FBM Small Cap Index - Upside Movements Still Intact

rhboskres

Publish date: Wed, 20 Jun 2018, 05:15 PM

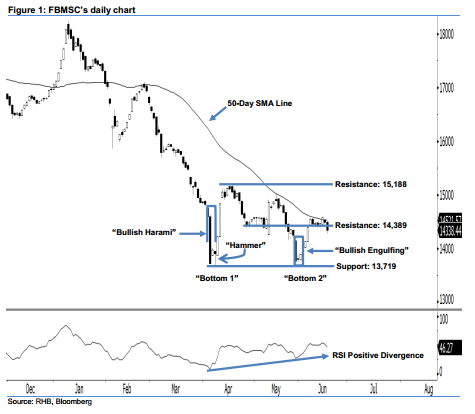

As the bullish bias is persisting above 13,719 pts, the positive view remains in play. At the end of yesterday’s session, the FBMSC posted a 155.34-pt loss to 14,338.44 pts. It left a black candle that breached below the previous 14,389-pt support, which implied that the bears were in control of the session. This led the index to its newest 1-week low. Nevertheless, we make no change to our positive view, given that no strong downside development has been sighted yet. As long as the 13,719-pt support is not taken out, we deem the bullish bias we witnessed since April as still in play.

At this juncture, we see the weak performance as the FBMSC merely taking a breather. This is a normal reaction, after the index breached above the 50-day SMA line on 14 Jun. Our positive view is supported by the appearance of a few bullish indicators – especially this month’s “Double Bottom” and “Bullish Divergence” patterns, which suggest the high possibility of the trend turning towards the upside from downside previously.

We set the immediate support at 13,719 pts, which was derived from the low of 5 Apr’s “Bullish Harami” pattern. This is followed by the 13,116-pt support, or the low of 25 Aug 2015. On the flip side, our immediate resistance is now at 14,389 pts, ie the low of 26 Apr’s “Bullish Harami” pattern. The next resistance is seen at 15,188 pts, which is located at the high of 17 Apr.

Source: RHB Securities Research - 20 Jun 2018

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024