NOW SHOWING: THE TRILOGY OF FAST & FURIOUS SHOWS PART 9 – ALCOM GROUP BERHAD/2674

SEE_Research

Publish date: Wed, 21 Apr 2021, 02:44 PM

Please read carefully especially on

CHAPTER 3

______________________________

MAIN CHAPTER

1 THE TWIN BUSINESSES FOR PRESS METAL ALUMINIUM HOLDINGS BHD/8869

& ALCOM GROUP BERHAD /2674

1.2 For your understanding , in KLSE , the KING of the aluminium business is Press Metal Berhad , and the followers ,

one of them is Alcom Group Berhad / 2674

1.3 Some of my KLSE investors who are well known in the corporate community ask direct questions:

Q1: Are there more than two or three listed companies in KLSE that manufacture and supply aluminium inter-related products

A: YES

Q2: Is there a listed company in KLSE that manufactured aluminium inter related products with good financial quarter that is just reported in this week ,from 22 Feb 2021 onwards

A: YES

Q3: Please disclose and reveal the name of this company listed in KLSE?

A: YES

CHAPTER 1

Stock traders, short term investors are always on the lookout for ways to improve their trading methods.

There are 1,400 counters in KLSE (including all types of warrants) to choose from when analyzing these 1400 counters and the market in general… but what should you be using,

AN IMPORTANT MESSAGE FOR MARCH, APRIL 2021

Thanks to the rare convergence of these 2 important catalyst factors of this particular stock,

the clock is ticking down for you.

ALCOM GROUP BERHAD / 2674 has these 2 important catalyst factors, namely

ALCOM manufacture, supply :

-

Aluminium interrelated products

-

Aluminium commodity record price is USD 2,298.15 per metric ton as at 26 Mar 2021

-

Historical high price now, comparing to April 2020 ,then was USD 1,460.00 per metric ton

-

Recent announcement by Alcom / 2674 on 23 Feb 2021

-

On the financial quarter with revenue RM 109,633,000.00

-

Record profit -for this financial quarter RM 10,074,000.00

-

Amazing Earning per financial quarter = 7.50 cents, on the assumptions same for the coming quarters = 7.50 x 4

-

Annualized per year 30 cents x 10 PER (price earning ratio )

-

Intrinsic value RM 3.00, less 50 % discount,

-

Final short term target price RM 1.50

CHAPTER 2

Please refer your reading from Author: SEE_Research | Publish date: Mon, 12 Apr 2021, 8:59 AM

CHAPTER 3

Important catalyst , for Alcom / 2674

In the aluminium industry, the big brothers and the KING of aluminium business are as follows

(i) King - Press Metal / 8869

(ii) Queen - PMB Technology /7172

A lot of the same industry players , have mentioned that there is a close possibility of

''merger and acquisition" exercise, for the Press Metal Aluminium Holdings Berhad /8869.

Main shareholders are the Koon brothers

(a) Tan Sri Dato Paul Koon Poh Keong for Press Metal /8869

(b) Mr Koon Poh Ming heading the

PMB Technology Berhad /7172

Do you know that PMB Technology/7172 -- completed the aluminium structures, claddings, using their

In house technology in using the aluminium composite materials / ACM , these materials are distinguished by their unique features , its lightweight , high rigidity , excellent flatness and long lasting coating qualities are just the construction industry required ?

For your better understanding , every week , Monday , Wednesday , Friday ,there were 3 units X40 footer

long conventional lorries from PMB Technology Berhad, Balakong, Selangor to Marina Bay Sand , Singapore

for one whole year of 2010 , meaning 156 units of 40 footer types lorries ;

just imagine the huge load of aluminium facades and claddings , curtain walls were well commissioned in the

Marina Bay Sands Hotel & Resort , Singapore .

fully commissioned in the grand opening - 17 February 2011 ,

Marina Bays Sands Hotel & Casino ,

10 Bayfront Avenue ,Singapore 018956

this special project is done by Special Designer Group , a global organization of designers, engineers , planners, business consultants, -

Arup - founded in 1946 by Sir Ove Arup ,

and by Main Architect - Safdie Architects

and by Main Contractor -Ssangyong, South Korea

This building has broke away from the conventional model of a mega hotel and fully integrated resort

==============================

Are eyeing for strategic assets in regards to adding value to the Press Metal Group ,

one of the likely candidates,

will it be Alcom / 2674 ?

