HLBank Research Highlights

FCPO – Potential downtrend reversal?

HLInvest

Publish date: Tue, 13 Mar 2018, 06:15 PM

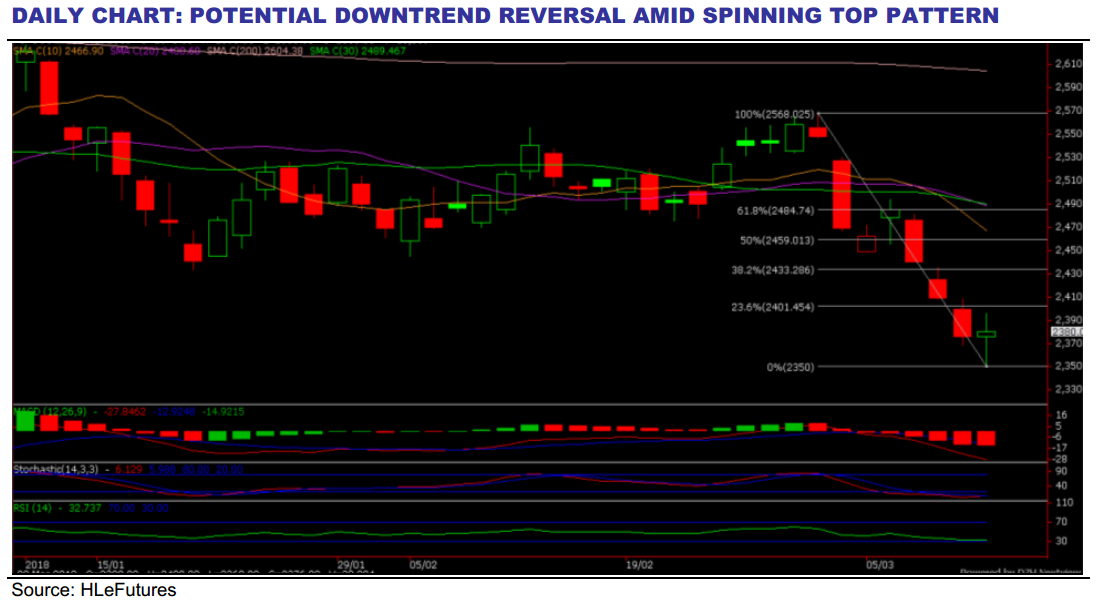

- A confluence of negative headwinds saw FCPO slid 7.3% from March high. FCPO staged a strong 2.7% rebound after recorded three consecutive monthly losses in Nov (-7.5%), Dec (-4%) and Jan (-0.3%) However, the bullish trend reversed in March as the index nosedived 7% to end at RM2380 on 12 March from end Feb following a confluence o discouraging data from Feb MPOB and industry cargo surveyors, coupled with less favourable outlook offered in the POC2018 last week. Sentimen was also dampened by the nagging concerns India tariffs hike

- Potential downtrend reversal? After sliding 7.3% or RM188 from March high of RM2568 (2 Mar), FCPO could stage a technical rebound from steeply oversold positions after tumbling to a low of RM2350 yesterday, supported by the bottoming up hourly chart and the spinning top pattern (daily chart). However, only a successful rebound above RM2400 will arrest current downtrend, with key resistances at RM2433/2459/2484 territory. On the flip side, failure to hold at the critical RM2375 (200w SAM) support could trigger further downward pressure towards RM2350/2300/2266 levels.

Source: Hong Leong Investment Bank Research - 13 Mar 2018

More articles on HLBank Research Highlights

Discussions

Be the first to like this. Showing 0 of 0 comments