HLBank Research Highlights

Trading Idea - SAMCHEM 18 Jul 2017

HLInvest

Publish date: Tue, 18 Jul 2017, 11:18 AM

- Company profile. Samchem Holdings Berhad (SHB) was established in 1989 to trade polyurethane in East Malaysia and has expanded its range of products to include intermediate and specialty chemicals, becoming a market leader in Malaysia. In 2015, it has established a regional network with offices and warehouses across Malaysia, Vietnam, Indonesia, Singapore and Cambodia. Currently, Samchem is a distributor of industrial chemical of Shell EP (Singapore), BP Chemicals (Malaysia) and Exxon Chemical (M) Sdn Bhd, BASF and Petronas.

- Gaining traction in the ASEAN region. SHB ventured into Vietnam in 2007 and it is one of the only 3 major petrochemical distributors in Vietnam, with offices and warehouses in Ho Chi Minh City and Hanoi. SHB’s overall revenue grew by 16.2% yoy to RM697.2m in FY16, which Vietnam’s and Indonesia’s operations contributed RM220.4m (+11.4% yoy) and RM97.1m (+17.3% yoy) in the similar period respectively. Meanwhile, Singapore’s contribution grew more than 4 fold to RM3.3m.

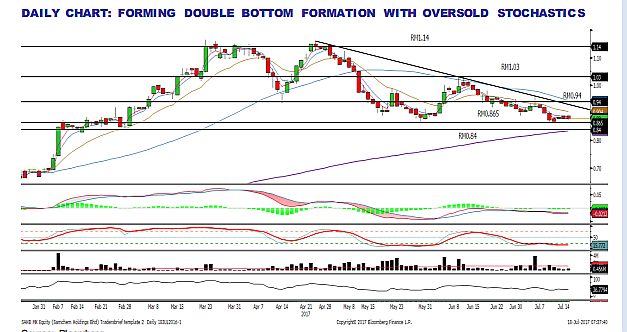

- Technical outlook. SHB has retraced from the recent peak of RM1.03 towards the RM0.865 level. The MACD Histogram has extended another green bar, while the Stochastics oscillator is oversold. SHB could be due for a rebound towards the immediate resistance zone of RM0.94-0.955, followed by a LT target of RM1.03. Support will be located around the RM0.845-0.86, with a cut loss point set at RM0.84.

Source: Hong Leong Investment Bank Research - 18 Jul 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Discussions

Be the first to like this. Showing 0 of 0 comments