials for the automotive cover division. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin declined from 22.8% in FYE 2020 to 20.8% in FYE 2023.

- The gearing ratio was 0.1 times in FYE 2023, which is below the benchmark. This indicates that the company still has room to further increase its debt, indirectly suggesting that in the event of any crisis, the company will not easily face risks due to excessive debt. (A good gearing ratio should be between 0.25 – 0.5).

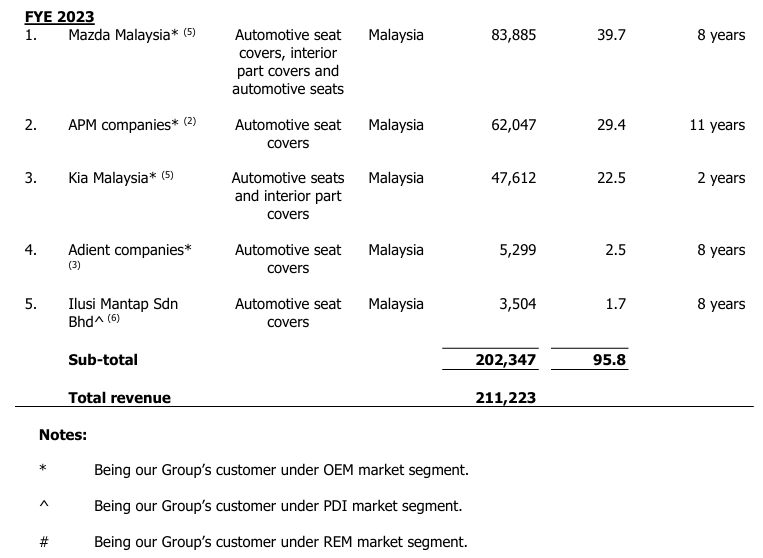

Major customers and suppliers

Major Customers

The top 5 major customers for FYE 2023 are as follows:

The top 5 customers contribute 95.8% of the company's revenue. The company faces high concentration customer risk as it is dependent on these major customers. However, the management mentioned that there is mutual dependency between the group and its major customers, who are Tier 1 automotive seat and/or interior part manufacturers. The Group depends on them to the extent of the purchase orders received, while they also rely on the Group for the supply of automotive covers.

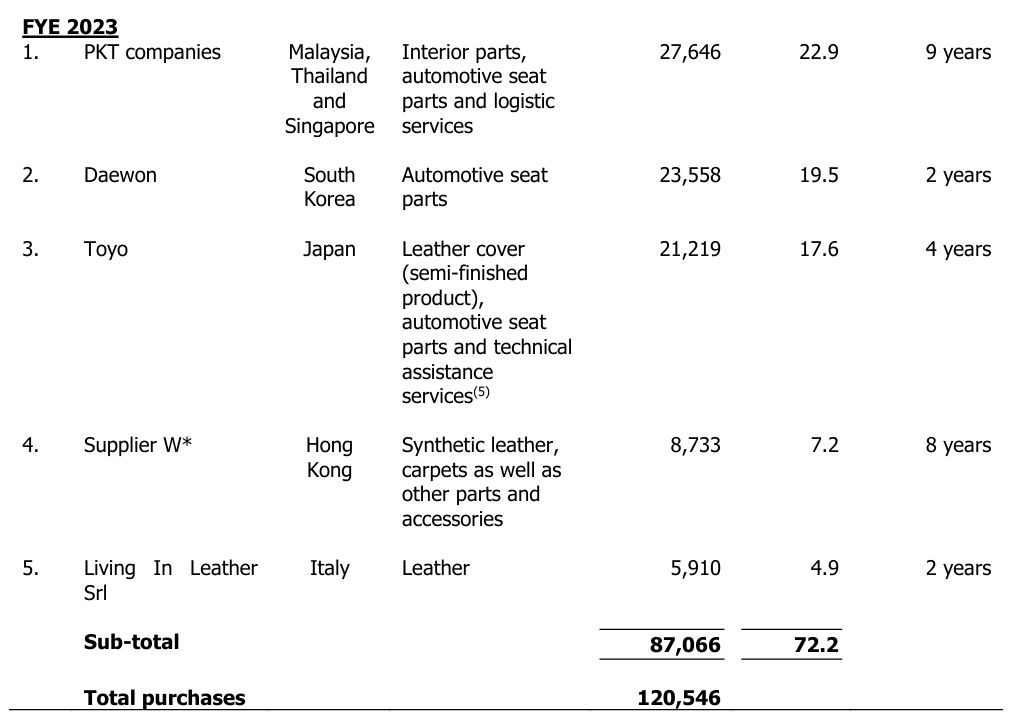

Major Suppliers

The top 5 major suppliers for FYE 2023 as follows:

The top 5 suppliers account for 72.2% of the purchases. The management mentioned that there are many other available local and foreign suppliers of automotive cover materials, parts, and accessories. Thus, the automotive seat and interior part industry is not dependent on these major suppliers or any individual country for the supply of such supplies.

