Stock on The Move - Uchi Technologies

AmInvest

Publish date: Mon, 08 May 2023, 09:21 AM

Company Background. Uchi Technologies (UCHITEC) is primarily an original design manufacturer (ODM) that specialises in the design, research, development, and manufacture of electronic control systems which includes software development, hardware design, and system construction. Over 97% of the group’s products are sold to the European market, while the remaining is sold to US, Japan, China, and India. Switzerland maintains its position as the highest contributor of export market.

Investment Highlights. (i) Invests strongly in R&D and have a number of projects in its own pipeline - these consist mainly of electronic control systems for both Art-of-Living and Biotechnology product segments. (ii) Develop long-lasting partnerships with clients that include MNCs that produce high-end household and commercial appliances as well as market leaders of laboratory and industrial instruments. (iii) UCHITEC has consistently distributed at least 70% of net profit as dividends since 2003.

Financial Performance. In FY22, UCHITEC reported higher revenue of RM214.3mil (+27.2% YoY) with a PAT of RM124.8mil (+36.6% YoY). This was mainly due to higher demand for the group's products and services, a better product margin mix and appreciation of USD to RM.

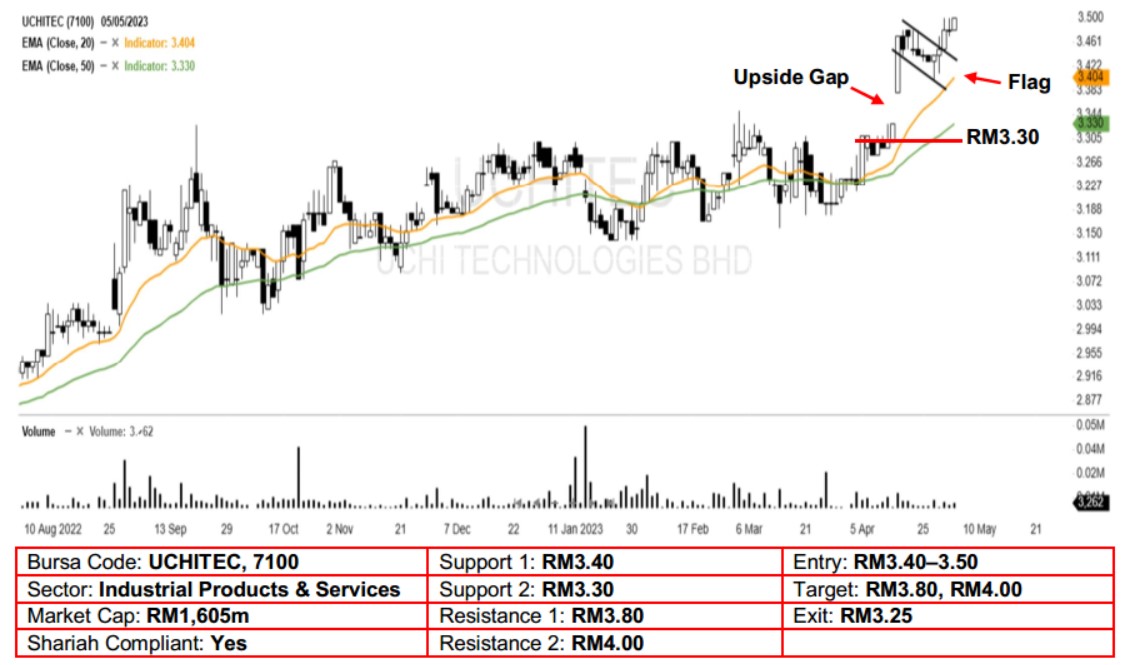

Technical Analysis. We believe buying interest for UCHITEC is back after it broke out from the 3-week bullish flag pattern and hit its 52-week high on Friday. In view of the uncovered upside gap formed on 14 Apr and together with its rising EMAs, upward momentum is likely to pick up further. A bullish bias may emerge above the RM3.40 level, with a stop-loss set at RM3.25, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM3.80, followed by RM4.00.

Source: AmInvest Research - 8 May 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Nov 21, 2024