Fitters Diversified - Turning Around Within the Pipes Division

HLInvest

Publish date: Fri, 05 Apr 2019, 07:44 PM

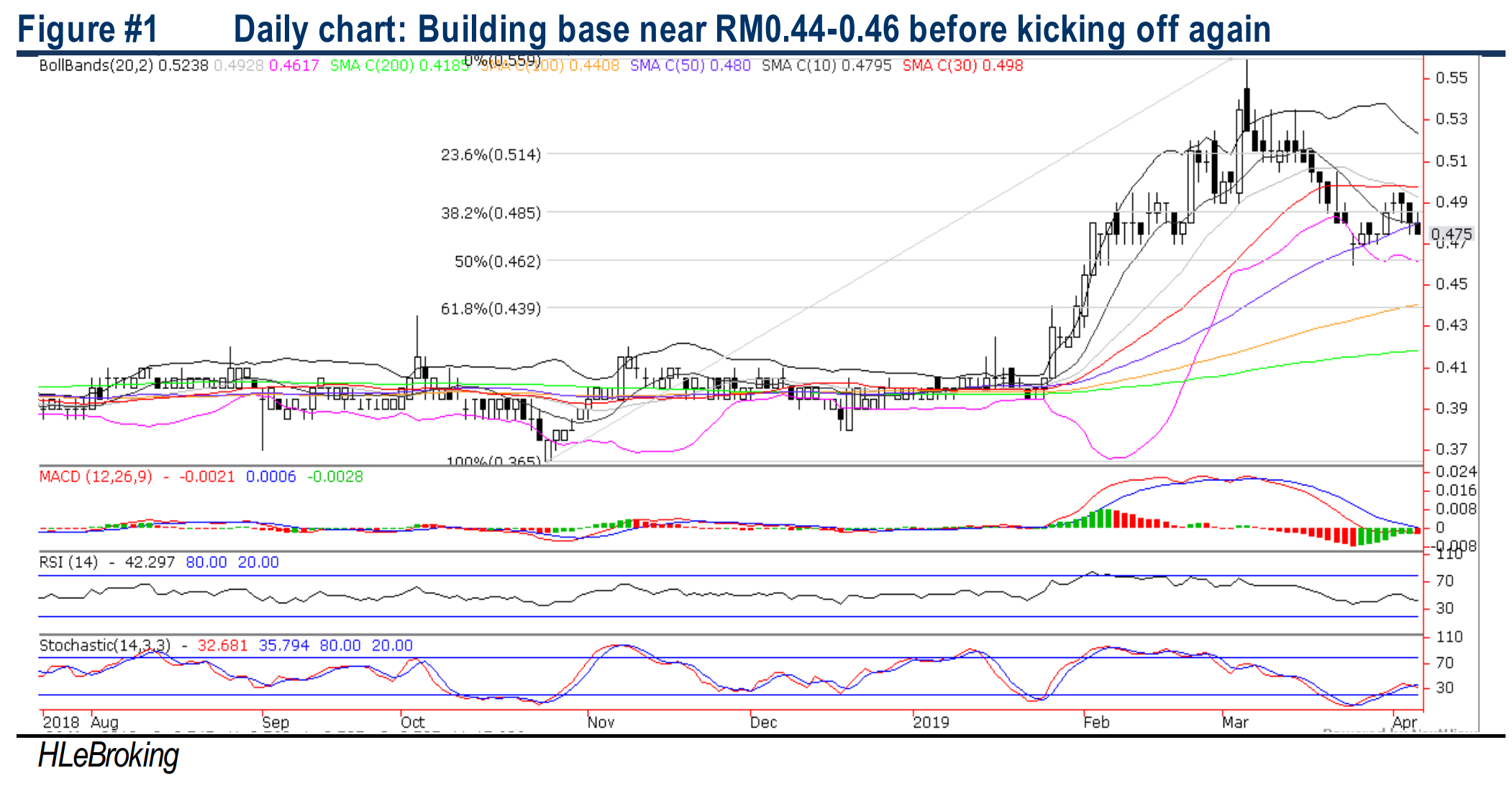

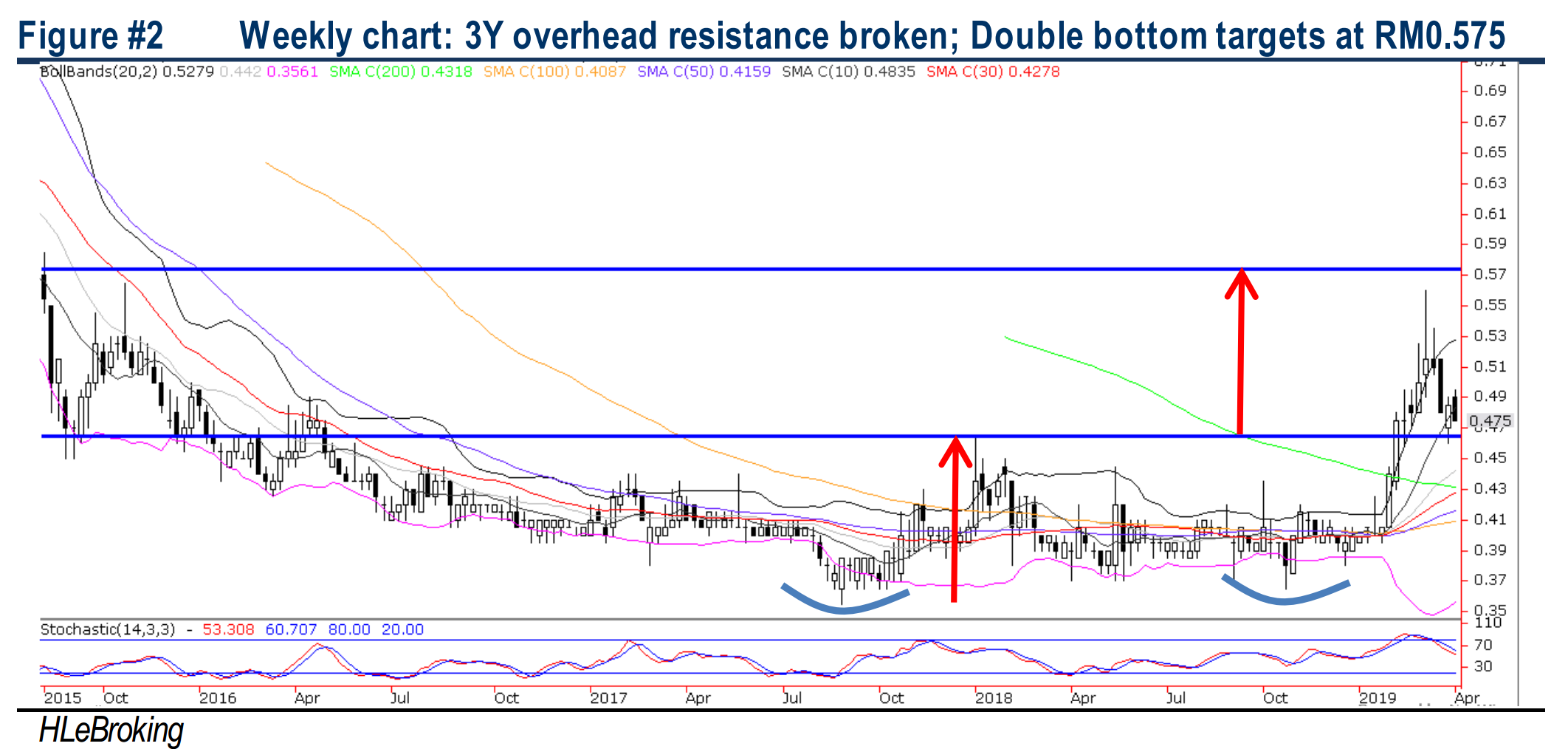

FITTERS is expected to perform better in 2019, as its pipes division is on track to receive larger orders, giving rise to economies of scale as Malaysia’s water and waste water infrastructure undergo upgrades, coupled with the central purchase contract from PAAB and commitment of RM50m sales from Unitrade to drive pipes segment’s performance. Meanwhile, the property development & construction division will remain a major contributor due to the construction progress of Azalea@TamanPutra II (RM82m). At RM0.475, valuation at 0.59x P/B is cheap against 10Y 0.7x. With the double bottom formation, we expect FITTERS to advance further towards RM0.50-0.575 after a brief pullback.

