FTSE Singapore Straits Times Index - Market Sentiment Remains Bearish

rhboskres

Publish date: Tue, 03 Jul 2018, 09:46 AM

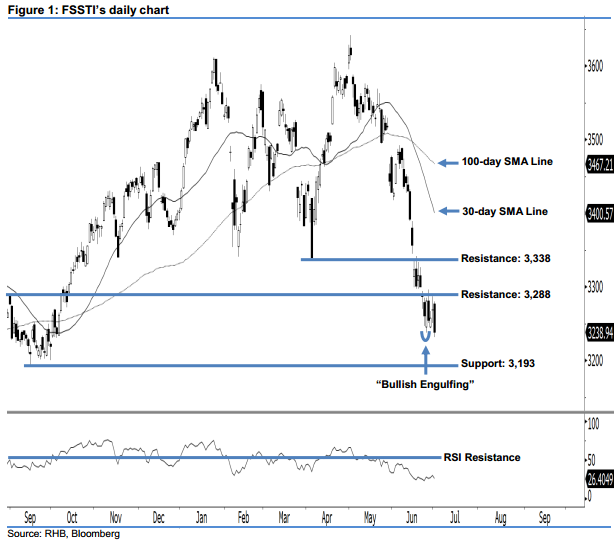

No firm rebound implies that the bears are still in control. The FSSTI began on a weak note, as it slipped 29.76 pts to 3,238.94 pts yesterday. It formed a black candle after oscillating between a low of 3,231.68 pts and high of 3,280.19 pts. This shows no continuation of the upside momentum we detected in the reversal “Bullish Harami” candlestick pattern on 26 Jun. Overall, the bears are still dominating market sentiment. The fact that the 30-day is situated firmly below the 100-day SMA line points towards a weak outlook. This enhances our bearish view.

As we do not see a strong rebound in the daily chart above, this implies that the current correction has not reached its limit yet. Based on the current technical landscape, chances are high the retracement may still be extended once the breather ends.

Towards the downside, we set the immediate support at the 3,193-pt mark, or the low of 15 Sep 2017. For the next support, look to 1,133 pts, ie 19 Apr 2017’s low. On the flip side, our immediate resistance is maintained at 3,288 pts, which is located at the high of 31 Aug 2017. The next resistance is pegged at the 3,338-pt threshold, or the low of 4 Apr.

Source: RHB Securities Research - 3 Jul 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024