MQ Trader - Introduction of Turtle Trading Strategy

MQTrader Jesse

Publish date: Wed, 24 Jul 2019, 06:19 PM

The unreliability of human can be eliminated by creating and following rules for the process of trading where the rules can only be implemented systematically and effectively by using systems. A successful trader always rely on the use of systems to carry out a trading plan more efficiently. This statement is proven to be true since decades ago when one of the famous systems, namely the turtle trading strategy that was known as a market legend since 1983.

What is Turtle?

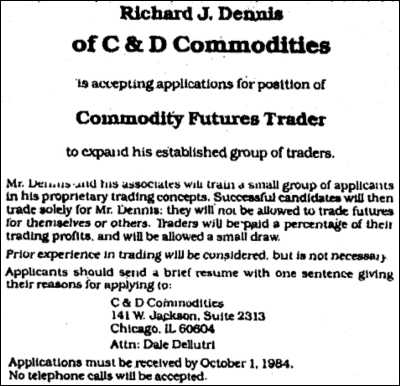

Figure 1: Dennis placed an ad in The Wall Street Journal to recruit “turtles”

Turtle is the name given to a group of traders who were selected to participate in an experiment conducted by two famous commodity traders, Richard Dennis and William Eckhardt. In the experiment, 10 out of 1000 applicants were selected to attend training for two weeks in ChiCago and they were then given small accounts to trade with before proving themselves.

Figure 2: Richard Dennis

Figure 3: William Eckhardt

The aim of the study was to identify whether a successful trader is born due to a genetic predisposition or proper training. The outcome of the experiment was used to settle the debate between Dennis and Eckhardt where the former believed that a person could be trained while the latter thought trading ability is a gifted skill.

Eventually, Dennis had demonstrated that traders with little or no trading experiences could turn out to be excellent traders after they were taught with a simple set of rules, as the turtles ended up generating returns of more than 80% compounded rate over the next four years.

Turtle Trading System

The turtle trading system included all the key decisions for a successful trading such as what markets to trade in, how to size positions, when to buy and sell, when to exit a losing position, when to exit a winning position and tactics for buying and selling. The main reason of this setting in turtle trading system is to ensure that novice traders’ own judgement, bias and emotion did not cloud their decision-making in trading. Hence, traders just have to follow the rules strictly to generate profit by using turtle trading system which was known as a profitable mechanical trading system.

Characteristics of Turtle Trading System:

- Consistency in executing orders according to the trading signals generated by the breakouts from key moving averages. This is because the entire gains throughout the year could come from one or two crucial trades out of numerous trades in the year.

- Placing limit orders over market orders and avoiding using stops are recommended when placing orders. This is because limit orders provided a higher chance for fills and less slippage than market orders.

- Relying on prices rather than relying on information from television or newspaper commentators to make trading decisions.

- Do not risk more than 2% of your account on a single trade.

- Always get comfortable with huge drawdowns if you expect a big return.

In the next article, we will be sharing on the concept of turtle trading system and how we can implement it in the stock market today. To read more, please visit MQ Trader - Turtle Strategy Rules.

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

More articles on MQTrader Education Series

Created by MQTrader Jesse | Apr 13, 2023

Created by MQTrader Jesse | Aug 06, 2021

Created by MQTrader Jesse | Nov 01, 2019

winbigbursa

Thks for good trading educational writeup ! Look forward to your insights on turtle trading system.

2019-07-25 11:40