HLBank Research Highlights

FITTERS – Expect a better FY18; Potential ascending triangle breakout

HLInvest

Publish date: Mon, 29 Jan 2018, 11:05 AM

- Profile: Listed in Oct 1994, FITTERS has ventured into various businesses and has enhanced its value through the Group’s diversification strategies. Over the years, FITTERS has gained recognition as a “one-stop” fire protection specialist before venturing into property development & construction, renewable & waste-to-energy and green palm oil as well as HYPRO® PVC-O ( Oriented Unplasticized Polyvinyl Chloride) pipes manufacturing & distribution.

- The Fire Services division (generated RM85m revenue and RM2.3m PBT for 9MFY17) will continue to be the bread and butter business, generating a steady stream of income as it focuses its efforts to increase its revenue stream through greater participation in cross sectoral projects and not limit its focus in the building and construction sector only.

- On the property front (generated RM7.5m revenue and RM1.5m PBT for 9MFY17), following the successful launchings of integrated commercial, retail and residential Development i.e ZetaPark @ Setapak in 2011 and high-rise development project named ZetaDeSkye @ KL in 2014, FITTERS is planning to redevelop the newly acquired Plaza Pekeliling that is strategically located in a prime location along Jalan Tun Razak, Kuala Lumpur, into high-end work suite. Besides, FITTERS has a 50- acre parcel of land in Rawang, Selangor which is suitable for residential development. Meanwhile, the construction division had recently been awarded a RM97.8m project management & construction contract; where earthworks and piling have commenced. It had received a further RM81.5m contract for the subsequent phase of the same development.

- The Renewable & Waste-to-Energy division (generated RM118m revenue and RM2.6m PBT for 9MFY17) is expected to perform better in FY2018 in view of the anticipated improvement of throughput at its palm oil mill and dry long fibre facilities and the new revenue stream from the medical waste treatment plant and the biogas capture plant. The mill has scheduled to start the final testing of the 2MW biogas power generation facility and is expected to be connected to the TNB grid for a period of 16 years.

- Since established in 2014 and incurred losses since FY15, HYPRO PVC O Pipes Manufacturing & Distribution Division (generated ~RM11m revenue and RM4.6m pre-tax loss for 9MFY17) is likely to breakeven in FY18 from a pre-tax loss of RM7.3m in FY15, given its growing acceptance for its pipe attributes, namely lightweight, easier to handle, highly durable and able to withstand high pressure for water transportation, make its pipes a viable choice for new pipe-laying opportunities from both the private and public sectors. The manufacturing plant is located in Gebeng Industrial Park, Kuantan, Malaysia to serve the market in Malaysia and South East Asia. FITTERS is currently growing its market presence in the region through export, starting with Papua New Guinea, Laos and Vietnam. The group is also aggressively engaging the state water authorities to expand its reach and is confident that revenue shall improve significantly in the coming quarters.

