Trading Idea - HTPADU

HLInvest

Publish date: Wed, 17 May 2017, 09:17 AM

- Company profile. HeiTech Padu is a global IT systems and technology services provider that specialises in developing ICT systems for public and private sectors. HeiTech’s core business segment focuses on system integration (application development, supply of hardware and maintenance services) and managed services (Managed Data Center Services, Managed Network and Communications Services, Desktop Management Services, Business Continuity Management, Customer Care / Helpdesk Services, ICT Deployment Services and Cloud Services), while other business areas include bulk mailing, parts database for automotive industry, engineering works and IT services.

- Growing managed services segment. Despite a drop in FY16 revenue to RM363m (-3.62% yoy), managed services division grew 7.2% yoy to RM119m, providing a steady recurring revenue (70% of total revenue) and defensive earnings to the Group against the high profile and volatile contribution from system integration business. Under this division, Disaster Recovery and Facility Management Services improved strongly by 53.9% to RM45m. We opine that cloud services could be the trend moving forward in this digital economy era

- Contracts secured in 2016 and 2017 by HeiTech:–

(i) Maintenance of mySIKAP system for Jabatan Pengangkutan Jalan worth RM79.7m over a two-year period. (1-Nov-16)

(ii) Integration of Foreign Worker Medical Examination System (FWMES) with Jabatan Imigresen‘s myIMMs system worth RM48.2m. (2-Nov- 16)

(iii) Development and integration of clinical documentation in Kementerian Kesihatan Malaysia’s Patient Management System worth RM28.6m.

(iv) Letter of award from Construction Industry Development Board (CIDB) for data centre and disaster recovery services valued at RM7.7m for 3 years. (10-Oct-16)

(v) Purchase order from Prudential Services Asia Sdn Bhd for disaster recovery services and office rental valued at RM14.9m for 3 years. (18-Oct-16)

(vi) Signed an agreement, worth RM41.9m with Permodalan Nasional Bhd (PNB) for the supply, installation, commissioning, operation and maintenance of managed wide-area network infrastructure services for PNB over a period of 5 years.

- Investors could be anticipating an earnings turnaround. Although the earnings contracted in FY13 and FY14, FY15 and FY16 experienced a turnaround amid better cost management and streamlining of business operations. At this current juncture, HeiTech is trading at trailing P/E of 12.4x based on EPS of 7sen. It is also trading at a discount of 36.6% from its NTA per share of RM1.38.

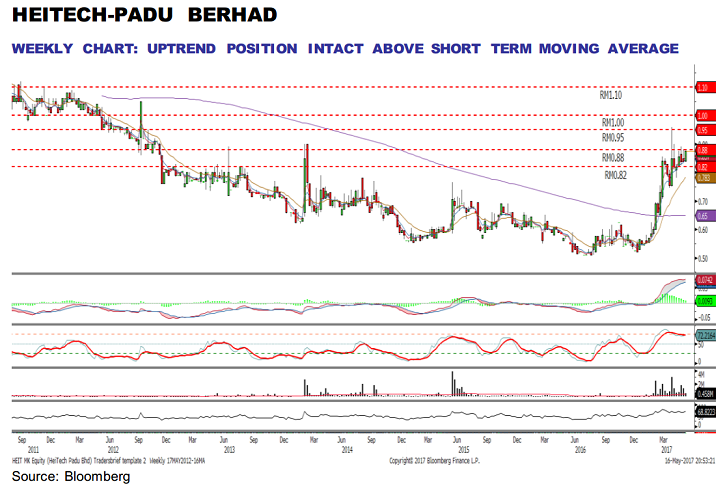

- Technical outlook. With both price and volumes spiking up, its technicals have triggered a potential sideways consolidation breakout formation. The MACD Line has crossed above the Signal Line, while the RSI is trending positively above 50. Given the setup on the technicals, we may anticipate a breakout above the RM0.88, targeting RM0.95-1.00, followed by a LT target of RM1.10. Support will be located around RM0.825-0.84. Cut loss will be set at RM0.82.

Source: Hong Leong Investment Bank Research - 17 May 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|