HLBank Research Highlights

FCPO – Pending a sideways consolidation breakout

HLInvest

Publish date: Tue, 06 Feb 2018, 09:51 AM

- A weak start in 2018… After tumbling 19.6% to RM2498 in 2017, FCPO rebounded 5.7% to RM2641 on 9 Jan amid firmer related edible oils and improving export data coupled with expectations of a confirmed La Nina. However, a confluence of negative news flows such as persistent worries of record stockpiles and strong RM coupled with the EU decision to curb biofuel imports triggered strong profit taking consolidation as FCPO slid 7.9% to a low of RM2433 on 19 Jan.

- Subsequently, rising edible related oils amid weather distress in the US as well as bullish FCPO outlook forecast at an industry conference held in Karachi coupled with the easing in RM saw the index rebounded 2.4% from RM2433 to end at RM2493 on 5 Feb.

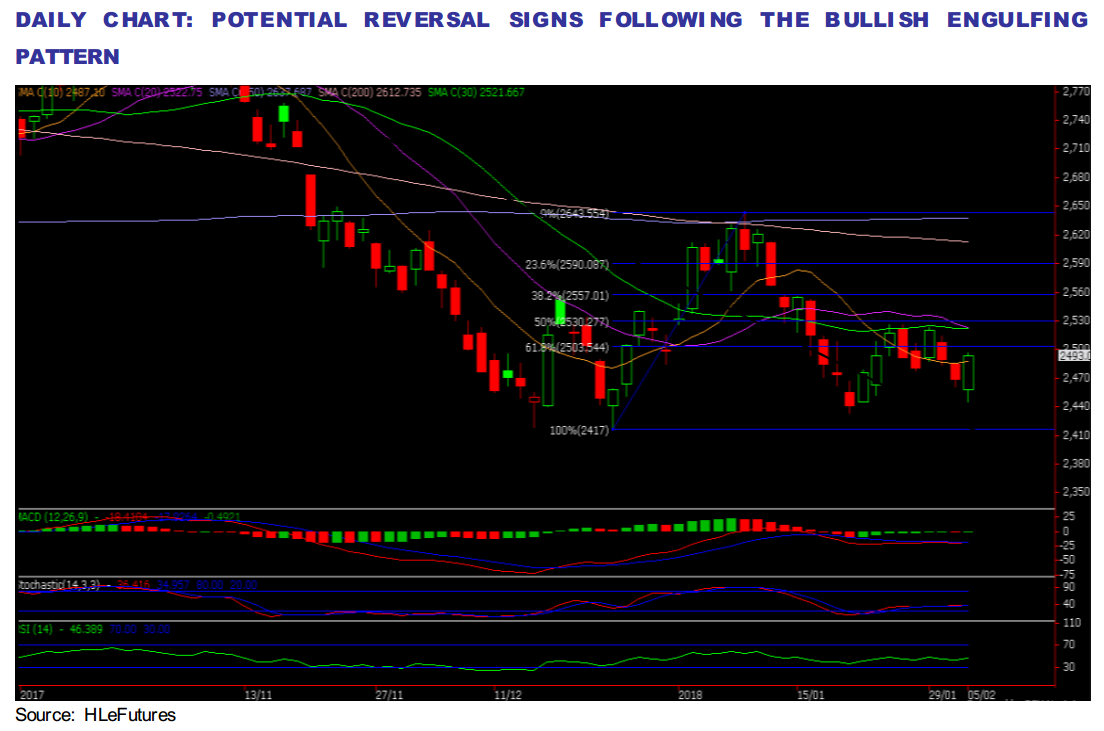

- …but potential technical rebound amid the bullish engulfing pattern (daily chart). Given the bullish engulfing pattern (daily chart) and the bottoming up signals in hourly chart, FCPO is envisaged to experience further rebound with immediate target at RM2518 (200H SMA). A decisive breakout above RM2518 will spur prices higher towards RM2530 (50% FR), RM2557 (38.2% FR) and our LT objective at RM2590 (23.6% FR). Conversely, a breakdown below RM2470 (76.4% FR) will trigger a resumption of downtrend to retest lower supports at RM2433 and RM2417 (22 Dec low) zones.

Source: Hong Leong Investment Bank Research - 6 Feb 2018

More articles on HLBank Research Highlights

Discussions

Be the first to like this. Showing 0 of 0 comments