Is it Alcom / 2674 ?

Time will eventually tell on the " take-over " corporate exercise whether it is friendly or hostile , thus it will create the company being bought out can be a real windfall for the investors .

That is generally in the correct perspective because when the company being bought has shown some respectable performances and has good prospects for the near future , a certain amount of goodwill can be involved.

Goodwill usually is an intangible asset, when one company acquires another , it includes reputation, brand, intellectual property and commercial trade secrets.

More often , the target takeover company will offer the premium especially in driving up the stock prices .

In this case , will it be Alcom /2674 ?

==============================

SUMMARY

EcoWorld Development Holdings Sdn. Bhd., bought over Focal Aims Holding Berhad/ 8206

for RM 230.69 millions or

translating RM 1.40 a share in cash

report by

# Update* Eco World buys 65% of Focal Aims for RM 231millions , extends MGO

THe Editor / The Edge - September 17, 2013 - 05 : 36 am

Focal Aims Holding Berhad /8206 in 13 September 2013 -the share price was RM 0.38

Focal Aims the peak price was created RM 2.17 - 11 April 2014 , almost 5 .71 from RM 0.38 ;

Is it incredible even after Eco World Development Holdings Sdn. Bhd. announcement of RM 1.40 , the share prices were driven up to RM 2.17

Before --- Focal Aims Holding Berhad /8206, the company was listed as Sanda Plastics Industries Berhad /8206 on 18 November 1997

So many takeover exercises in this manner :

from Sanda Plastics Industries Berhad /8206 to

Focal Aims Holding Berhad /8206 to

Eco World Development Group Berhad /8206 --this is Tan Sri Liew Kee Sin - main shareholder ; the ex founder of SP Setia Bhd/ 8664

==============================

When the target company of the listed company is on

'' merger and acquired " exercise , by the big KING of aluminium -

Press Metal Aluminium Holdings Berhad /8869 ,

closing 9 April 2021 RM10.02 ,

there will be a bountiful harvest to be a huge gain on the

stock prices- multi folds uptrends.

REMARKS

ALCOM / 2674

(1) Do you have some understanding of that old high for this stock?

----?

(1.1) This stock old high was RM 2.32 done on 29 June 2017,

From previous chart analysis,

From 30 May 2017,

At RM 1.35

(1.2)With 20 trading days,

from 30 May 2017 /RM 1.35 to

29 June 2017/RM 2.32,

Share prices movements in technical chart,

can behave in their previous manner,

can Alcom /2674 follow up on her previous technical pattern,

(a) 4 trading days resting =

from 2 June 2017 to 7 June 2017

(RM 1.54 to RM 1.61)

(b) 3 trading days resting =

from 13 June 2017 to 15 June 2017

(RM 1.75 to RM 1.85)

(c) 4 trading days resting =

from 19 June 2017 to 22 June 2017

(RM 1.91 to RM 2.08)

(d) 3 trading days onwards

from 23 June 2017 to 29 June 2017

Reaching RM2.32 / old high

==============================

Can history repeat itself,

Time will tell, more important it needs to reach

RM 1.59/ R 2, and cross decisively with new buy orders

==============================

For those investors who can wait, the next target,

mid term RM 1.50,

==============================

Alcom /2674

Technical Analysis from

A. 24 February 2021,

RM 0.65/ Low

RM 0.81 / High

Closed RM 0.73

B. 4 trading days, consolidation,

From 2 March to 8 March 2021

C. 9 March 2021,

Closed RM 0.60

D. To 11 March 2021

Closed RM 0.69

E. To 25 March 2021,

11 trading days, closed RM 0.81

F. From 25 March 2021,

5 trading days consolidation.

