HLBank Research Highlights

Trading idea: Signs of bottoming up

HLInvest

Publish date: Wed, 14 Jun 2017, 11:16 AM

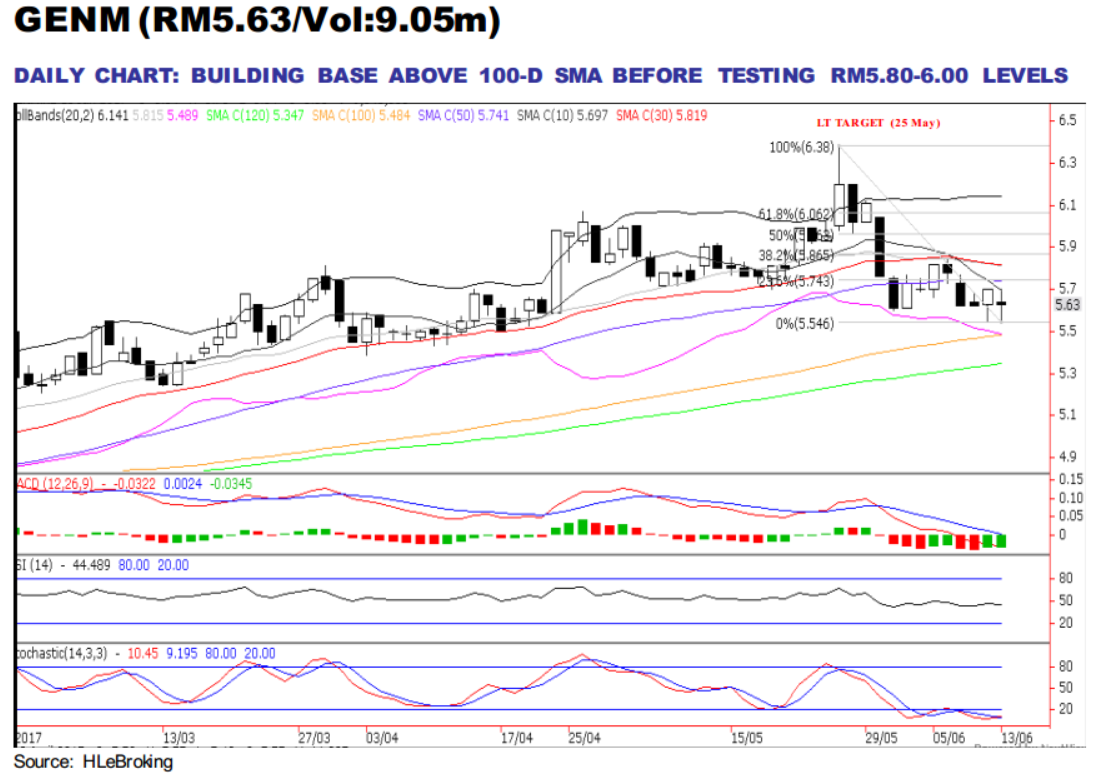

- Negatives priced in? GENM’s share prices slid 13.1% from 52-week high of RM6.38 (25 May) to a low of RM5.54 (13 June) before creeping up to close at RM5.63 yesterday. The pathetic performance was mainly driven by: 1) A sluggish 1Q17 results; 2) The recent 3.9% mom slump (amid political uncertainty and terrorist attacks) in pound sterling against RM as its UK’s leisure & hospitality business accounted about 10-15% of EBITDA. Besides, sentiment was dampened by the impending tourism tax, which is expected to be imposed in Malaysia as early as 1 August 2017 coupled with the potential delays in the opening of new amenities of the Genting Integrated Tourism Plan (GITP).

- Currently, GENM is trading at 15x FY18 P/E (8.5% below its average 10- year average P/E of 16.4x), supported by a strong 11.2% earnings CAGR for FY16-19. We believe such valuations and steeply oversold positions have priced in most of the negatives, providing sufficient margin of safety to cushion further plunge in share prices.

- Ripe for downtrend reversal. Given the formation of Tweezers bottom pattern and upticks in daily slow stochastic and MACD histogram, we expect prices to inch up further in the near term. A decisive breakout above the immediate resistance of RM5.74 (50-d SMA) will likely to lift share prices higher towards RM5.86 (50% FR) and our LT objective at RM6.06 (61.8% FR). On the flip side, key supports are RM5.54 and RM5.48 (100-d SMA). Cut loss at RM5.43.

Source: Hong Leong Investment Bank Research - 14 Jun 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on HLBank Research Highlights

Discussions

Be the first to like this. Showing 0 of 0 comments