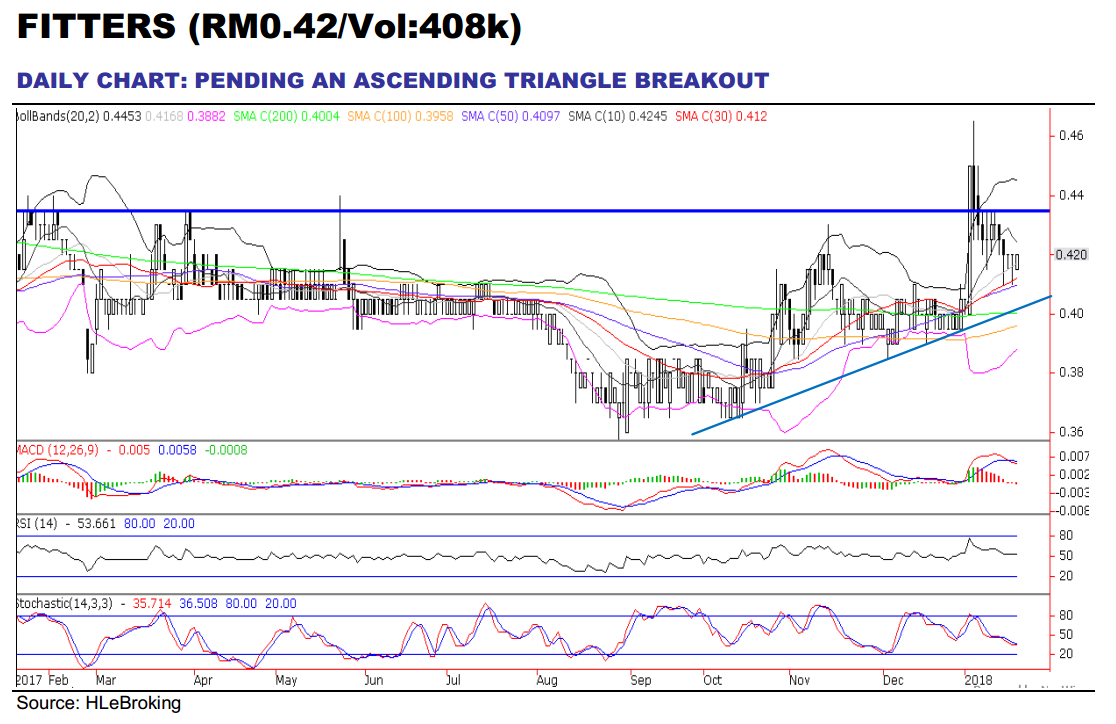

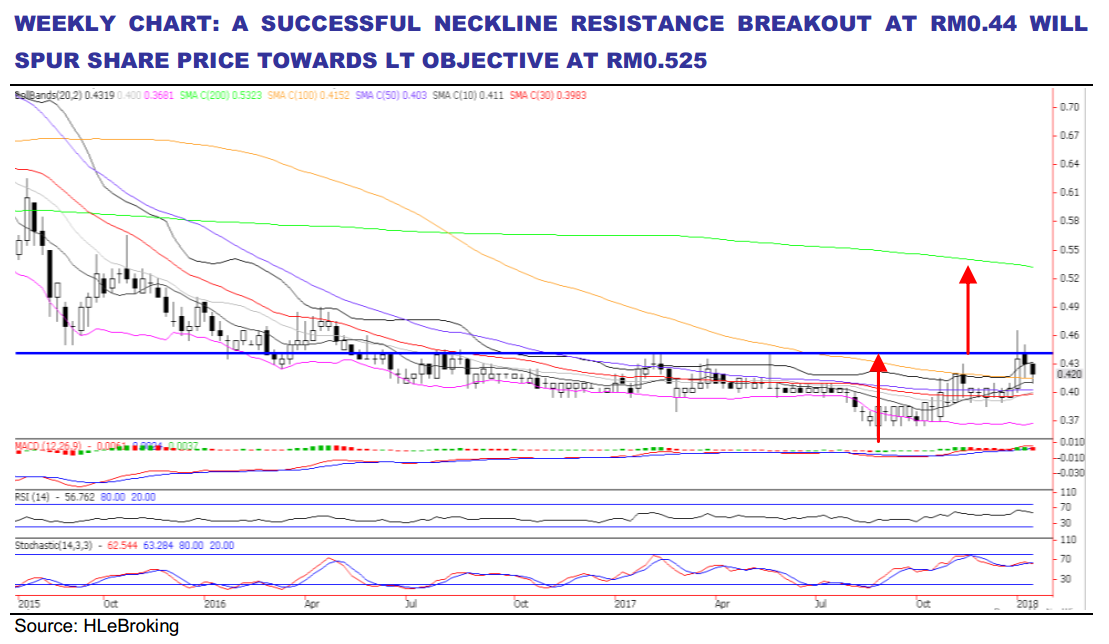

- Downside risks limited and pending a bullish ascending triangle breakout. Following a bullish breakout above 200d SMA (now at RM0.40) in early Jan, the bulls are likely to back in charge, in anticipation of a potential ascending triangle pattern breakout. Downside risks are cushioned by active share buyback exercises (treasury shares of 29.63m as at 19 Jan or equivalent to 6.2% of issued shares), expectations of better FY18 results (after recording the best quarterly results since 3Q15) and undemanding 0.55x P/B (lower than its 10-year historical mean 0.83x).

- A decisive break above RM0.44 (overhead neckline resistance) would spur prices higher towards RM0.465 (5 Jan high) and our ascending triangle breakout objective at RM0.525 next. On the flip side, key supports are RM0.41 (50d SMA) and RM0.40. Failure to hold near RM0.40 may weaken share prices lower towards RM0.355 (28 Aug low) zones. Cut loss at RM0.39.

Source: Hong Leong Investment Bank Research - 29 Jan 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on HLBank Research Highlights

Discussions

Be the first to like this. Showing 0 of 0 comments