Econpile - Improving sector dynamics and oversold positions

HLInvest

Publish date: Fri, 03 May 2019, 02:30 PM

Following a 22% slump in 7 trading days to RM0.625 from YTD high of RM0.80 (18 Apr), ECONBHD provides an attractive risk-reward profile at 12.3x FY20E P/E (18% lower against peers), supported by superior ROE, coupled with robust order book ~RM1bn (after secured RM620m contracts in 9MFY19). Overall, ECONBHD remains the market leader in the piling and foundation with its expertise in undertaking complex and larger scale jobs. After a sluggish 1HFY19 (mainly due to the variation orders, cost overrun and impairment of its trade receivables), 2HFY19 and FY20-21 earnings are expected to improve further, backed by solid RM1bn order book and potential more job replenishments as the sector dynamics have turned positive following the revival of ECRL and Bandar Malaysia. Technically, ECONBHD may be due for a downtrend reversal to test RM0.70-0.78 territories after a brief consolidation.

One-stop foundation specialist. ECONBHD is a full range of piling (bored piling, driven piles and jack-in piles) and foundation specialist in Malaysia providing piling solutions and foundation works, which includes earth retaining systems, earthworks, substructure and basement construction works. To date, the group has completed more than RM2.5bn worth of piling and foundation services encompassing numerous infrastructure and property development projects in the Klang Valley, Penang, Johor, Pahang, Sabah and Sarawak.

Job opportunities that may bode well for ECONBHD. Pipeline of job opportunities that could emerge in the future include the Klang Valley Double Track (RM3bn), ECRL (RM35-40bn), KL-SG HSR (RM25bn), and Klang Valley MRT 3 (RM20bn) and ECONBHD is likely to become a major contender to capture a slice of the jobs given its proven track record.

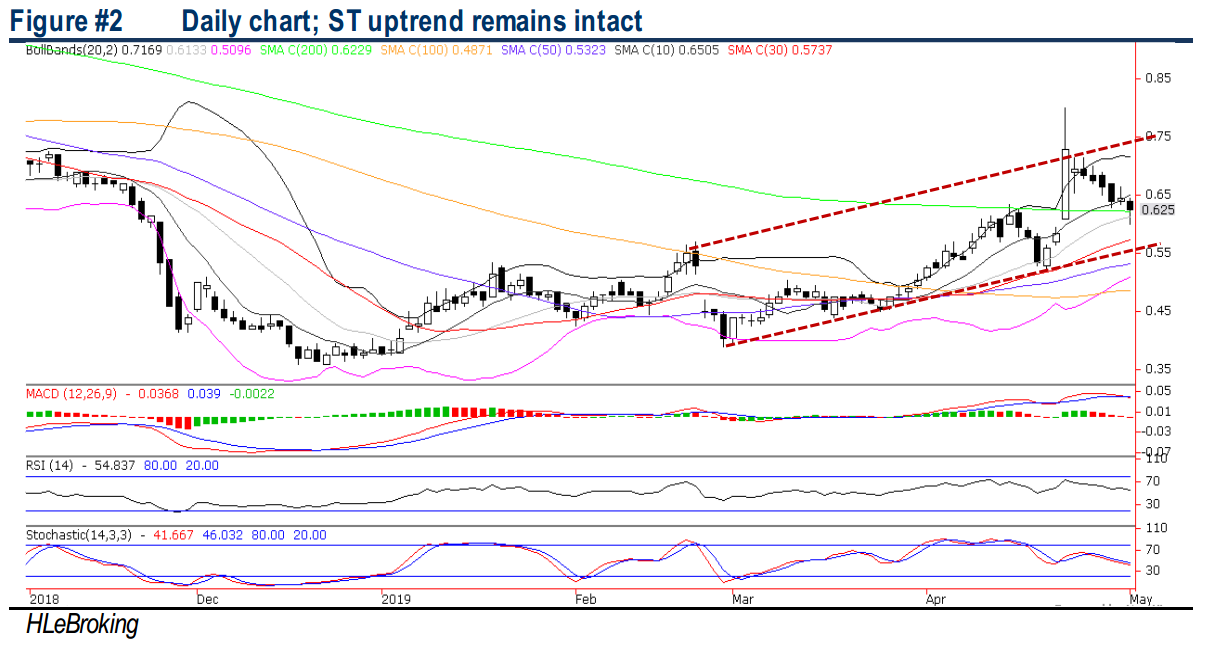

Potential downtrend reversal. In the short term, ECONBHD could still engage in a consolidation mode amid negative daily technicals indicators. Nevertheless, downside risk is limited amid bottoming up hourly chart and ECONBHD continues to trend above multiple (eg 20d/30d/50d/100d/200d) key SMAs. Once this pattern ends, we expect prices to stage a breakout above RM0.65 (10d SMA) to advance further towards RM0.70 psychological barrier before reaching our LT objective at RM0.80 (52W high). Key supports are RM0.60 and RM0.575 (20d SMA). Cut loss at RM0.56.

Source: Hong Leong Investment Bank Research - 3 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|