WTK - My 2 cents on the Quarterly Results and Others

ipodkaki

Publish date: Fri, 01 Dec 2017, 12:55 AM

Summary

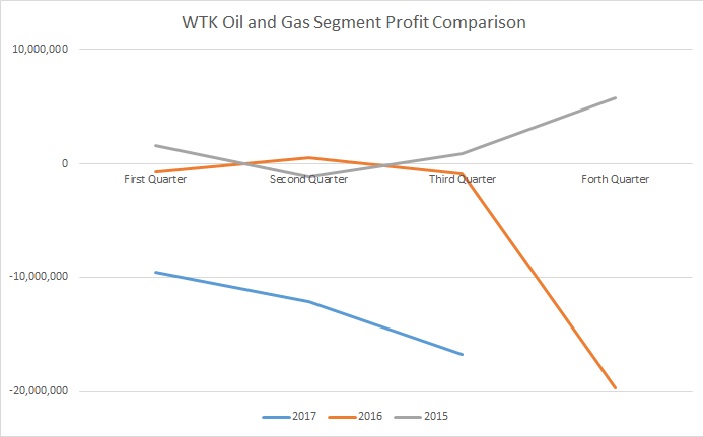

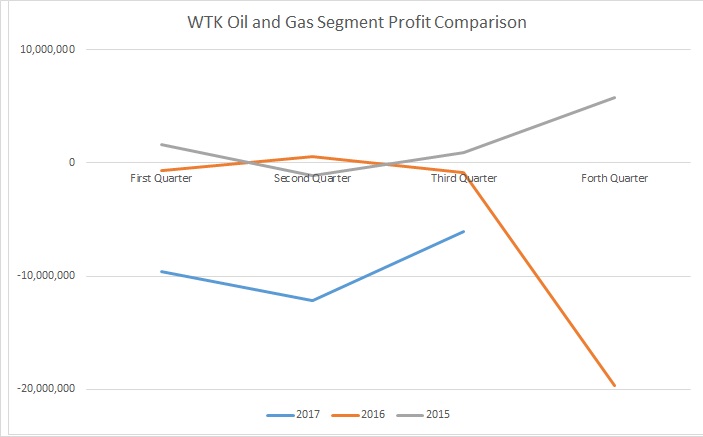

- WTK recorded 17 million of loss in quarter of 30-06-17 to 30-09-17

- 10 million Impairment loss and the project status in Oil and Gas segment

- Impacts of the hike of hill timber premium rate to Timber segment

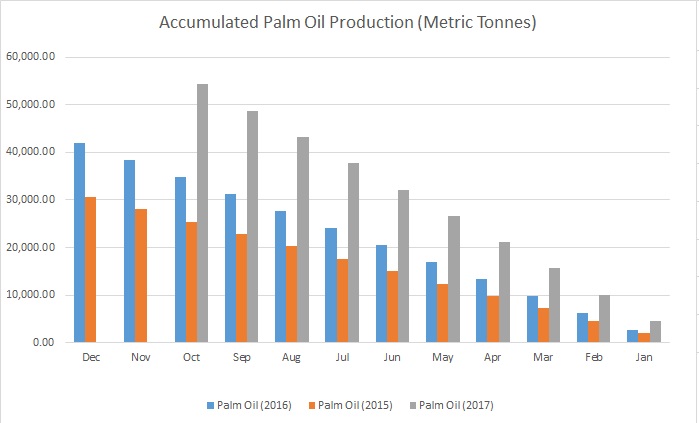

- New Palm Oil Mill commisioning is complete and will contribute in the coming quarters

- What is next?

- Compared to last quarter's surprising/embarrassing 0 revenue, this quarter they somehow managed to engage the Alanya Marine Ventures Sdn Bhd and have 12.1 million charter fee.

- The last two off work vessels are STILL waiting on Petronas.

- They managed to get some work under Petronas's general umbrella project

- They managed to offload the vessels to other majors in August and September.

