Rakuten Trade Research Reports

Technical View - Hibiscus Petroleum Bhd

rakutentrade

Publish date: Wed, 09 Mar 2022, 09:53 AM

Hibiscus Petroleum Bhd (HIBISCS, 5199)

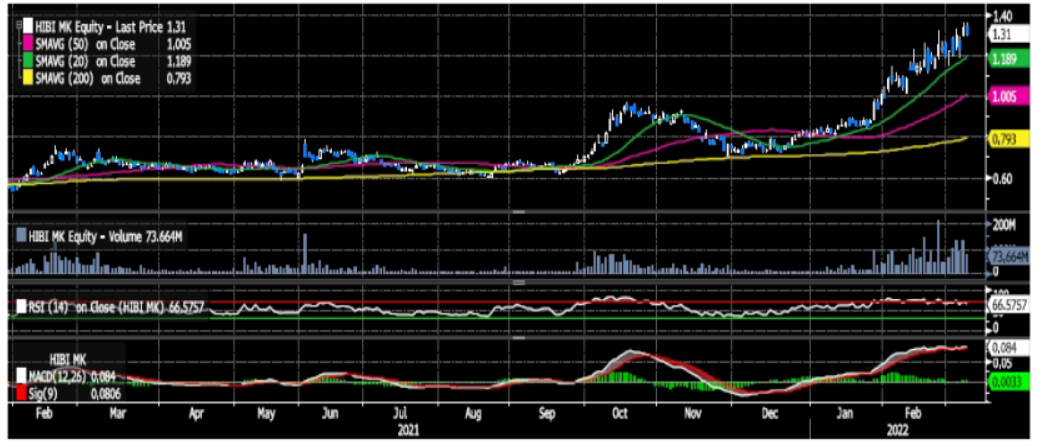

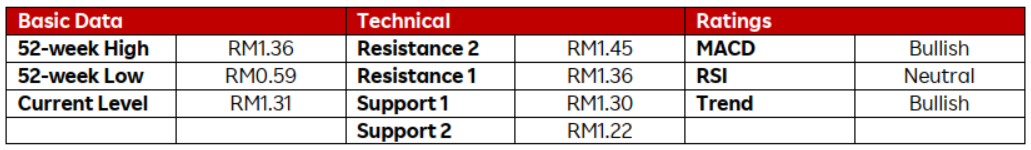

• Share price closed 2.2% lower at RM1.31 on Tuesday.

• HIBISCS has been trading on a strong uptrend mode since 27 Jan 2022. Its share price is trading above all Its key moving averages which are swinging upwards. Backed by hike in Brent Crude Oil price, yesterday’s price weakness could be a buying opportunity.

• Coupled with uptick in its indicator and long-term uptrend, we anticipate the share price to trend higher.

• Resistance levels are identified at RM1.36 (R1) and RM1.45 (R2).

• On the flipside, support levels are pegged at RM1.30 (S1) and RM1.22 (S2).

Source: Rakuten Research - 9 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Rakuten Trade Research Reports

Discussions

Be the first to like this. Showing 0 of 0 comments