Traders Brief - Overbought Signals, Market May Take a Breather

HLInvest

Publish date: Tue, 12 Nov 2019, 08:56 AM

MARKET REVIEW

Asia’s stock markets ended mostly in the negative region amid increased tension in Hong Kong, which contributed to a sharp dive in equities across the board; the Hang Seng Index and Shanghai Composite Index tumbled 2.62% and 1.83%, respectively, while Nikkei 225 fell 0.26%.

Similarly, trading sentiment was pointing towards profit taking mode and the KLCI slipped 0.10% to 1,608.15 pts. Market breadth was negative with decliners led advancers by a ratio of 5-to-3. Market traded volume stood at 2.37bn, worth RM1.64bn. Nevertheless, selected O&G stocks such as Penergy and Armada traded actively higher.

Wall Street ended mixed for the session as investors digested new development in Hong Kong protest where the tensions intensified on Monday, coupled with the ongoing stand-still trade progress (awaiting for the phase-1 deal to go through). The S&P500 and Nasdaq slid 0.20% and 0.13% respectively, but the Dow managed to eke out marginal gains on the back of buying support in Boeing following the news that 737 Max jet will start to deliver as early as next month.

TECHNICAL OUTLOOK: KLCI

The FBM KLCI has trended sideways over the past four trading days ranging between 1,600- 1,613 levels. The MACD Histogram has weakened yesterday, but the MACD Line is still hovering above zero. Meanwhile, both the RSI and Stochastic oscillators are overbought, hence we believe the upside could be limited over the near term around 1,610-1,620. Support is set around 1,600, followed by 1,580.

On the local front, we expect the KLCI to digest the recent extended technical rebound and the key index could take a breather moving into the full blown November reporting month with the expectation of a lacklustre reporting season. However, we opine that traders may take the opportunity to position for a decent window dressing in December. The KLCI’s trading range is expected to be hovering within 1,580-1,620 over the near term.

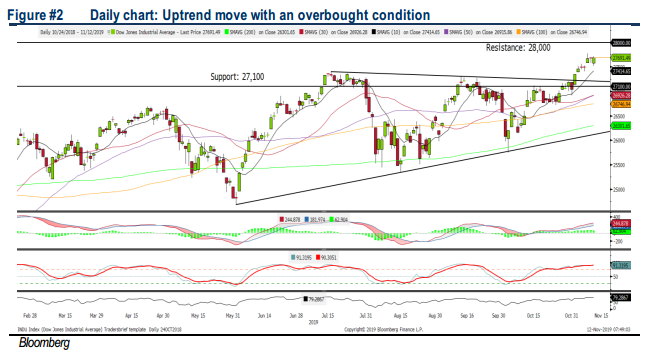

TECHNICAL OUTLOOK: DOW JONES

The Dow continues to trend higher, rebounding from the intraday low of 27,520, to mark a fresh all-time high yesterday. The MACD indicator is trending positively above zero, while the Stochastic oscillator is overbought. Resistance will be set along 28,000, while support is pegged around 27,400.

Given the overbought condition on major indexes, we believe the upside potential likely to be capped over the near term, with the investors monitoring closely on the trade progress between the US and China, where President Trump has been sending conflicting signals over the past weeks. Meanwhile, market participants will also be focusing on the Trump impeachment hearing this Wednesday. Hence, with the slightly negative bias catalysts for now, we believe the Dow upside may be capped near the 28,000 level.

Source: Hong Leong Investment Bank Research - 12 Nov 2019

.png)