HLBank Research Highlights

Trading Idea: FCPO & WTI crude oil

HLInvest

Publish date: Tue, 25 Jul 2017, 09:36 AM

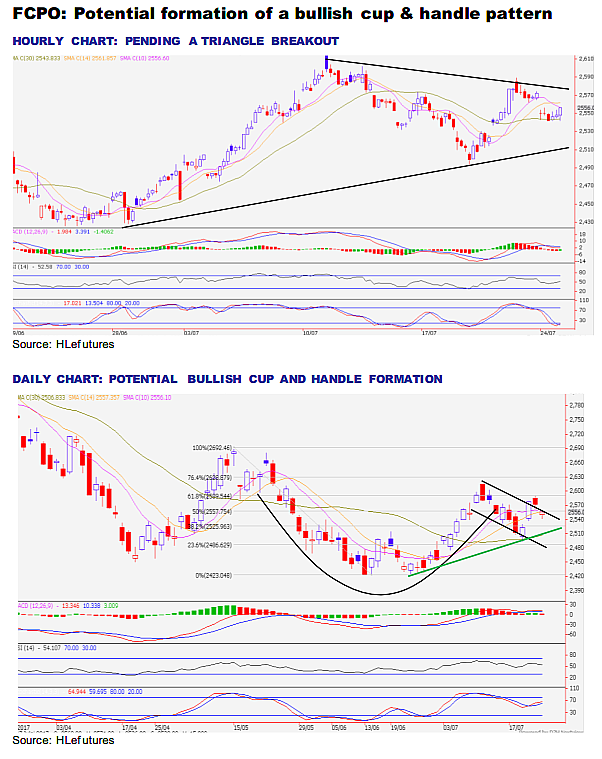

- FCPO eased RM16 to RM2556 on profit taking following a strong rebound from RM2494 (19 July) as the market recovered on the back of strength in other edible oils and tracking stronger export data from cargo surveyors.

- Given the possible cup & handle formation in daily chart, supported by positive daily and hourly indicators, FCPO is poised to retest RM2580 and RM2590 levels after a brief consolidation with LT objective at RM2614 (11 July high). ? On the contrary, failure to hold at key support of RM2526 (38.2% FR) will witness prices to retreat back towards RM2494 and RM2475 (4 July low) levels.

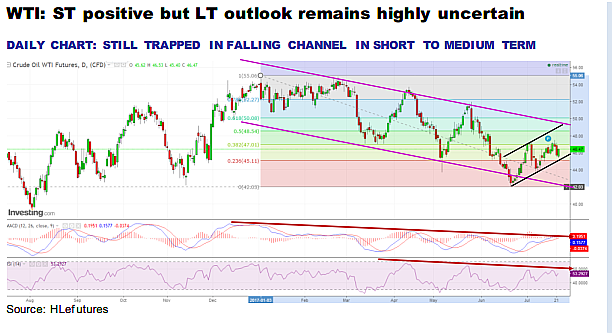

- WTI has been trading within a falling channel since hitting YTD high of US$55.2 on 3 Jan. On 21 June, WTI tumbled 23.8% (from $55.2) to YTD low of $42.1, as the effort to drain global inventories has taken longer than expected. Overall, rising output from U.S. shale producers has offset the impact of the output curbs, compounded by climbing production from Libya and Nigeria.

- Nevertheless, after hitting a trough near $42, oil prices staged a relief rally to a high of $47.2 on 20 July before settling 1.5% higher at $46.5 overnight as OPEC and non-OPEC leaders wrapped up their meeting in St. Petersburg Russia on a positive note, with Saudi Arabia, OPEC’s largest producer, limiting exports to 6.6 million barrels a day in August, 1 million lower than a year earlier. Meanwhile, Halliburton, the world’s top frackingservices provider, said U.S. explorers are "tapping the brakes" as oil struggles to breach US$50 a barrel. Sentiment was also boosted by news that Nigeria has agreed to cap their oil production output at 1.8 million barrels a day.

- Technically, WTI is likely to trend higher in the near term as it has been trading above the short term uptrend support from $42, with resistances pegged at $48.5 (50% FR) and $50 (61.8% FR and LT downtrend resistance).

- Barring a successful breakout above $50, WTI’s long term outlook remains uncertain as prices are still stuck in downtrend channel since Jan 2017. Failure to maintain a posture above the short term support trend line near $45 will witness oil prices retreating back to $42-43 levels.

Source: Hong Leong Investment Bank Research - 25 Jul 2017

More articles on HLBank Research Highlights

Discussions

Be the first to like this. Showing 0 of 0 comments