G. From 2 April 2021, closed RM 0.72 to 12 April 2021 =

6 trading days uptrend,

12 April 2021 =RM1. 07

H. From 12 April 2021 /RM 1.07

to 14 April 2021 / Closed RM 1.22

14 April 2021,

Low RM 1.05

High RM 1.25

I. From 14 April 2021, to consolidate 4 trading days,

REMARKS

Latest day,

for upwards prices by

21 April 2021 / Wednesday,

22 April 2021 / Thursday

Will surge upwards to

RM 1.60,

with 6 or 7 trading days to

29 April 2021

New catalyst, on the likely

" merger + acquisition" theme by the king of aluminium -

Press Metal /8869

PMB Technology Bhd /7172

PMB Technology Bhd

is the official sub contractor in building the exterior facade, claddings, wall curtains for

Marina Bay Sands Hotel +Resort,

10, Bayfront Avenue,

Singapore 018956

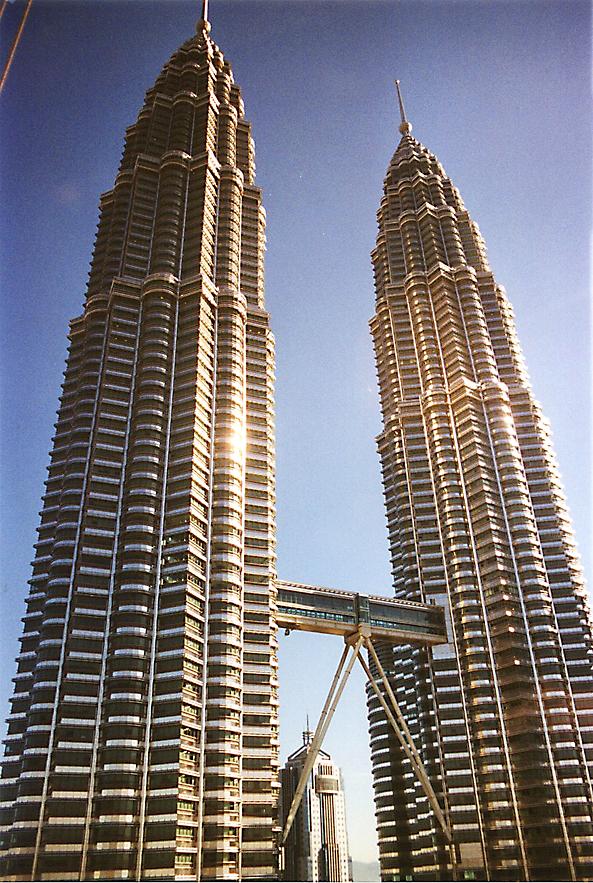

Alcom Bhd /2674

is the official sub contractor in building the exterior facade, claddings, curtain walls for

Petronas Twin Towers,

Kuala Lumpur City Centre,

Jalan Ampang, Kuala Lumpur.

Both are reputable aluminum facade, claddings, wall curtains panels,

Both companies are manufacturers , having its in its own house plants, factories

PMB Technology Bhd., in Balakong ,Selangor

Alcom Group Berhad , in Bukit Raja Industrial Estate , Klang

Using their in house technology that manufacture-- the aluminium composite materials / ACM.

These materials are distinguished by their unique features, it's lightweight, yet high rigidity qualities, excellent flatness and more importantly long lasting -

coating qualities are just the construction industry required.

Now, you can understand their business similarity, two of a kind, a twin?

Can it be a real winner for Alcom /2674,

when the target company or takeover company will offer the premium especially in driving up the stock prices.

==============================

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION, WRITTEN AS ARTICLE FOR SHARING PURPOSES TO KLSE COMMUNITY MEMBERS.

DISCLAIMER: Investment involves risks, including possible loss of investment and other losses. This article and charts are provided for information only and should not be construed as a solicitation to buy or sell any of the instruments mentioned herein. The author may have positions in some of these instruments. The author shall not be responsible for any losses or profits resulting from investment decisions based on the use of the information contained herein. If investments and other professional advices are required, the services of a licensed professional person should be sought.

ISSUED BY SEE RESEARCH

(SENSING EAGLE EYES RESEARCH)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on SEE_Research

Created by SEE_Research | Feb 26, 2023

Created by SEE_Research | Jan 05, 2023