Industry Overview

According to Providence Strategic's research,the automotive cover and automotive seat industries in Malaysia grew by 9.6% and 4.3% between 2018 and 2019, respectively. Both of the automotive seat and cover industries in Malaysia were adversely impacted by the COVID-19 pandemic in 2020, resulting in a fall of 23.0% and 37.5% between 2019 and 2020. Nevertheless, the automotive cover and seat industries in Malaysia improved in 2021, registering a growth of 6.8% and 33.3% between 2020 and 2021, respectively. The automotive cover and seat industry sizes in Malaysia have grown to RM420.3 million and RM3.1 billion in 2022, respectively. In 2023, the automotive cover and seat industry sizes in Malaysia further increased to RM 503.5 million and RM3.3 billion, respectively. Moving forward, the automotive cover and seat industries in Malaysia are forecast to grow at CAGRs of 8.0% and 6.7% between 2024 and 2026, respectively, in light of the following demand drivers:

- Long term growth of the automotive industry which will drive demand for automotive seats and covers. Since its recovery from the COVID-19 pandemic, the automotive industry in Malaysia grew, in terms of automotive sales, from 508,911 units in 2021 to 720,658 units in 2022, and further increased to 799,731 units in 2023. The automotive industry is expected to continue to grow in the long term in light of improved consumer spending, introduction of new models including EVs at more competitive prices, government incentives as well as promotional sales campaigns by automotive marques. As automotive seats and covers are necessities in all types of automotive vehicles including EVs, the progressive shift of the automotive industry towards EVs is expected to drive the automotive seat and cover industries;

- Malaysia’s position as an automotive hub is expected to continue to drive automotive vehicle OEMs to carry out their automotive manufacturing activities in Malaysia, which will drive the local automotive seat and cover industry; and

- Consistent demand for automotive cover replacements will lead to the growth of the automotive cover industry.

As a key industry player in the automotive cover industry in Malaysia, Feytech Group stands to benefit from the positive outlook of the automotive cover industry in Malaysia. Feytech Group also stands to benefit from the growing automotive seat industry in Malaysia.

Source:Providence Strategic

Future plans and strategies for FEYTECH HOLDINGS BERHAD.

The Group’s business strategies and future plans are as follows:

- The company plans to expand the automotive seat manufacturing operations in order to cater for increasing orders for automotive seats.

- The company intends to expand the automotive covers division operations by setting up a new corporate office with manufacturing plant and warehouse.

MQ Trader View

Opportunities

- The company has outstanding financial performance. It is growing rapidly, and the management can maintain the gross profit margin around 38%, showing the efficiency of management in balancing the company's expansion and controlling costs. Moreover, the company's gearing ratio is below the standard benchmark, meaning that the company still has room to increase its debt ratio.

- The company can manufacture both automotive seats and automotive covers, serving various market segments. The company has expanded downstream in the industry value chain to venture into the manufacturing of automotive seats. This allows the company to provide a complementary range of services to automotive vehicle OEMs. Furthermore, they also offer automotive covers to various market segments, including OEM, PDI, and REM market segments. This allows them to expand their customer base, targeting not only automotive vehicle OEMs and Tier 1 automotive seat suppliers, but also automotive dealers, distributors, used car dealers, and so on.

Risk

- The company is dependent on its major customers and/or automotive vehicle OEMs that have appointed these major customers. The Group is thus dependent on these major customers in the respective FYEs. For major customers who are Tier 1 automotive seat and/or interior part manufacturers, the Group is dependent on them to the extent of the purchase orders received from them. However, it is important to note that the Group is also dependent on the automotive vehicle OEMs that have appointed them, namely, Local OEM, Mazda Malaysia, and Kia Malaysia.

Click here to refer the IPO - Feytech Holdings Berhad (Part 1)

Eager to explore more trading opportunities?Apply margin account now! https://bit.ly/mqatamargin

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)