HSS Engineers - Infrastructure and Water Projects Beneficiary

HLInvest

Publish date: Wed, 15 May 2019, 10:07 AM

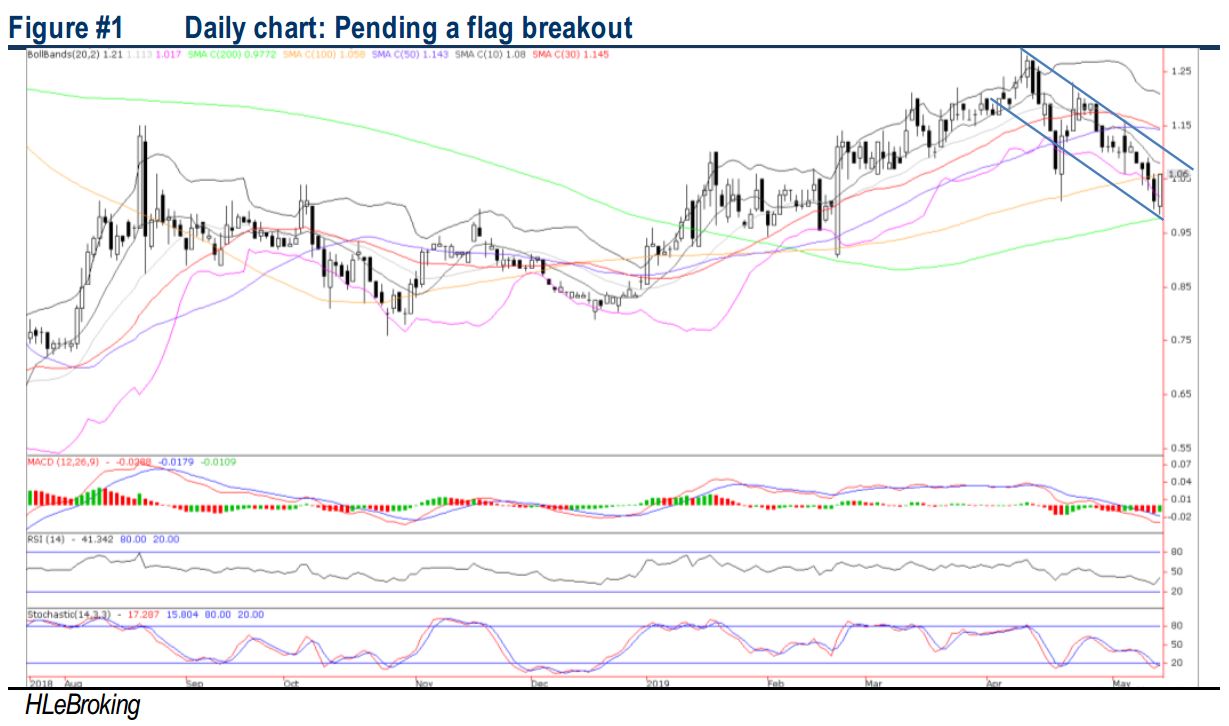

We like HSSEB’s exposure to a wide array of domestic infrastructure segments, riding on the pump-priming projects in Malaysia and the ASEAN as major energizing force for growth that are impervious to heightened trade war tensions and decelerating global economy. Valuation is undemanding at 17.5x FY20 P/E (22.4% below its average P/E of 22.5x since listing), supported by RM546m order book (sustainable for 2-3 years) and a strong 27% EPS CAGR from FY18-21. Yesterday’s bullish engulfing candle provides an impe tus for HSSEB to break above the flag resistance in the short term, opening the door for a retest of the 52W high of RM1.29.

Malaysia’s engineering DNA. HSSEB is the 1st engineering consultancy services listed on Bursa Malaysia and the largest local engineering firm that provides engineering and project management services to a wide array of sectors including urban infrastructure, roads and highways, railways and metro systems, building and structures, transportation planning, power generation, and water resources management and supply. Its clientele is spanning from the domestic and international arenas (India, the Middle East and ASEAN). The Group has been involved in many notable large-scale projects including MRT 1 & 2, Maju Expressway 2, West Coast Expressway, SUKE Expressway, Pahang – Selangor Water Raw Transfer, Development of Sungai Selangor Phase 1, 2 and 3, Sarawak Water Grid Study and East Coast Rail Link. The Group now operates from 4 main offices, based in Kuala Lumpur (2 offices) and Penang in Malaysia as well as Chennai in India.

Beneficiary of mandatory use of BIM. According to the Construction Industry Development Board (CIDB), property developers working on government projects worth more than RM100m will be required to use BIM by 2020, in line with the 5-year Construction Industry Transformation Plan (CITP) launched in 2016. BIM is the process of designing a building or facility using an intelligent system of 3D modelling and computer simulation, which can identify design issues and construction errors before construction works start and this ultimately leads to 20-25% cost savings and reduced time on project delivery. HSSEB is one of the few consultants in Malaysia that can offer an integrated BIM system and is set to benefit from CIDB’s imposition of BIM requirement for government projects by 2020.

Strong order book of RM546m to sustain 2-3 years growth and tapping the huge infra boom in Asia. HSSEB’s current order book of RM546m will accord earnings visibility over the next 2-3 years. Moreover, it is aggressively making inroads into the huge infrastructure potential in Asia. According to the Asia Development Bank report in Feb 2017, a total of US$1.7trillion infrastructure spending (defined as transport, power, telecommunications, water supply, and sanitation) is needed in Asia each year through 2030 to maintain its growth momentum, tackle poverty, and respond to climate change, apart from the increased population and urbanization, accelerated mobility and demand for transportation coupled with increased trade competitiveness. The gap is acute in ASEAN, where infrastructure investment stood at just ~US$55bn, far short of the US$147bn benchmark.

Look to participate in upcoming project tenders From the slump in mega projects post-GE14, there appear to be signs of pump-priming making a gradual comeback, with more positive news flow on new tenders’ outlook in 2H19. As the leading engineering consulting firm for railway and road projects in Malaysia, HSSEB is looking to participate in the upcoming tenders including the following: (1) Iskandar Malaysia Bus Rapid Transit (BRT); (2) MRT3; (3) Penang LRT; (4) Central Spine road; (5) Kuching LRT; (6) Bandar Malaysia; (7) ECRL, (8) Penang Transport Masterplan etc.

Pending a flag breakout. Despite recent selloff in the lower liners amid external and internal headwinds, HSSEB is still able to build a base above support trend line near 200D SMA or RM0.975. Yesterday’s bullish engulfing candle provides an impetus for HSSEB to break above the flag resistance (near RM1.11) in the short term, opening the door to test RM1.15 (50D SMA) and our LT objective at 52W high of RM1.29 levels. Key supports are RM0.975-1.00. Cut loss at RM0.96.

Source: Hong Leong Investment Bank Research - 15 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|