Research Hive - Rhone Ma Holdings Bhd

rakutentrade

Publish date: Thu, 17 Mar 2022, 09:43 AM

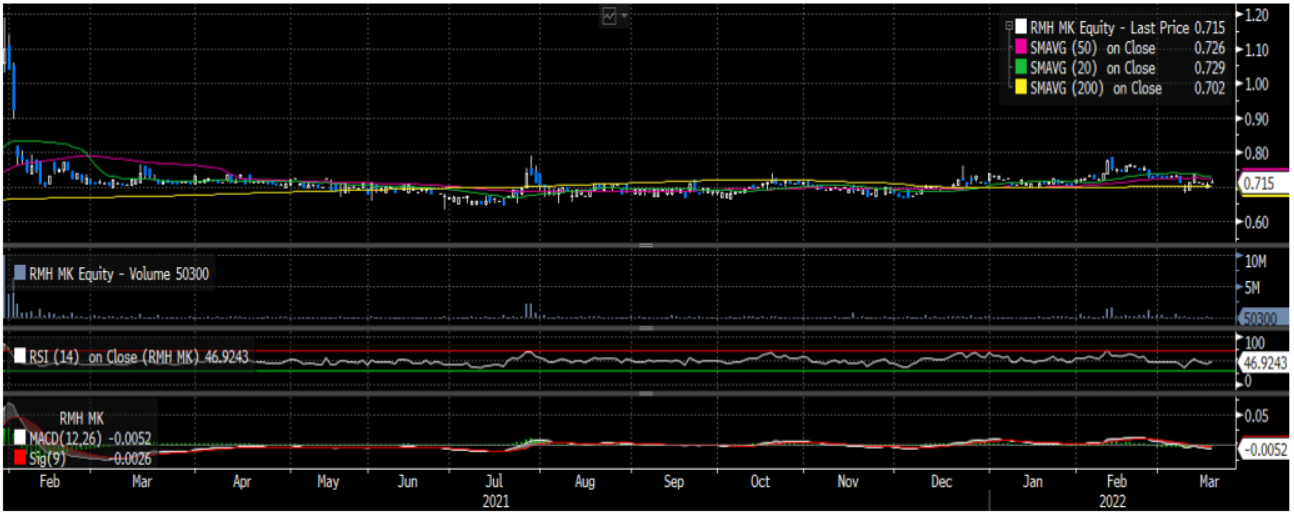

Rhone Ma Holdings Bhd (Fundamental BUY with TP RM1.07)

• Rhone Ma Holdings Bhd (Rhone Ma) is an end-to-end animal health solution provider. The company ventured into fresh milk production in 2019.

• Despite the slow business environment during the Covid-19 pandemic, Rhone Ma’s revenue has recorded a 12% CAGR over the past 2 years. In tandem with the expanding market revenue in Animal Health and Nutrition Industry, the company’s market share has grown from 4.7% in 2018 to 5.8% in 2021.

• Rhone Ma’s GMP compliant plant in Nilai which has a production capacity of 2,500 MT/year has commenced operation in April 2021. The plant is currently 35% utilised and is expected to increase gradually. Management guided the plant to reach full utilisation rate by end 2023 as the PJ GMP compliant plant has been running at full capacity (637 MT/year).

• Its Human Healthcare segment revenue grew 231% in 2021, attributed to the Covid-19 outbreak. The company’s imported CiTest Covid-19 Antigen Rapid Test Kit is widely used by clinics and hospitals. Moving forward, Rhone Ma will continue its R&D effort to expand its human healthcare products range such as other purpose test kit.

• We see Rhone Ma’s venturing into Ruminant industry as synergistic to its animal health product segment. Meanwhile, the government aims to increase the country’s fresh milk self-sufficiency level to 100% within five years; and this will create an opportunity to its 49% owned A2 Fresh SB. The company is planning to expand its dairy farm from 300 cattle to 500 cattle by end 2022, producing its own brand milk targeted to launch in 1Q2023.

• According to Protégé Associates, the Animal Health and Nutrition Industry has grown to a RM2.33bn revenue industry vs RM2.09bn in 2018. We see Rhone Ma is well positioned in the growing livestock market in Malaysia. BUY with a target price of RM1.07 based on 18x PER FY22F (3-year average).

• Financially, the company’s leverage is manageable with net gearing of less than 10%.

Source: Rakuten Research - 17 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|