Traders Brief - Easing trade tensions may lift KLCI higher

HLInvest

Publish date: Tue, 19 Feb 2019, 05:10 PM

MARKET REVIEW

Asia’s stock markets ended on a firmer note after the conclusion of the high-level discussion in Beijing last week. Also, investors were slightly optimistic as the US and China officials are set to continue the trade talks in Washington this week. The Shanghai Composite Index jumped 2.68%, led the regional benchmark indices such as Hang Seng Index and Nikkei 225 higher by 1.60% and 1.82%, respectively.

In tandem with the bullish tone on Wall Street and the regional peers, the FBM KLCI added 0.23% to 1,692.74 pts. Market breadth was positive with 446 gainers vs. 378 losers, accompanied by 2.75bn shares traded for the session, worth RM1.65bn. Nevertheless, we noticed the emergence of profit taking activities amongst O&G stocks.

Wall Street was closed for President’s day public holiday. Meanwhile, stocks in Europe ended mostly positive amid optimism on trade deals between the US and China. The Stoxx Europe 600 rose 0.23% to 359.78 pts (4-month high) led by telecommunications companies. Also, sentiment was lifted as WTI crude oil rose above USD56.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has been consolidating sideways between the 1,682-1,700 levels over the past 12 days. The MACD Indicator is flattish but hooking mildly upwards above zero. Meanwhile, the RSI and Stochastic oscillators are turning higher over the past two trading days. With the technical readings turning positive on most of the indicators, we could anticipate the key index to retest 1,700 over the near term. Should the key index breaches above 1,700, next target will be located around 1,730, support will be set around 1,682.

As trade tensions eased on the back of positive statements from President Trump over the weekend and strong regional gains yesterday, we anticipate that the positive sentiment could extend over the near term. Meanwhile, we expect trading activities to increase in O&G sector as Brent oil prices extended the rebound above USD66.

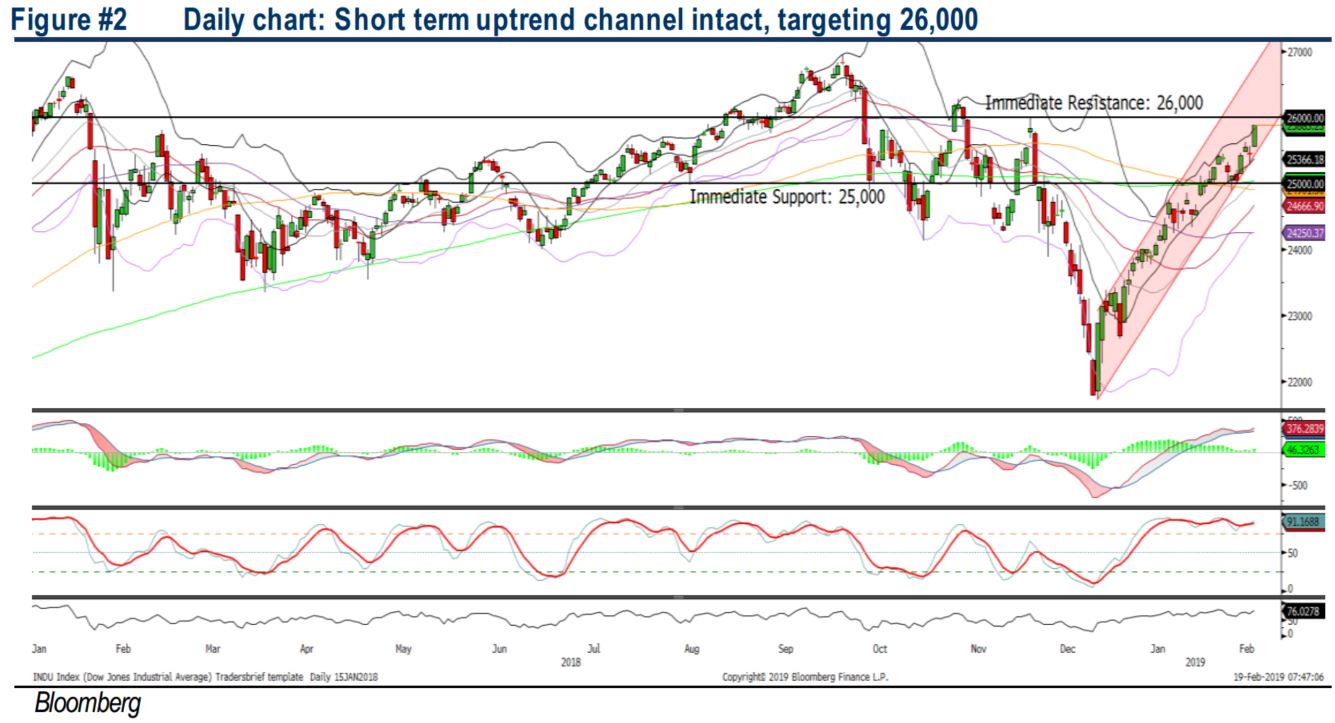

TECHNICAL OUTLOOK: DOW JONES

The Dow’s technical readings are positive with the key index hovering within the short term upward channel and could be retesting the 26,000 level. The MACD Indicator expanded positively last week. However, both the RSI and Stochastic oscillators are suggesting that the key index is overbought. The Dow could hit the 26,000 and profit taking could emerge, forming a potential retracement phase. Support will be pegged around 25,000.

At this current juncture, investors are taking a slightly positive stance on trade developments; expecting a positive outcome before the 1st of March deadline. Nevertheless, FOMC meeting minutes will be watched closely this week, to gauge the interest rate outlook moving forward.

TECHNICAL TRACKER: WZ SATU

Uplifting of bauxite mining ban should benefit WZSATU. WZSATU’s share price has dampened by the bauxite mining ban since Jan 2016. With the uplifting of bauxite mining and export ban, we see potential of WZSATU writing back its RM14.4m one-off impairment of mining assets and reboot its mining operations, eventually translating to higher earnings in the upcoming quarters. Besides, we expect the recovery seen in other business units (O&G and Construction) under WZSATU. Should there be a breakout above RM0.345, next target will be at RM0.37-0.40, followed by RM0.50. Support will be anchored around RM0.295-0.30, with a cut loss set below RM0.28. We do not rule out a possibility of WZSATU hitting the upper limit on the back of this positive headline of bauxite mining ban.

Source: Hong Leong Investment Bank Research - 19 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|