Daily Technical Highlights - (AYS, PENTA)

kiasutrader

Publish date: Wed, 15 Nov 2017, 08:45 AM

AYS (Not Rated). AYS saw its share price climbing 3.5 sen (7.0%) yesterday to finish at the day’s high of RM0.535 amid a surge in trading volume to 8.3m shares. From a charting perspective, AYS has been on a long-term uptrend since August last year, having doubled from RM0.32 to as high as RM0.665 in June this year. Although the share price has been consolidating downward these recent 6 months, this long-term uptrend remains largely intact. In fact, yesterday’s bullish move signals a departure from the trend-line support. At the same time, the MACD-Signal line and Zero line crossovers yesterday also indicated that momentum has transitioned from bearish to bullish. Hence, we would not discount the possibility of AYS commencing the next leg higher. From here we see the potential for a move towards September’s high of RM0.56 (R1) before a retest of the R0.60 (R2) resistance further up. Any weakness towards the RM0.50 (S1) support may be viewed as a buying opportunity, although a break below would be highly negative with the next support level present at RM0.44 (S2).

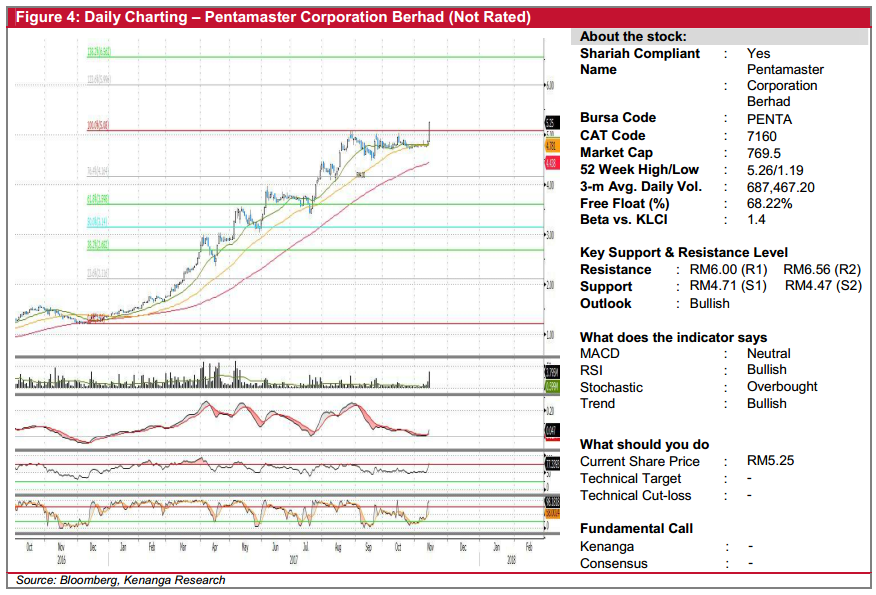

PENTA (Not Rated). Yesterday, PENTA saw an impressive gain of 39.0 sen (8%), closing at new high of RM5.25. This was accompanied by high trading volume, with 3.8m shares exchanging hands – more than 6-fold its 20-day average. More importantly, yesterday’s move marks as a breakout above its previous high of RM5.08, as well as a 3-month consolidation period. Chart-wise, PENTA has been undergoing a strong uptrend since early-2016, and yesterday’s breakout could possibly signal a continuation of this uptrend. Likewise, positive upticks from key indicators could also be suggestive of a move higher. From here, sustained momentum should see the counter clearing a path towards the overhead resistances at key psychological level of RM6.00 (R1) and RM6.56 (R2). Conversely, downside supports can be identified at RM4.71 (S1) and RM4.47 (S2).

Source: Kenanga Research - 15 Nov 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

.png)