Kenanga Research & Investment

Actionable Technical Highlights – DIALOG GROUP BHD

kiasutrader

Publish date: Wed, 02 Oct 2024, 10:44 AM

DIALOG GROUP BERHAD (Technical Buy)

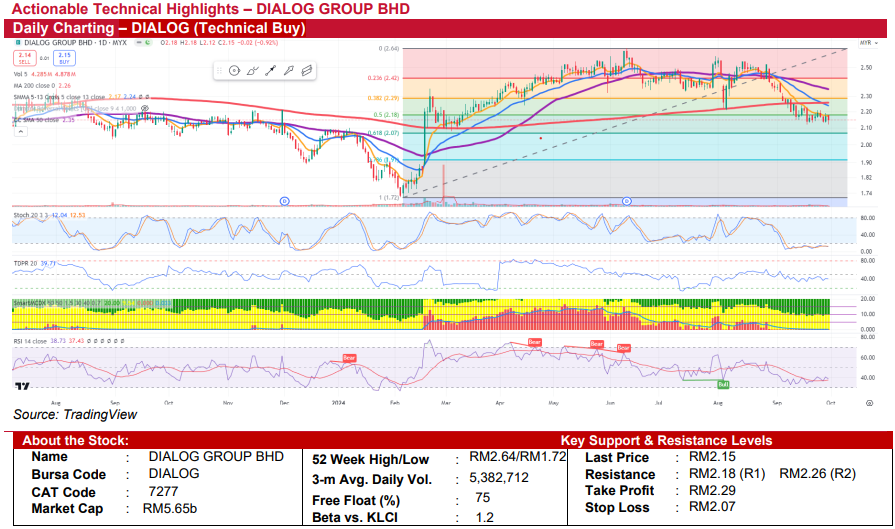

- Dialog Group Bhd (DIALOG) closed at RM2.15 yesterday, marking a modest decline of 0.92%. The stock appears to have formed a base, consolidating within the RM2.12-RM2.21 range over the past eight days after a sharp decline from its recent high.

- From a technical standpoint, the stochastic oscillator remains in oversold territory, showing no clear upward momentum yet. However, both the Tom Demark Pressure Ratio (TDRP) and SMART MCDX index are stable, suggesting that selling pressure has eased, indicating that the downside could be limited.

- If the stock manages to close convincingly above its immediate resistance at RM2.18, which aligns with its 5-day SMA and 50% Fibonacci retracement level, there is a good chance it will re-test the 38.2% Fibonacci retracement level at RM2.29. On the downside, risks appear limited due to the stock's consolidation over the past two weeks and oversold conditions in both the daily and weekly stochastic indicators.

- Given the current technical signals, we recommend bottom-fishing investors consider accumulating the stock at current levels with a take-profit target of RM2.29, offering an upside potential of approximately 6.5%. To manage risk, a stop-loss should be placed below RM2.07 (-3.7%) to protect against further downside.

Source: Kenanga Research - 2 Oct 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Jan 20, 2025

Renewable Energy - Big News, Another 2GW LSS Incoming (OVERWEIGHT)

Created by kiasutrader | Jan 20, 2025

Bond Market Weekly Outlook - Domestic yields set to rise ahead of Trump’s inauguration

Created by kiasutrader | Jan 17, 2025

Discussions

Be the first to like this. Showing 0 of 0 comments