HLBank Research Highlights

Trading Idea: FCPO & FKLI

HLInvest

Publish date: Tue, 18 Jul 2017, 12:06 PM

- Strong profit taking after peaking at RM2614 (monthly high on 11 July). FCPO rose as much as RM5 in the early trade to RM2,571, supported by gains in rival oilseed soy and cargo surveyor data showing stronger export demand. Shipments of Malaysian palm oil products during July 1-15 rose 17.8% from a month earlier, according to Intertek.

- However, strong profit taking erased the early gains as the FCPO dropped RM27 to end at RM2,539 in anticipation of a seasonal pick-up in palm oil output in 2H and recent strength of RM, which usually makes the tropical oil more expensive for buyers holding foreign currencies.

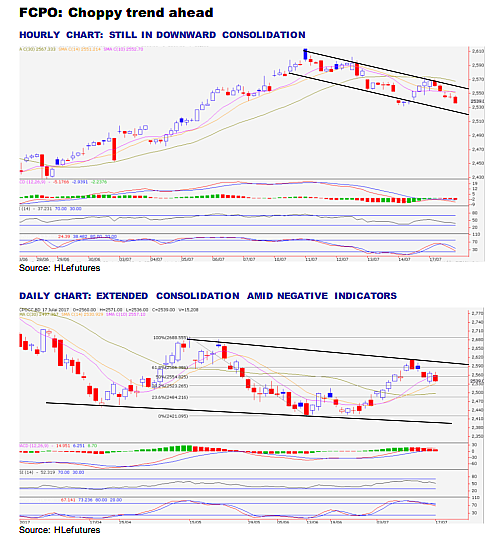

- Still trapped in consolidation. In the short term, FCPO is facing an uphill task to break the critical downtrend resistance (near RM2,614) from 3M high of RM2,688 (15 May). Failure to do so will witness another round of downward consolidation towards RM2,523 (38.2% FR), RM2,500 and RM2484 (23.6% FR), supported by weakening hourly and daily oscillators.

- On the contrary, only a decisive breakout above the immediate 10-d SMA resistance of RM2557 will reignite another rally towards RM2,586 (61.8% FR), RM2,614 and RM2,626 (76.4% FR)

- Driven by overnight record gains in Wall St and better-than-expected China 2Q17 GDP numbers, FKLI rose as high as 1764 intraday but profit taking activities amid lack of domestic catalysts witnessed the index ended unchanged yesterday.

- Sideways consolidation. Unless staging a successful breakout above 1,770 (38.2% FR) resistance in the near term, FKLI is likely to experience an extended sideways consolidation due to the lack of local rerating catalysts. A breakout above 1,770 will trigger further rebound towards the next targets at 1,780 (23.6% FR) and 1,800 objective.

- On the back of grossly oversold positions, we expect FKLI to trend sideways with critical support at 1,754 (30 June low). Failure to hold at 1,754 will spur the index sliding lower towards 1,743 (76.4% FR) and 1,727 (17 Apr low) territory.

Source: Hong Leong Investment Bank Research - 18 Jul 2017

More articles on HLBank Research Highlights

Discussions

Be the first to like this. Showing 0 of 0 comments