Daily Technical Highlights - (BONIA, PETRONM)

kiasutrader

Publish date: Tue, 19 Sep 2017, 11:04 AM

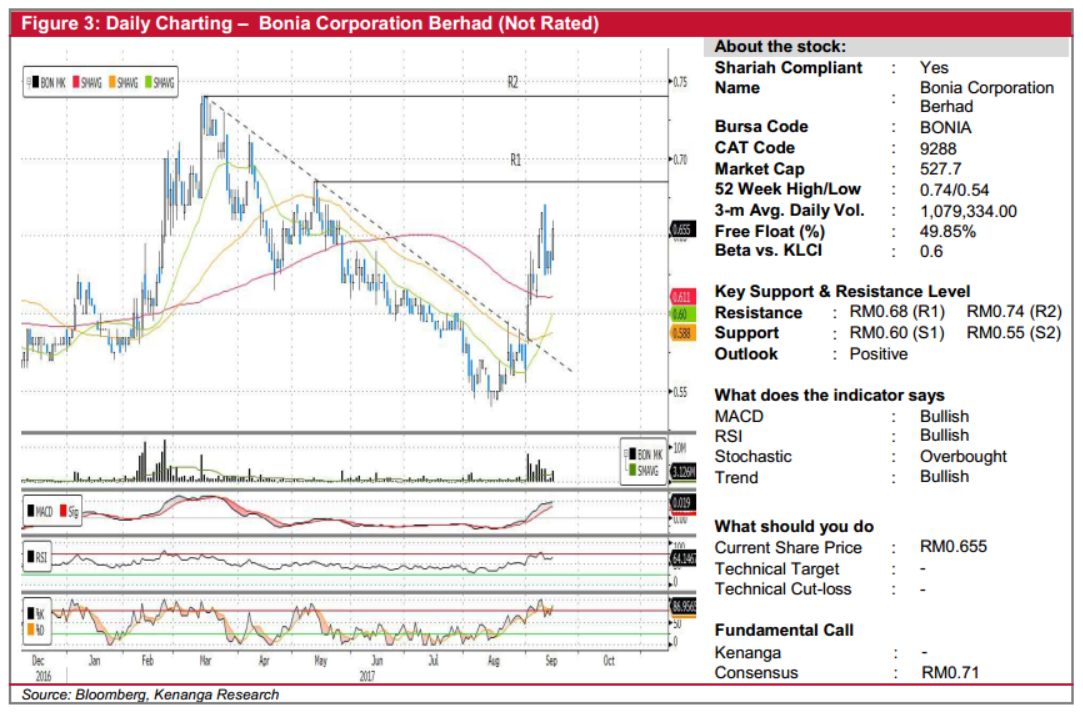

BONIA (Not Rated). BONIA’s share price rose 2.5 sen (4.0%) to close at RM0.655 yesterday. Earlier in the month, the share price had broken out of its long-term downtrend following the announcement of a 30.2% jump in FY17 earnings, and had since rallied over the recent weeks. BONIA’s technical picture is now showing a marked improvement, with a healthy volume trend and “Golden Crossover” by the 20-day and 50-day SMAs for the first time since January. With these positive signals, investors may expect bias to now be on the upside over the coming months. Immediate resistance levels to watch are RM0.68 (R1) and RM0.74 (R2) while support levels to buy on weakness are RM0.60 (S1) and RM0.55 (S2).

PETRONM (Trading Buy, TP: RM11.25, SL: RM9.82). Among top gainers was PETRONM, which saw its share price rose 40.0 sen (4.0%) yesterday to close at all-time high of RM10.30. Notably, yesterday’s move marks not only a continuation of an underlying uptrend since the start of the year but also a decisive breakout beyond its previous resistance at RM9.90 which was retested multiple times throughout the past few months. The bullish move is further supported by positive displays from key indicators, with both the MACD and RSI gradually trending upwards to show sustained momentum. From here, we expect the share to have a clear path towards its overhead resistance at RM11.28 (R1), with our technical target placed 3.0 sen below at RM11.25. Sequentially, a break beyond that would see a higher resistance at RM12.14 (R2). Conversely, near-term downside is considerably limited as an immediate support can be identified at RM9.85 (S1), with our technical stop-loss placed 3.0 sen below it at RM9.82. However, a decisive break below would be highly negative, with the share potentially capitulating to its lower resistance at RM8.20 (S2).

Source: Kenanga Research - 19 Sept 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)