7 things I learned from the 2022 Hartalega AGM -Tan Jiunn Yi

Tan KW

Publish date: Fri, 09 Sep 2022, 12:28 PM

Hartalega is the world’s second largest manufacturer of gloves and a constituent of the FTSE Bursa Malaysia KLCI index. The company was a massive beneficiary of COVID-19 as global demand for medical gloves shot through the roof in the midst of a pandemic.

However, Hartalega now faces the prospect of being booted from the index. Since reaching a peak of RM20.28 in July 2020, Hartalega’s share price has now plummeted by over 90% as the world (and medical glove demand) returns to normalcy. Is Hartalega still a viable investment post-pandemic? Here are the seven things I learned from the 2022 Hartalega AGM.

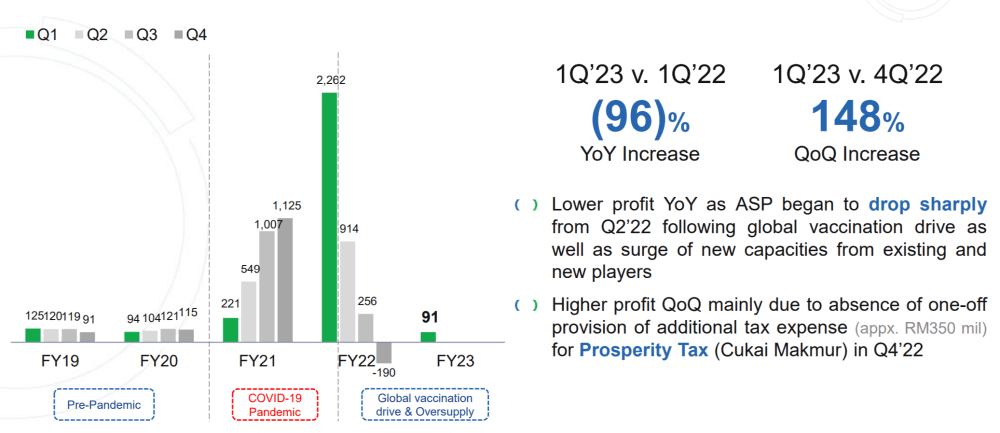

1. Although Hartalega posted record revenue and profit for FY22, it now faces a collapse in demand and profit moving forward. Net profit fell 96% year-on-year from RM2,262 million in Q1 2022 to just RM91 million in Q1 2023.

The plunge was mainly due to demand returning pre-pandemic levels, an oversupply of gloves in the market, and a drop in average selling prices. Additionally, Hartalega faces rising operating and labour costs, and continued disruption in global logistics.

2. Despite the oversupply issue, Hartalega will proceed with its NGC 1.5 expansion plans. The company will complete its construction for Plant 10 and Plant 11 by the end of 2022. However, the commissioning of the new plants would be dependent on prevailing market supply-demand dynamics.

The current global supply of gloves is around 500 billion pieces annually, with 80 billion pieces coming from new glovemakers. Hartalega believes that the newer players will exit the industry as glove demand returns to pre-pandemic levels which will balance the supply-demand equilibrium in due time.

3. Hartalega’s long-term strategies are to continually improve its operational efficiency and product/customer diversification. This includes improving automation, energy optimization, and production efficiency. For example, the company decommissioned Plant 2 at Bestari Jaya which had a low production efficiency of 14,000-22,000 pieces per hour. Hartalega is also exploring opportunities to expand its plants to outside Malaysia through acquisitions, and it lower its risk by reducing its customer concentration.

4. Hartalega faces increasing competition from Chinese glovemakers. Chinese companies grew their market share during the pandemic as they expanded production capacity aggressively supported by heavy subsidies from the Chinese government. They also rely on coal energy for their manufacturing which is about 50% cheaper than natural gas which Hartalega primarily relies on.

However, fuel and labour costs are only part of the cost equation; technology and operational efficiency can also reduce unit costs. On this end, Hartalega has the fastest glove production lines in the industry at a speed of 45,000 pieces per hour. Automation and operational efficiency are competitive advantages that Hartalega focuses on to reduce its unit costs.

5. Hartalega also faces growing competition from Thailand. Sri Trang Gloves – one of the largest glovemakers in Thailand – has its own rubber tree plantation. This gives Sri Trang the ability to procure its own raw materials and improve its cost controls.

6. Hartalega is confident that it will avoid any U.S. labour sanctions. The U.S. has banned imports from glovemakers who’ve been suspected of using ‘forced labour’ in its operations. Hartalega has provided purpose-built hostels for its workers since 2013 and it strictly adheres to labour laws and regulations on recruitment of migrant workers.

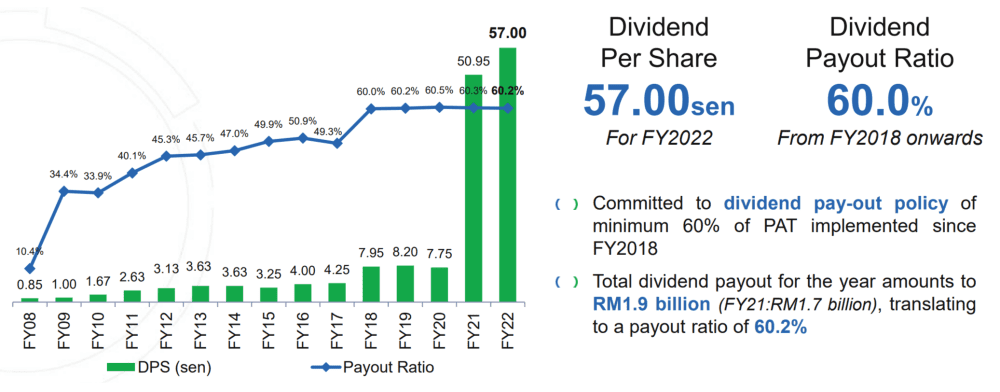

7. Dividend payout will be maintained at 60% of profit after tax. Hartalega paid record dividends in FY21 and FY22, but dividend per share is expected to return to pre-pandemic levels moving forward.

Assuming a dividend per share of 7.75 sen (similar to FY2020 before the pandemic), Hartalega’s expected yield is 4.8% based on the closing share price of RM1.61 as of 8 September 2022.

The fifth perspective

Hartalega is a well-run glove company that has a track record of embracing technological innovation and automation to improving its efficiency and lower its costs. The pandemic brought a windfall to the company, but also fierce competition from both established and newer players as they jostled to win market share as global demand skyrocketed. Post-pandemic, less well-managed glovemakers may exit the industry as demand returns to normal, leaving behind stronger, more efficient players like Hartalega.

https://fifthperson.com/2022-hartalega-agm/

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Good Articles to Share

Created by Tan KW | Apr 26, 2024

Created by Tan KW | Apr 26, 2024

Created by Tan KW | Apr 26, 2024

Created by Tan KW | Apr 26, 2024