! The Renewable Energy Stock to Monitor !

FlashParadox

Publish date: Tue, 07 Nov 2023, 09:10 PM

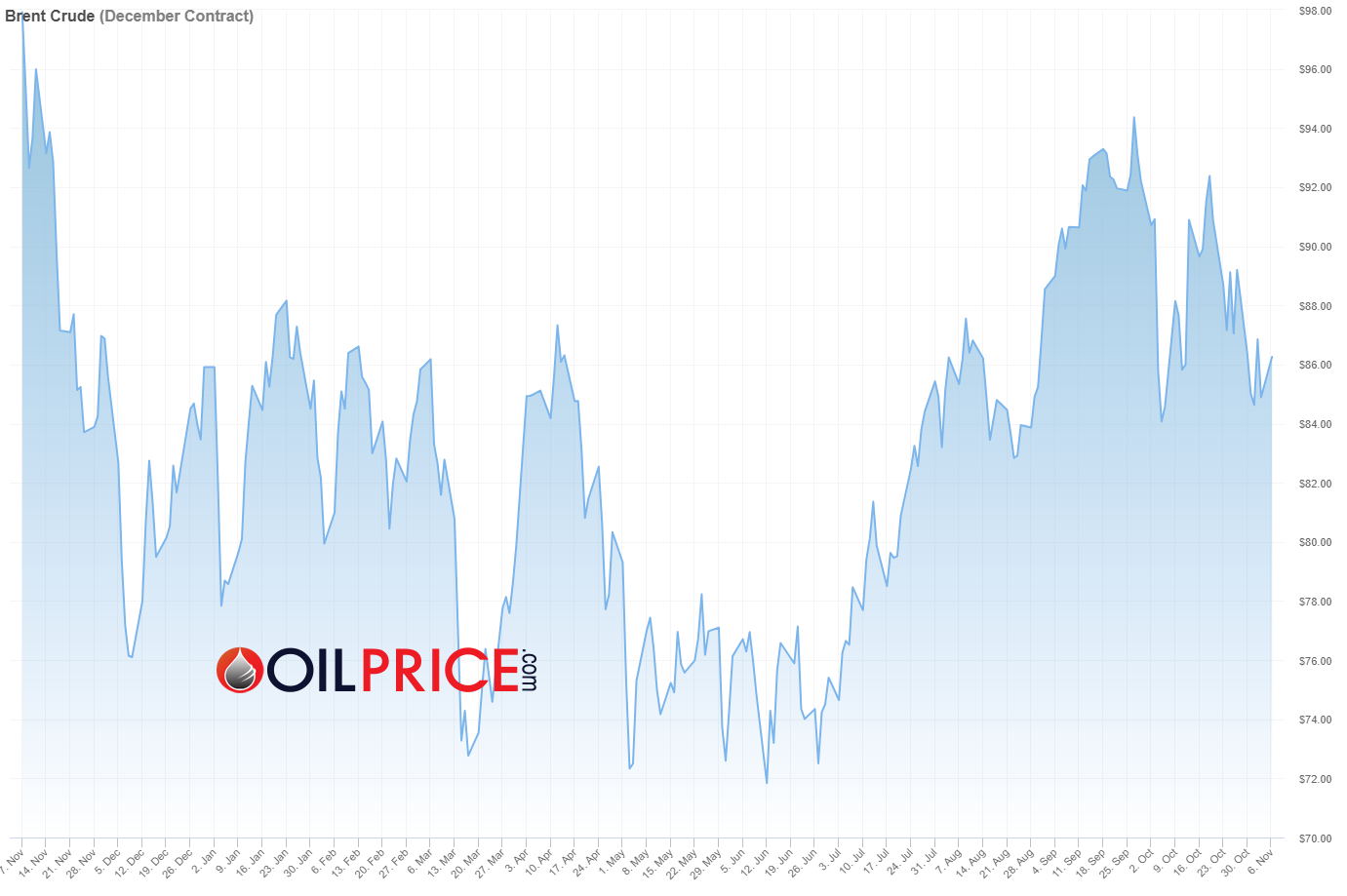

As global markets contend with the relentless surge in oil prices due to political uncertainties, the narrative of energy production is being rewritten with a green pen. Renewable Energy (RE) has swiftly moved from being an alternative energy source to the frontrunner in the energy transition race.

Source: Oilprice.com

In the midst of this shift, Malaysia has outlined a robust plan through the Ministry of Economy to achieve a 70% RE power mix by the mid-21st century, with an interim goal of 31% by 2025. This pivotal move creates fertile ground for investors looking to be part of this transformative journey.

In the landscape of Malaysian RE companies, Jentayu Sustainables Berhad (‘JSB’) distinguishes itself not just by its soaring share price but by its strategic investments in hydro-powered energy.

