HLBank Research Highlights

Trading idea: TALIWRK – Earnings and dividend certainty; Technically oversold

HLInvest

Publish date: Mon, 22 May 2017, 09:03 AM

- Share prices tumbled 15.8% from 52-week high as Selangor’s water restructuring deal remains unresolved. Taliworks is a public utilities conglomerate involved in water, highway concessions, solid waste collection and public cleansing management in the states of Negeri Sembilan, Melaka and Johor in Malaysia under a 22-year concession agreement with the Federal Government.

- Despite a further delay from Management expectation of the Selangor water sector restructuring settlement by end April, Taliworks remains the best proxy to an eventual settlement of Selangor’s water restructuring. Post completion of the water sector restructuring, Taliworks is expecting to recover the trade receivables owed by SPLASH, most probably through a multi-year repayment scheme with interest accrued on any outstanding balance and a possible one-off special dividend after recouping the said trade receivables (amounting to c.RM471m which represents about 26% of Taliworks’ market capitalization).

- Strong relationship with EPF. Taliworks has a strong relationship with EPF and is expected to continue partnering it for future venture into acquisition of concession assets. We opine that Taliworks will enjoy a lower cost of capital by partnering with EPF.

- Ripe for a technical rebound? Although we may witness near term sideways consolidation as daily indicators are still trending sideways, downside risks are limited. Taliworks is an appealing investment (HLIB has a BUY rating with SOP target price of RM1.85) case given its concession businesses in different sectors which enjoys stable growth profile coupled with reduced vulnerability to idiosyncratic risk. Moreover, its attracti ve projected FY17-18 dividend yield of 5.4% and a deeply oversold weekly slow stochastic should provide a decent support to the share price.

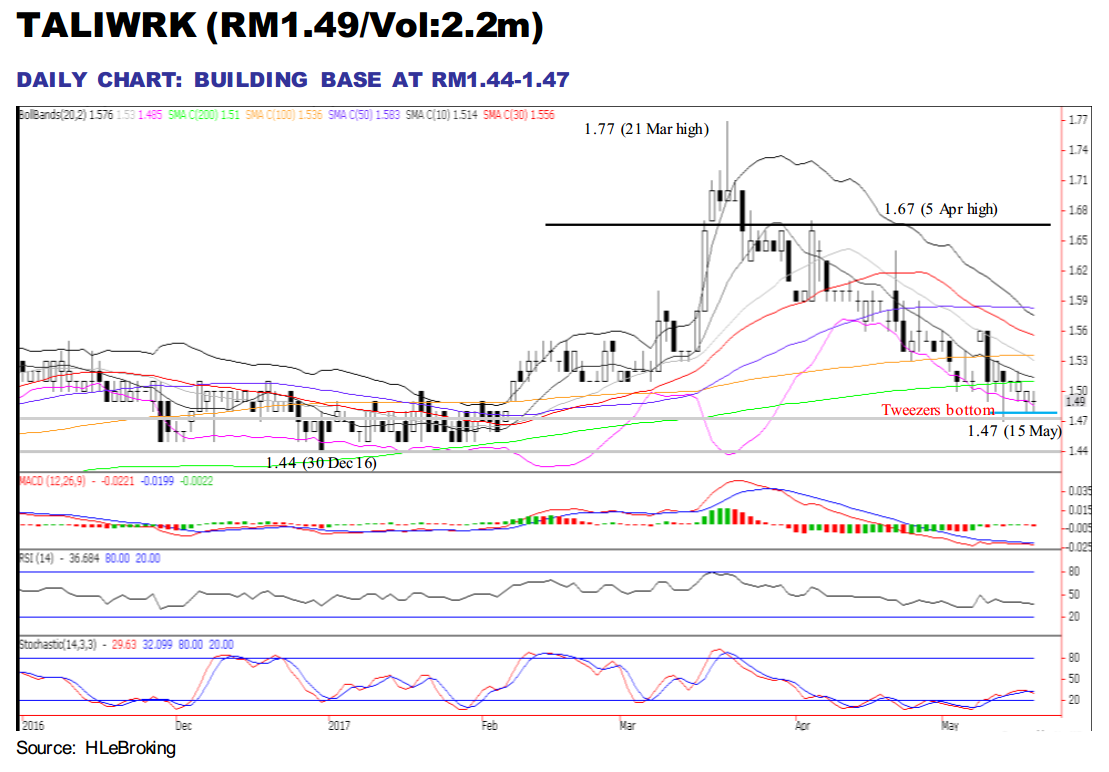

- Following the formation of Tweezers bottoms and deeply oversold weekly indicator, the stock is ripe for a potential relief rebound soon. A decisive breakout above RM1.51 (200-d SMA) will spur prices higher towards RM1.56 (30-d SMA) and RM1.67 (5 Apr high) before retesting our LT objective at RM1.77. Key supports are situated near RM1.44-1.47 levels. Cut loss at RM1.41.

Source: Hong Leong Investment Bank Research - 22 May 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Discussions

Be the first to like this. Showing 0 of 0 comments