Company profile: FITTERS FY18 main revenue contributors include:-

1) Renewables & waste-to-energy segment (RM134m or 38%). Operation of green palm oil mill (Green palm oil mill in Baling, Kedah capacity: 60 MT/hr of FFB) with generation of renewable energy and waste treatment. It has commenced sale of electricity to Tenaga Nasional Berhad (TNB) under Renewable Energy Power Purchase Agreement in March 2018 with feed-in tariff rate set at RM0.47 per kilowatt hour. Targeting to breakeven in FY19/20 as pre-tax losses reduced to RM1.8m in FY18 from RM9.6m in FY15;

2) Fire service (RM116m or 32%) – A reputable “one-stop” fire protection and prevention specialist with over 30 years of experience will continue to be the bread and butter business but experienced declining PBT from RM15.3m in FY15 to RM3.9m in FY18.

3) Property development & construction segment (RM87m or 25%). Established track record for developing high-rise properties in KL, with the completion of Zetapark in Setapak, KL (GDV: RM423.2 mil) in 2014 and Zeta Deskye off Jalan Ipoh, KL (GDV: RM169.3 mil) in 2016. It has also delivered the 365,904 sq ft Festival City Mall to Lion Group and commenced RM97.8m contract to build first phase of Azalea@TamanPutra in 4Q17. Meanwhile, it will commence RM81.5m contract for the second phase of Azalea@TamanPutra in 2H19. Future projects included the redevelopment of Plaza Pekeliling located along Jalan Tun Razak (GDV: RM191m) and 50 acre residential development in Rawang (GDV: RM391.4 m). This division is expected to contribute substantially to in FY19 after recorded RM22m PBT in FY18.

4) PVC-O pipes (RM18m or 5%). Manufacturing and distribution of HYPRO® oriented unplasticised polyvinyl chloride (PVC-O) pipes through 72.3%-owned subsidiary, Molecor (SEA) Sdn Bhd. Its products have proven technology from Spain with superior and more cost-effective alternative to steel- and concrete-based pipes, and other plastic pipes for municipal and commercial use. Since 2015. HYPRO®pipes have gained a strong track record across 10 states in Malaysia, with over 450km of pipes installed and approved by SPAN, Ranhill SAJ, Syarikat Air Negeri Sembilan (SAINS), Air Selangor and Air Kelantan. In Nov 2018, FITTERS secured a central purchase contract from Pengurusan Aset Air Bhd (PAAB) to supply HYPRO PVC-O water pipes from Oct 2018- Sep 2020. PAAB is the owner of water assets in seven states, namely Johor, Melaka, Negeri Sembilan, Kelantan, Penang, Perak and Perlis. To kick off the contract, the PVC-O pipes will be utilised to replace ageing asbestos cement pipes in Kelantan and Johor, and will be expanded to other states in Malaysia in the near future as PAAB plans to upgrade water infrastructure in states under its jurisdiction to ensure uninterrupted supply of water to customers. In Dec 2018, Molecor (SEA) appointed UNITRADE (a major distributor, stockist, importer and exporter of pipes, fittings, valves, accessories, fire-fighting and building materials) as the master stockist and distributer for HYPRO PVC-O water pipes for supply to water and sewerage projects in Malaysia with a commitment to RM50m. Overall, this division is expected to turnaround for FY 2019 after registering accumulated pre-tax losses of RM23.2m from FY15-18.

LT positive following the double bottom formation. Based on weekly chart, Fitters has staged a strong breakout above the 200W SMA at RM0.43 and the 3Y overhead resistance at RM0.45 recently to reach a 52W high of RM0.56 (6 Mar) before ending at RM0.475 yesterday on profit taking pullback. Overall, we remain optimistic that after a brief consolidation to neutralise overbought positions, Fitters is likely to launch another upleg to retest RM0.50 (30D SMA), RM0.52 (upper Bollinger band) and the double bottom long term objective at RM0.575 levels. Key supports are RM0.46 (50% FR) and RM0.44 (61.8% FR). Cut loss at RM0.43.

Source: Hong Leong Investment Bank Research - 5 Apr 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|