Genetec - Backed by strong EV & e-mobility demand. CIMB raise TP to RM4.50

Genetec A baby step

Publish date: Fri, 27 May 2022, 10:30 AM

■ FY3/22 net profit of RM56.4m beat our expectation by 4% due to better-thanexpected profit margin delivery in 4QFY3/22.

■ We project stronger earnings growth in FY3/23F, underpinned by healthy orderbook replenishment in EV, ES and e-mobility segments.

■ Reiterate Add, with a higher TP of RM4.50.

4QFY3/22 results beat expectations due to stronger margins

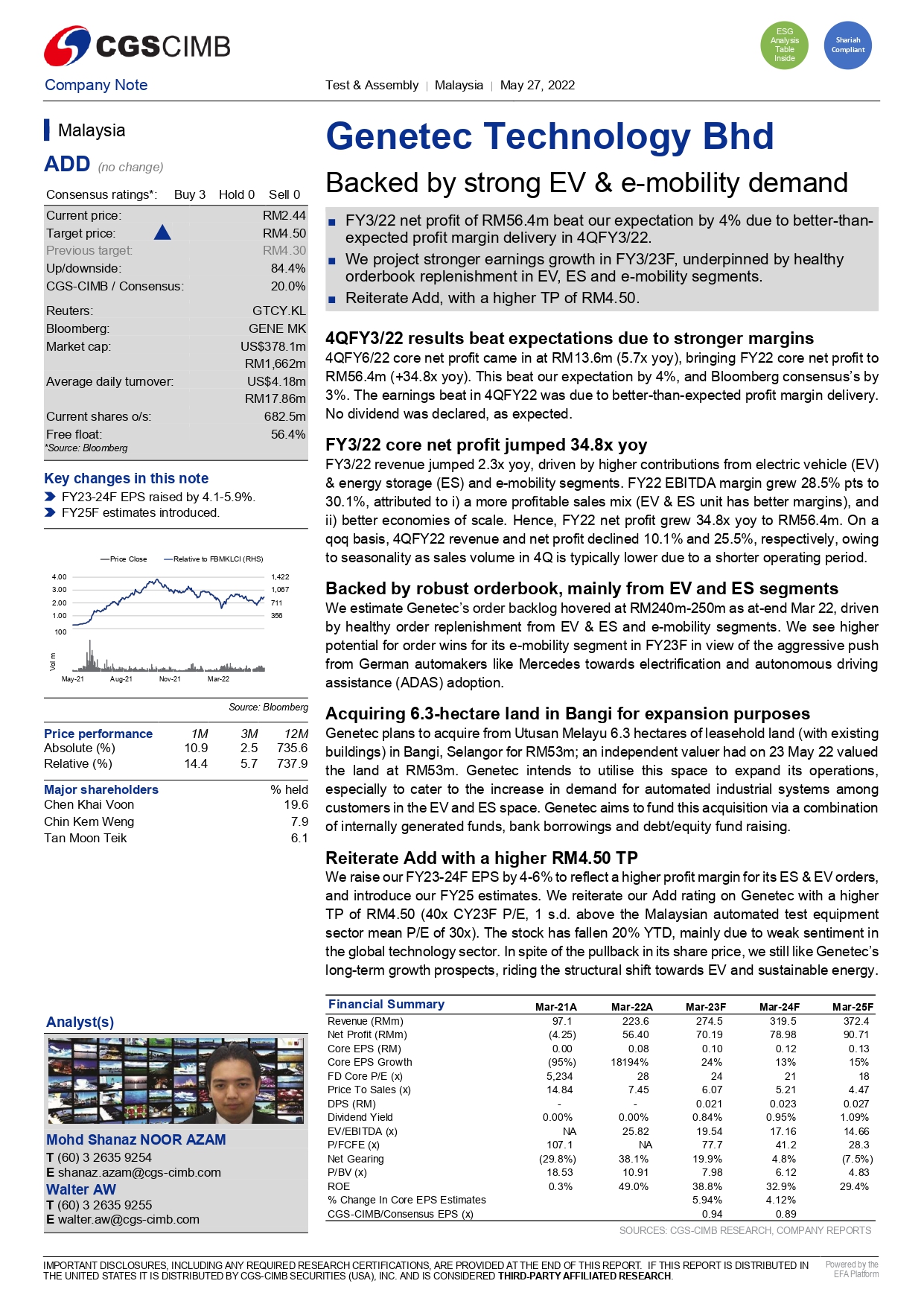

4QFY6/22 core net profit came in at RM13.6m (5.7x yoy), bringing FY22 core net profit to RM56.4m (+34.8x yoy). This beat our expectation by 4%, and Bloomberg consensus’s by 3%. The earnings beat in 4QFY22 was due to better-than-expected profit margin delivery. No dividend was declared, as expected.

FY3/22 core net profit jumped 34.8x yoy

FY3/22 revenue jumped 2.3x yoy, driven by higher contributions from electric vehicle (EV) & energy storage (ES) and e-mobility segments. FY22 EBITDA margin grew 28.5% pts to 30.1%, attributed to i) a more profitable sales mix (EV & ES unit has better margins), and ii) better economies of scale. Hence, FY22 net profit grew 34.8x yoy to RM56.4m. On a qoq basis, 4QFY22 revenue and net profit declined 10.1% and 25.5%, respectively, owing to seasonality as sales volume in 4Q is typically lower due to a shorter operating period.

Backed by robust orderbook, mainly from EV and ES segments

We estimate Genetec’s order backlog hovered at RM240m-250m as at-end Mar 22, driven by healthy order replenishment from EV & ES and e-mobility segments. We see higher potential for order wins for its e-mobility segment in FY23F in view of the aggressive push from German automakers like Mercedes towards electrification and autonomous driving assistance (ADAS) adoption.

Acquiring 6.3-hectare land in Bangi for expansion purposes

Genetec plans to acquire from Utusan Melayu 6.3 hectares of leasehold land (with existing buildings) in Bangi, Selangor for RM53m; an independent valuer had on 23 May 22 valued the land at RM53m. Genetec intends to utilise this space to expand its operations, especially to cater to the increase in demand for automated industrial systems among customers in the EV and ES space. Genetec aims to fund this acquisition via a combination of internally generated funds, bank borrowings and debt/equity fund raising.

