Normal Sharing

还未被市场发现的 《太阳能》 潜力股

janitor2021

Publish date: Fri, 24 Sep 2021, 11:14 AM

从 LSS1 到 LSS4,LSS4 中的项目容量已激增至 1GW。 许多公司都争先恐后地加入太阳能行业,但只有一家公司为该行业开辟了新的契机。 让我们见识这个行业的最新发展消息。

这是来自 《星报》 THE STAR, 的摘录:

KUALA LUMPUR: Clean energy specialist, Solarvest Holdings Bhd has launched its new solar financing programme, Powervest, to promote the adoption of renewable energy among businesses in Malaysia.Group chief executive officer, Davis Chong Chun Shiong said the programme comprises two competitive financial models, Powerflex and Powerlease, targeted at commercial and industrial users with different financing needs."The launch of Powervest is in line with our efforts to make clean energy more convenient, affordable and accessible."While we recognise that there is not a one-size-fits-all solution when it comes to solar photovoltaic (PV) system investment, we are offering a financing solution that we believe is comprehensive enough to meet the different financing needs of our potential customers,” he said during Powervest’s virtual launch today.Chong said the Powerflex model offers a flexible financial package with zero upfront costs."Businesses can opt to fully own the solar PV system by obtaining 100 per cent financing, or they can co-own the asset with Solarvest, in which case they would only need to apply for 50 per cent financing."Repayment would be on a monthly instalment basis to the respective financial institution and Solarvest over a customisable period, ranging from three to 10 years," he said.Meanwhile, Chong said the Powerlease model, which has been in the market since 2017, is a long-term lease agreement between Solarvest and its partners for the sale and purchase of electricity generated from the solar PV system to be installed."The customer will pay Solarvest and its partners a tariff rate that is up to 30 per cent lower than what is normally charged by their utility provider while enjoying free operation and maintenance costs throughout the lease period," he added. – Bernama

单一经营的公司或 EPCC 所有者不再是利润丰厚的行业,因为该行业有很多竞争对手。 但是,租赁融资或融资方面可能会看到有利可图的机会。

这就是为什么 Solarvest 这样做的原因。

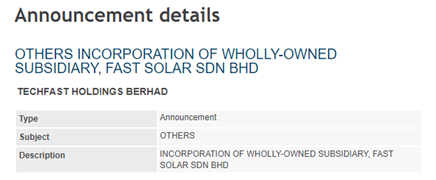

8 月 2 日,FAST ENERGY(旧称为 TECFAST HOLDINGS)成立了一家以 FAST SOLAR 命名的子公司。 你或许会有疑问,为何一家石油燃料供应公司会涉足太阳能行业?

正如大多数能源公司的目的,脱碳。 但在大多数情况下,这家公司不是以 EPCC 的方式, 而是以最有可能的融资租赁的方式涉足太阳能行业。

在 FAST 进行配股之前,该公司 手头上已拥有充足的现金, 所以该公司以融资租赁涉足太阳能领域是完全合理的。 为什么我会知道这件事? 好吧,因为我总是和一位来自可再生能源同事的人“喝茶”,他们都提到了 FAST。

有趣的是,FAST 在最近的股价正在飙升。 以目前最低的20仙来看是,我相信这对该公司来说是一个强劲的反弹。 投资者们,请在近期内留意这家公司!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Normal Sharing

Another solar-related gem that is YET to be discovered by investors.

Created by janitor2021 | Sep 23, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments