Stock Idea - Hume Cement Industries

AmInvest

Publish date: Thu, 30 Nov 2023, 09:12 AM

Company Background. Hume Cement Industries (HCIB) is principally engaged in the manufacture/sale of cement, concrete and related products. HCIB’s main subsidiaries are Hume Cement and Hume Concrete. Currently, Hume Cement is a key player in the Malaysian cement industry under the brand, Panda Cement. The group operates an integrated cement plant located in Gopeng, Perak and 3 factories strategically located throughout Malaysia.

Prospects. (i) Benefit from the continued recovery of construction activities due to increased development expenditures as announced in the recent Budget 2024, (ii) Intensifying research and development (R&D) efforts to create new innovative products that address emerging needs of the market, particularly the new product line - Panda Yellow (Portland Limestone Cement) - which has generated substantial new sales volumes, (iii) Diversifying customer base and expanding into new markets/industries to reduce reliance on a single market segment, and (iv) Optimising plant operations through the integration of digital transformation technologies such as robotic processing automation, distribution control system and programmable logic controllers.

Financial Performance. In 1QFY24, HCIB reported a higher revenue of RM306.6mil (+48.3% YoY) with a PAT of RM48.3mil (+5x YoY). This was mainly due to better cement selling price, which more than mitigated increased energy costs, and higher cement sales volume on the recovery of construction activities.

Valuation. HCIB is trading at an attractive FY24F P/E of 8.2x, which is lower than its 5-year forward average of 15.9x and Bursa Industrial Production Index’s 23.6x currently. As a comparison, Malayan Cement, involved in manufacturing/trading of cement, clinker, ready-mixed concrete, other building materials and related products, trades at a much higher FY24F P/E of 21.5x .

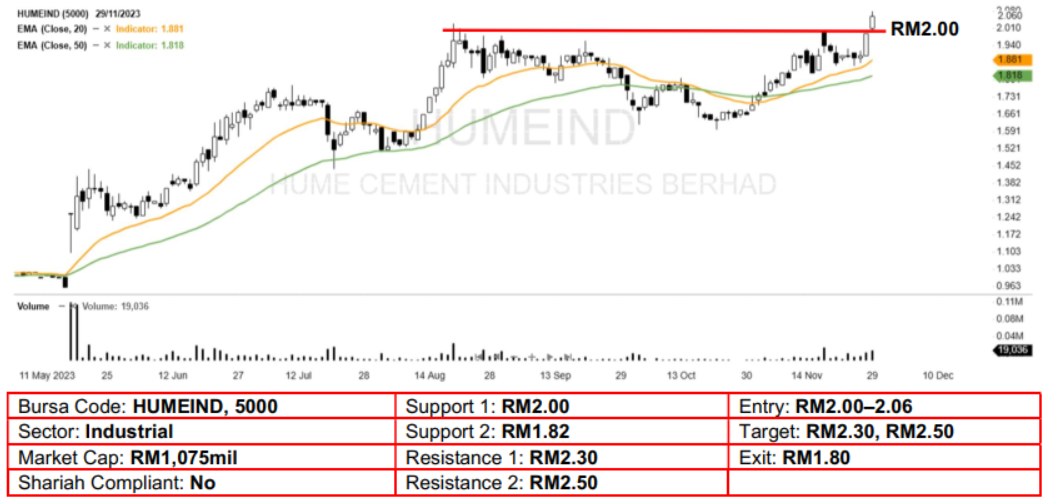

Technical Analysis. HCIB posted 2 white candles in a row and pushed above the RM2.00 resistance yesterday, which likely indicates the return of buying interest. As the stock also surged to a new multi-year high and coupled with rising EMAs, additional upside strength may be present in the near term. A bullish bias may emerge above the RM2.00 level, with stop-loss set at RM1.80, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM2.30, followed by RM2.50.

Source: AmInvest Research - 30 Nov 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|