Artroniq Bhd’s Strategic Warrants Issuance, A Potential Windfall for Shareholders?

ChandranG

Publish date: Wed, 14 Jun 2023, 04:05 PM

Warrants are very commonly seen as a “sweetener” for investors to participate in the corporate exercise, but that being said, there are still instances where a public listed company issues free warrants to reward their shareholders?

In our case, Artroniq Bhd (KLSE: ARTRONIQ) had made a public announcement where the company proposes to have i). Private Placement, ii). Bonus issue of warrants, and iii). Diversification plan.

All 3 of the proposed items are interlinked which each of them plays an equally important role. Nevertheless, all of the proposed items had been approved by the shareholders of ARTRONIQ in their EGM back in 19th May 2023.

We will now look into each of the items individually.

1. Private Placement

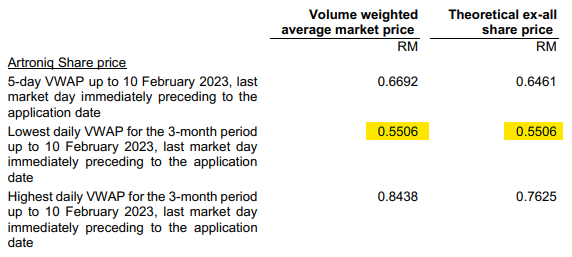

ARTRONIQ plans to issue up to 20.0% of the total number of issued shares via private placement, representing an issuance up to 65.66 million Placement Shares. According to the circular provided by the company, the discount for such Placement Shares shall not exceed 20.0% to the 5-day VWAP of the company.

Based on historical price, the company had determined to use an illustrative issue price of RM0.560 per Placement Shares based on VWAP – however if you were to look at the recent trading price of ARTRONIQ, the company should expect to raise more funds from the private placement as the post-discount Placement Shares should be higher than RM0.560.

But for the sake of understanding the proposal, we will first delve into how the funds would be utilised.

For the benefit to those who do not know, Artroniq ITech Sdn Bhd (“AITech”), a wholly owned subsidiary of ARTRONIQ had entered into a memorandum of agreement with Beno to provide assembly services to complete the production of “Reevo Bikes”, a high-performance E-Bike.

As a matter of fact, AITech had received a confirmation from Beno on 16th January 2023 for the order of assembling 7,000 E-Bikes which are expected to be delivered on or before 30th September 2023, which is where exactly ARTRONIQ is putting the placement’s money to use.

For information, ARTRONIQ had on 1st March 2023 entered into a 2 years tenancy agreement with Bond Industrial Supply Sdn Bhd to rent a factory with build-up area of approximately 6,900 sqft., which is situated in Bandar Cassia, Pulau Pinang.

The RM14.01 million proceeds are expected to invest in setting up office, inventory and storage facilities, purchase of software, setup and installation of security system, purchase of machineries and inventories, costs related to the assembly plant as well as any staff costs involved.

Apart from the new E-Bike business, a sum of RM22.21 million would also be utilised for general working capital purposes. In fact, EA Global Integrated Sdn Bhd (“EGISB”), a wholly owned subsidiary of ARTRONIQ had on 29th November 2022, entered into a MoU with Panda Commercial Bank in collaboration with the research and development of blockchain based financial services, in which the MoU had formalised into a letter of award from Panda Commercial Bank with a contract value of USD10.0 million and tenure of 24 months.

With such a strong contract on hand, ARTRONIQ plans to utilised RM13.0 million of the funds raised for setting up the technology infrastructure, purchase of ICT equipment and software for blockchain system development, investing into staffs and partially outsourcing of the software development to 3rd party vendors. Where the rest of the funds shall be utilised on purchase of inventories of ARTRONIQ’s existing business, as well as for their repayment of trade payables.

From what we can see here, ARTRONIQ currently had 2 key new projects which could significantly contribute to their future growth.

2. Bonus Issue of Warrants

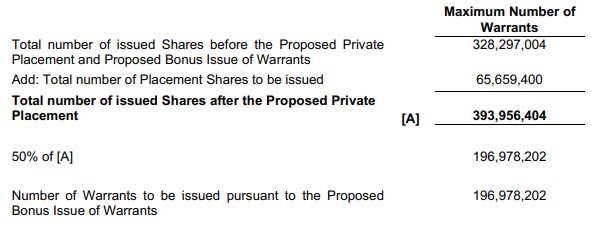

Upon the completion of private placement, the company would follow up with a bonus issue of free warrants on the basis of 1 warrant for 2 existing ARTRONIQ shares.

What’s more interesting is, the exercise price of the warrant had been fixed at RM0.600, in which the adjusted price could be close to zero if the theoretical ex-all share price is below RM0.600, rendering the warrant carrying “zero value”. But as with many cases on Bursa, it is very easy for ARTRONIQ to past the RM0.600 exercise price, and this would start reflecting conversion value in the warrants, which would bring arbitrage opportunity for the company.

Hence, it is important for investors to participate in ARTRONIQ at this juncture.

3. Diversification Plan

In line with ARTRONIQ’s plan to grow the company and reward shareholders, the company had also made a conscious decision to discontinue the loss making businesses of the company, which includes the resin compound for wire and cable, as well as for other industries.

In FYE 31 December 2021, the resin compound for other industries recorded a profit before tax of RM5.07 million primarily due to one-off gain from the disposal of property, plant and equipment which amounted to RM5.4 million, which means the said business segment is still in the red.

Looking at the roadmap of ARTRONIQ thus far, the company is actively seeking to diversify their business away from the discontinued resin compound business, and one successful example would be their ICT business.

All in all, there will be a significant transformation for ARTRONIQ going forward, and re-rating of the company would happen by then. With a market capitalization of RM265.9 million, there is still ample room for growth for ARTRONIQ.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|