Reiterate Add with a higher RM4.50 TP

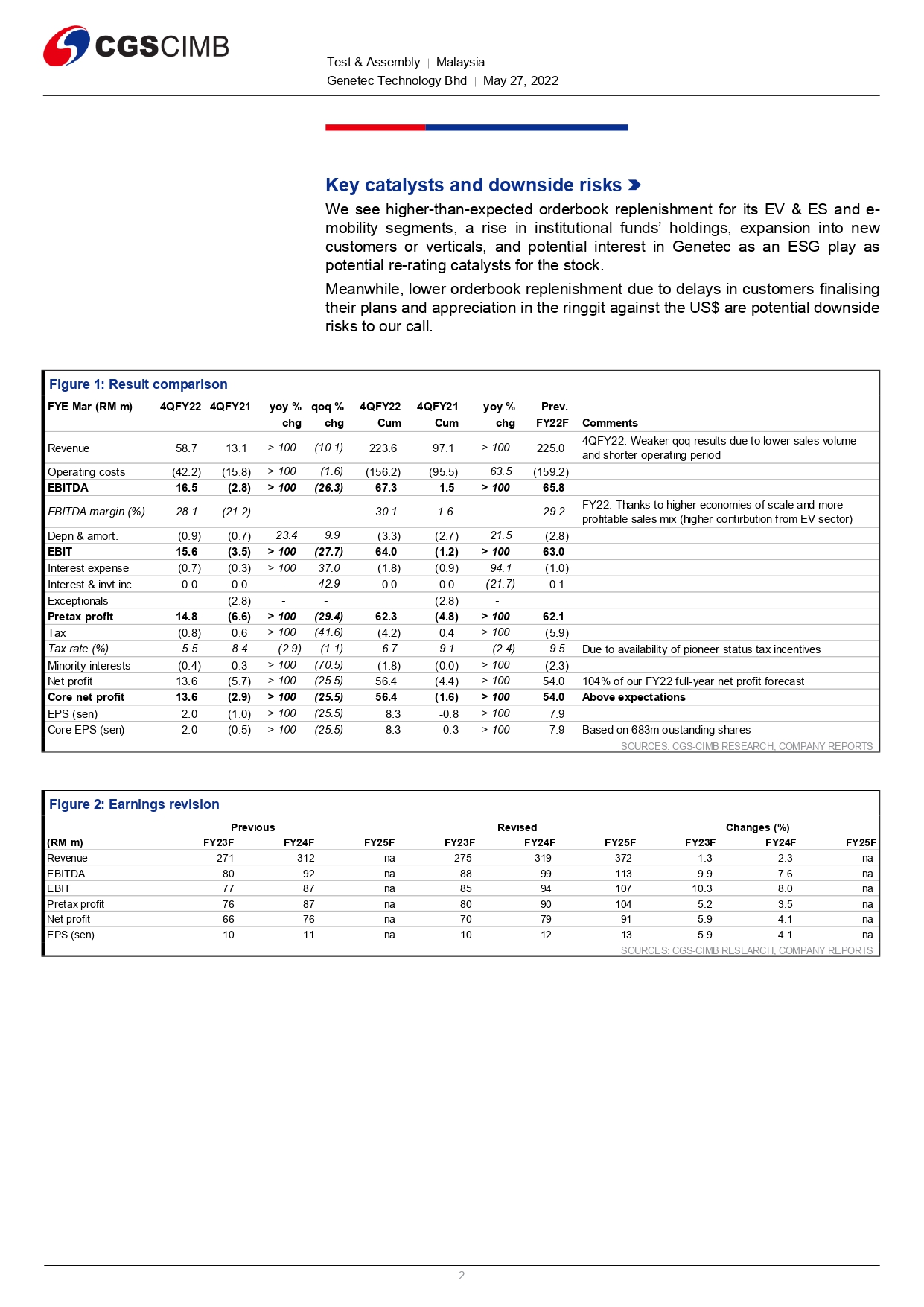

We raise our FY23-24F EPS by 4-6% to reflect a higher profit margin for its ES & EV orders, and introduce our FY25 estimates. We reiterate our Add rating on Genetec with a higher TP of RM4.50 (40x CY23F P/E, 1 s.d. above the Malaysian automated test equipment sector mean P/E of 30x). The stock has fallen 20% YTD, mainly due to weak sentiment in the global technology sector. In spite of the pullback in its share price, we still like Genetec’s long-term growth prospects, riding the structural shift towards EV and sustainable energy

Key catalysts and downside risks

We see higher-than-expected orderbook replenishment for its EV & ES and emobility segments, a rise in institutional funds’ holdings, expansion into new customers or verticals, and potential interest in Genetec as an ESG play as potential re-rating catalysts for the stock. Meanwhile, lower orderbook replenishment due to delays in customers finalising their plans and appreciation in the ringgit against the US$ are potential downside risks to our call.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Genetec - A baby step

Created by Genetec A baby step | Apr 24, 2024

Created by Genetec A baby step | Feb 29, 2024

Created by Genetec A baby step | Jan 18, 2024

Created by Genetec A baby step | Jan 04, 2024

Created by Genetec A baby step | Dec 12, 2023

Discussions

Genetec - 270M Order Book. Above CIMB estimation - 240-250m https://klse1.i3investor.com/blogs/genetec_rm400/2022-05-27-story-h1623454428-Genetec_Latest_Order_Book_by_Industry.jsp

2022-05-27 19:14

Genetec A baby step

Genetec - An update on Trade Receivable Collection from Management https://klse1.i3investor.com/blogs/genetec_rm400/2022-05-27-story-h1623455359-Genetec_An_update_on_Trade_Receivable_Collection_from_Management.jsp

2022-05-27 19:14