Although it is not enough to make it profitable but at least the oil and gas are progressing. Hopefully with the oil price comes back in $58 (about 20% higher than the average oil price in July 1 to September 30), they will do better and Petronas will soon assign some projects to them. And if this impairment loss in receivable is considered one time shot in a long time, the actualy loss in Oil and Gas is around 6 million.

Honestly, 3rd quarter is not a good quarter for WTK. I hope the management continue to work out options for Oil and Gas segment and have to work out the alternate client base other than Petronas. Also worth to note that WTK is holding 403 million cash on hand, even after debt deduction it is still a 150 million net cash company.

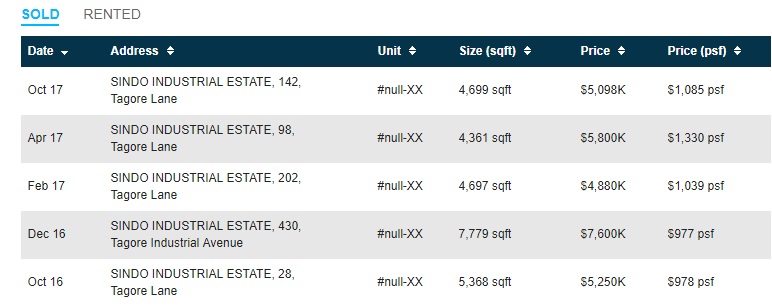

I also noticed that WTK is holding some valuable asset, the one really attracts me is the Tagore Lane Industrial Estate buildings and land. Those are 19000 ft freehold property in SINGAPORE. The netbook value per annual report is around RM 10.5 million but It was probably never been revalued since its purchase 33 years ago as the land and housing prices hike drastically.

For example according to srxproperty site, the price per squareft in Tagore industrial area is between SGD980-1300. Even If we take the lower side, WTK's asset overthere is easily = SGD 980 * 19000 = SGD 18.6 million, which is around RM 56.7 million (5 times of the current book value). Not to mention other undervalue asset like the 98000 sq ft land in Lumut.

However no matter how valueble are the asset that WTK have and how cash rich they are, that won't turn to be profit unless the management turn the oil and gas division around and reduce cost of lumber division. Of course, the internal family issue needs to be sorted out. Then spend the cash in some strategic areas and we will see WTK rises again with the plantation growth.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

Discussions

Dato Calvintan specialist in providing free Holland ticket but himself didn't buy it. He just lonely and you guys attentions only.

2017-12-01 08:20

not easy to be terbalik king. even monkey has 60 percent winning rate but terbalik king has 0%.

2017-12-01 12:11

yes David you are damn right. lonely old fark just here to talk cock. u listen to him u die.

2017-12-01 12:12

the wtk management has made a damn wrong decision in venturing into o&g business, it is killing the company in the long run, the only way to turn around is to drop o&g business immediately

2017-12-01 15:21

@ipodkaki

an old eagle who non stop talking craps and liked his own post every day and yet fails to beat the worst performing Asian market

2017-12-01 15:54

Holland tickets for us to make Holland babies in Holland who would then enjoy the assets invested by grandpa 10-20 years earlier in Bursa

2017-12-01 15:55

Don't forget this is also on top of sifu KC recommendation. So, if you have faith in KC and many would, then should keep WTK

2017-12-01 15:59

ironically you will be making a fortune if you buy the stocks that King of Terbalik defined as " crap stocks ".

2017-12-01 16:01

@beso,

I agree partially with you. If you consider the recent hike of the timber premium rate from 0.80 to RM 50, long term they need to diversify the business. Plantation of palm oil was a great move. Entering oil n gas could have been a great move as well, just their timing was horribly wrong. They entered when the oil price was peak n it was the ending of that oil bull run. Its all about timing and now it is up to them to decide want to painfully maintaining the oil n gas business till the price back to good time or just sell away.

I think share holder also the same, they have multiple problems like family issues and oil n gas at the moment but you cant deny their base n asset, they have cash, the palm oil division gonna contribute.

2017-12-01 16:11

Just chop off oil and gas , company will be save, otherwise company going to Holland, cannot keep loss making company

2017-12-03 09:36

John Lu

Another holland stock from Dato Calvin

2017-12-01 07:46