DoitDuit Blog - Just do it and the duit will follow!

Malaysia's Next Big IPO - Farm Fresh Berhad Analysis

doitduit

Publish date: Sat, 06 Nov 2021, 02:08 PM

Malaysia's Next Big IPO - Farm Fresh Berhad

2 weeks ago, Farm Fresh IPO prospectus draft was published on Securities Commission's website. This can be a good opportunity for me to value the company unbiasedly because the actual listing price is not yet published. So, let's get started.

Farm Fresh Background

Farm Fresh is a famous Malaysian brand that produce fresh milk in the dairy industry. The company is very young with less than 15 years history, founded by Mr Loi Tuan Ee. Today, the company is the 2nd largest player in the ready-to-drink (RTD) milk category, with 18% market share. The market leader position of Farm Fresh is in the chilled RTD milk subsegment with over 54% market share. Besides, Farm Fresh is also among the top 3 in terms of market share in the ambient RTD milk subsegment and yoghurt category.

Mr Loi started Farm Fresh when he noticed that 95% of the milk offered in Malaysia are actually reconstituted or powdered milk. This means that most milks claiming that they are "fresh" are actually made by adding water & some additives to milk powder, instead of "freshly squeezed" from the farm. Then, he started Farm Fresh with the mission to produce fresh and pure dairy just as nature intended. With this mission in mind, Farm Fresh promise to deliver their milk from farm to shelf in 48 hours. To achieve this, their milk must be produced, packaged and distributed locally.

Competitive Advantage of Farm Fresh

1. Exclusive Australian Friesian Sahiwal (AFS) Dairy Cow Breed

To achieve Farm Fresh's 48 hours farm to shelf promise is easier said than done, or else their competitors would have did it long ago. Malaysia is not the best place to raise dairy cow because of our warm temperature. The milk yield for dairy cows raised in Malaysia is much lower than those from Australia or New Zealand, which is why their competitors choose to import milk powder instead.

Farm Fresh bought over a genetic company in Australia that has exclusive ownership to the Australian Friesian Sahiwal (AFS) dairy cow breed. This AFS dairy cow breed can withstand Malaysia's temperature while maintaining better milk yield than local dairy cow. This way, Farm Fresh solved the supply problem and can get locally sourced milk with quality on par with imported Australian fresh milk.

Currently, they still have a farm in Australia that act as a nursery. The cross breeding of the AFS cow will be done over there and the offspring will be exported to Malaysia for milking. One thing to note is that the Australian farm is also producing milk and have 2 times higher milk yield than their Malaysia's cow.

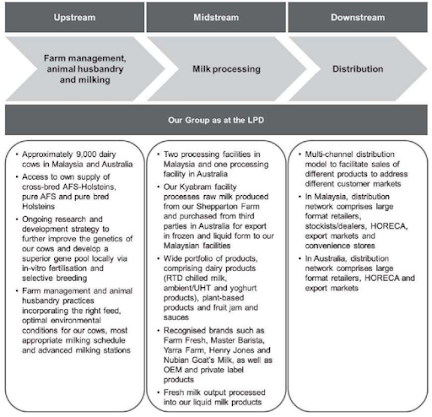

2. Vertical Integrated Grass-to-Glass Business Model

Having the suitable AFS cow breed in Malaysia is the first step for Farm Fresh to deliver their fresh milk in 48 hours. They also need to invest capital into integrating their dairy milk value chain, from the farming of milk to processing and logistic facilities. For example, all their delivery trucks and storage facilities must be capable of storing the milk in a specific temperature to keep the milk fresh.

By having presence from upstream to downstream in the entire value chain of the dairy industry, Farm Fresh has ensured lower distribution turnaround time and better quality control over their dairy products. This vertically integrated model is unique because most of their competitors import milk powder instead of producing fresh milk locally. This has given Farm Fresh the niche market to differentiate themselves.

3. Home Dealership Network

The biggest competitive advantage of Farm Fresh is their "Home Dealership" network. Unlike most of their competitors that sell dairy products through distributors and retailers, Farm Fresh is unique by having the Home Dealership programme as a means for their distribution channel.

Essentially, their Home Dealership structure is very similar to what we commonly known as "Direct Selling". Currently, they have 832 home dealers with 1,302 agents under these home dealers. This network contributed significantly to Farm Fresh's rapid growth through word-of-mouth marketing without the company needing to spend too much on marketing cost. They just need to share part of their margin with the home dealers, while at the same time they save listing cost from selling their products in large format retailers such as Tesco & Aeon.

To ensure every home dealers earn a bit of the pie, they limit their sellers according to geographic regions. For example, home dealers from Kuala Lumpur cannot sell in Johor Bahru, so there is no over competition between home dealers. Looking at the flip side, this system allows home dealers to penetrate into rural or untapped areas to expand their customer base and in return, this has contributed significantly to Farm Fresh's growth in market share.

Read more about Farm Fresh's growth prospect, risk and intrinsic valuation here.

Discussions

1 person likes this. Showing 11 of 11 comments

This IPO could explain why basic necessities like vegetables price has gone up.

Now monopoly extended to food items.

2022-01-29 09:56

Last IPO Senheng 1.07 now become 0.85 not sure how will be Farm Fresh going to be. because quite high 1.35 and market is not stable.

2022-02-28 11:16

VenFx

Big like to doitduit

prompt forecasting valuation price for 'FARM FRESH' IPO

2021-11-07 11:49