CIMB Analysis: Genetec Maintains Growth Trajectory - Strong Buy Recommendation at RM3.60

Genetec A baby step

Publish date: Thu, 29 Feb 2024, 10:50 AM

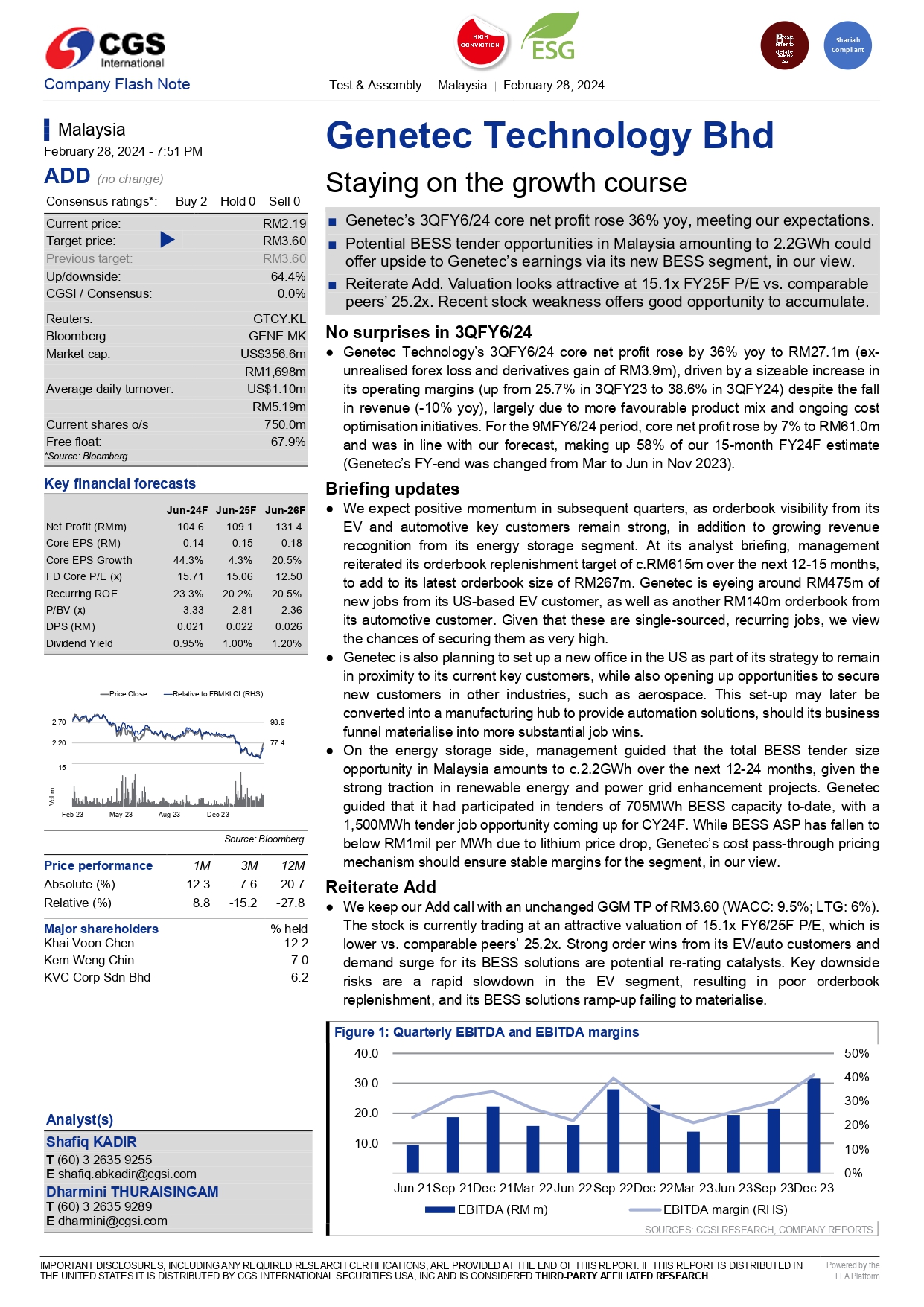

Genetec Technology showcased robust growth in its 3QFY6/24 performance, with a core net profit surge of 36% year-on-year to RM27.1

million, despite a 10% revenue decline. This growth is attributed to improved operating margins, rising to 38.6%, and strategic product mix

and cost optimization efforts. Over nine months, the company's core net profit increased by 7% to RM61.0 million, aligning with forecasts and accounting for 58% of the anticipated 15-month FY24 figures after adjusting its fiscal year-end.

Looking forward,Genetec's new venture into the Battery Energy Storage Systems (BESS)market in Malaysia, with potential tenders amounting to 2.2GWh, promises further earnings enhancement. With an attractive valuation at 15.1x FY25F P/E versus peers' 25.2x and recent stock price adjustments, Genetec stands as a compelling investment opportunity, underscoring its resilience and strategic growth potential in challenging times.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Genetec - A baby step

Created by Genetec A baby step | Jun 25, 2024

Created by Genetec A baby step | Jun 25, 2024

Created by Genetec A baby step | Jun 25, 2024

Created by Genetec A baby step | Jun 25, 2024

Created by Genetec A baby step | May 29, 2024

Created by Genetec A baby step | Apr 24, 2024