Formosa Prosonic Industries - Divesting the Last Australian Project - Solid Net Cash, Strong DY and Attractive Valuations

HLInvest

Publish date: Tue, 19 Nov 2019, 05:15 PM

We like FPI due to its fruitful diversification from conventional speakers into richer margins audio system and component/ musical instrument segments coupled with the synergistic partnership with an established global EMS, Wistron (parent company with 28% stake). Despite facing higher costs, FPI’s prospects remain bright, driven by (i) bullish speaker market outlook, (ii) capacity expansion, (iii) strategic tie-up with Wistron, (iv) weak RM and (v) beneficiary of the US-China trade war. Valuation is undemanding at 11.4x trailing P/E (23% lower than peers), supported by solid balance sheet with RM0.65 net cash and 6.3% dividend yield (97% higher than peers). In anticipation of a seasonally stronger 3Q results, the stock is ripe for a relief rebound towards RM1.65-1.86.

A reputable audio parts and musical instruments manufacturer. Established in 1989, FPI is one of the leading OEM of high quality sound system in Malaysia, including conventional speaker systems, smart audio systems and musical instrument components and FPI has evolved from manufacturing of conventional speaker systems to smart audio systems and musical instrument components, including design and development of wireless and bluetooth speakers with cutting edge functionality and seamless connectivity. Its strong team of audio experts has over 30 years of experience in the design, manufacturing and marketing of sound system products to worldwide multinational companies.

Bullish speaker market outlook. According to Technavio, global speaker market will post a 4-year CAGR growth of 17% from 2018-2022 to reach USD27bn, the key factor driving the growth of the market is the rise in popularity of wireless streaming of audio device. The behavioural shift in how people listen to music inside and outside their homes will boost demand for portable speakers and sound bar.

Strategic tie-up with Fortune Global 500 company. Wistron Corporation (holding a 28% stake in FPI) is a global leading technology service provider (TSP) supplying innovative ICT products, service solutions, and systems to top branded companies worldwide. Its product and service lines include PCs, server and networking systems, enterprise storage solutions, professional display products, communication devices, electronics scrap recycling, as well as cloud and display vertical integration solutions. Wistron was listed as a Fortune Global 500 company in 2011, 2012, and 2018. Meanwhile, since 2009, Forbes Magazine has included Wistron among the Global 2000 for ten consecutive years (2009-2018). With 80,000 employees in various R&D, manufacturing, and after-sales service facilities in North America, Europe, and Asia, Wistron’s FY18 revenue and net income rose 6.4% and 26.3% to TWD 890bn and TWD 4.9bn, respectively. We believe as part of the world leading TSP giant, FPI is able to reap benefits from pooling knowledge resources, expanding geographic reach and product lines as well as technological transfer.

Positive outlook despite easing margins. FY19 is projected to be another record breaking year for top line, but bottom line would be slightly dragged by higher cost. Nevertheless, long term prospects remain favourable on the back of (i) additional new production line; (ii) weak RM; (iii) strategic tie-up with Wistron, (iv) potential business inflow from China. We like its impeccable balance sheet where it is in a net cash position of RM162m or 65sen per share (41% of share price) as end of 2Q19.

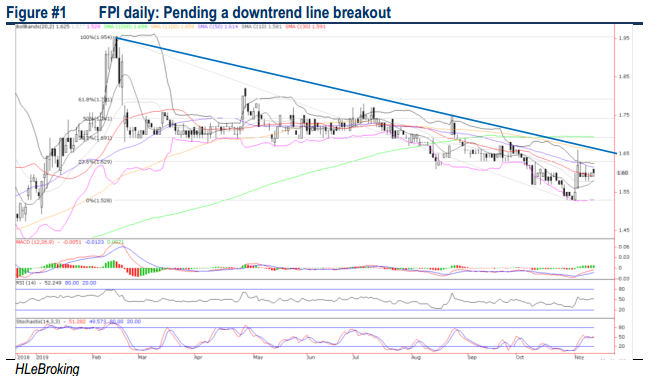

Ripe for a downtrend channel breakout. After hitting all-time-high of RM1.96 (18 Feb), FPI experienced a 21.9% correction to a low of RM1.53 (1 Nov) before gradually recovering at RM1.60 yesterday, mainly driven by the lower FY18 earnings and persistent selling spree from PNB (from 25.6% stake on 24 Jul 2009 to 6.1% on 8 Nov 2019 amid disposal of non-core strategic holdings). As prices seem to be holding well above RM1.53 support levels, FPI is poised for an impending the downtrend channel breakout in the short term as daily and weekly indicators are on the mend. A successful breakout above RM1.65 downtrned line could potentially lift prices towards RM1.74 (50% FR) before reaching our LT target at RM1.86 (76.4% FR). Supports are pegged at RM1.53 and RM1.50. Cut loss at RM1.48.

Source: Hong Leong Investment Bank Research - 19 Nov 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)