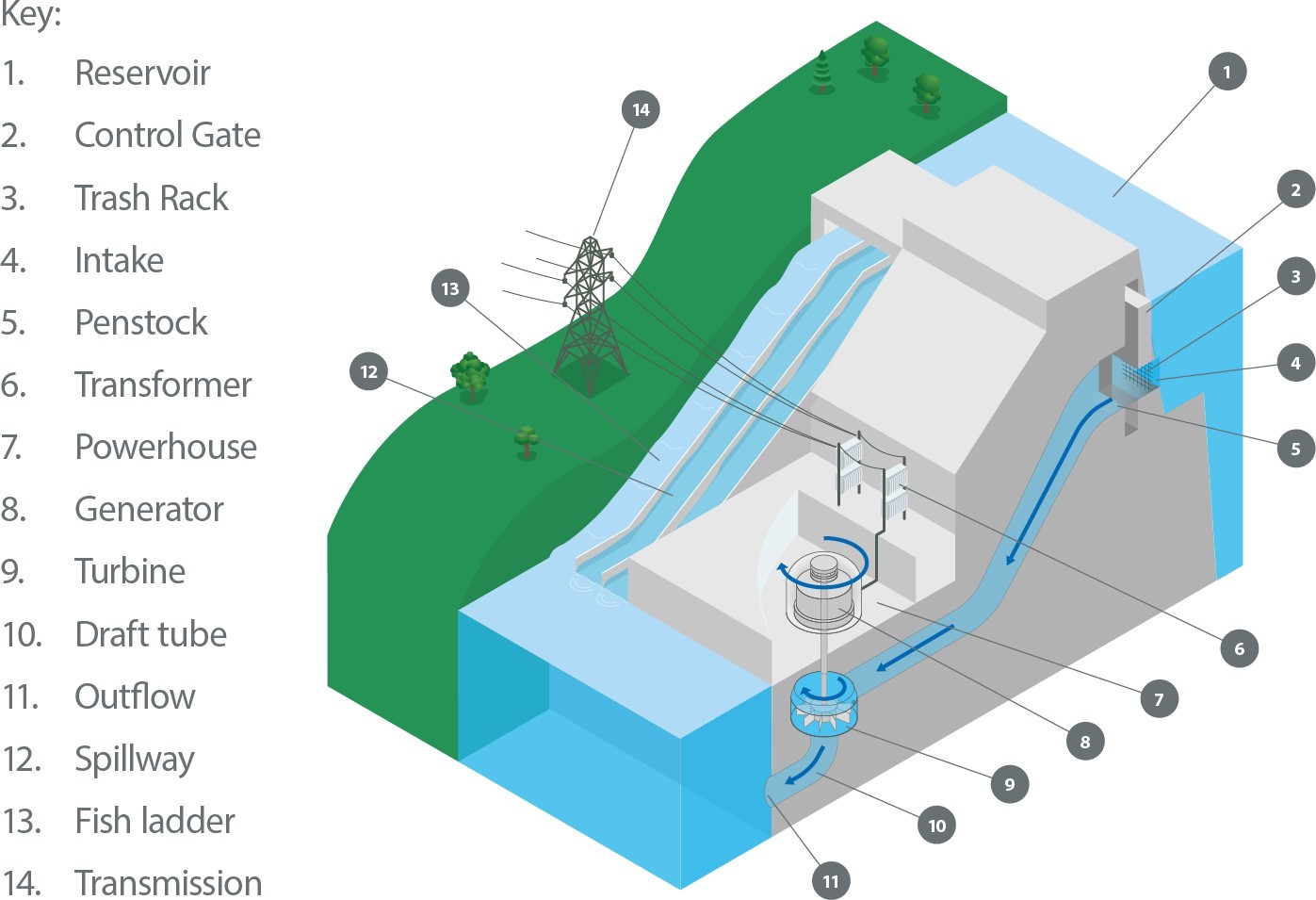

Unlike the majority of its RE counterparts who rely on Large Scale Solar Photovoltaic (LSSPV) projects, JSB is tapping into the inherently higher tariff rates offered by hydro-powered facilities. Industry insights reveal that hydro rates in Sabah fluctuate between RM 0.300 to RM 0.330 per kWh, considerably eclipsing the LSSPV tariffs, with the third phase (LSSPV3) being as low as RM 0.1777 and the fourth phase (LSSPV4) at RM 0.2610 per kWh.

Source: st.gov.my

This economic gradient is where JSB's potential for long-term yield becomes evident, positioning it as a premium investment opportunity. The company's vision materialises through the development of Malaysia’s most ambitious run-of-river hydro scheme in Sabah, expected to contribute an impressive 170 MW to the state’s power supply by 2027. The hydro project, coupled with the planned acquisition of 46 MW of brownfield RE assets, lays the groundwork for a resilient and profitable RE portfolio.

It is also important to note that JSB’s proposed acquisition, which has been meticulously reported in a series of announcements dating from 22 September 2021 to 1 November 2023, is now pending approval from the Securities Commission (SC) of Malaysia. This significant milestone is expected to be reached by Q1 2024, marking a pivotal turn for JSB to transition into a comprehensive domestic and regional renewable energy (RE) powerhouse.

Source: International Hydropower Association

Supporting this dynamic RE venture, JSB continues to draw strength from its healthcare operations, spearheaded by the unique OHANA Specialist Hospital with its all-female obstetrics and gynaecology team. This facility, although currently operating with 18 beds, harbours the capability for expansion, embodying growth potential in the healthcare sector.

Complementing its healthcare and RE endeavours, JSB's restructured trading divisions, Ipmuda Buildermart and Ipmuda Edar, continue to consolidate its market position with their long-standing reputation and specialised offerings.

For the discerning investor, JSB is more than a company; it is a conduit to a sustainable future.

By investing in JSB, stakeholders are not just part of a renewable revolution but are placed at the forefront of a movement set to redefine Malaysia's energy framework. With a focus on hydro-powered RE and its advantageous tariff rates, JSB offers a high-yield, long-term investment avenue that is both environmentally and economically astute.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|