【ShareInvestor Station】EMS Providers Comparison

SISFoo

Publish date: Thu, 02 Nov 2017, 04:35 PM

VS Industry Bhd and SKP Resources Bhd are two of the largest home-grown electronics manufacturing services (EMS) providers in Malaysia.

Both of these Johor-based companies serve some common customers, Dyson.

Hence it is the best idea to compare 2 of these companies as they are the two closest peers in their industry

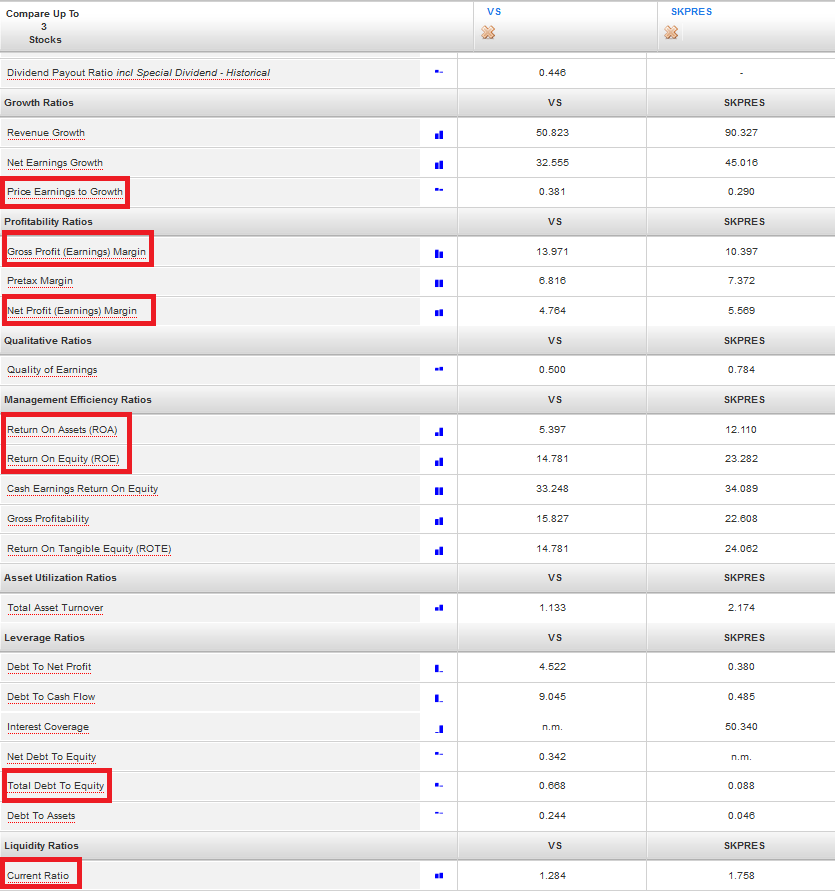

Looking at the key ratios of these 2 companies by using "Stock Comparison" features, it is really useful and convenient for our users to pick the right stock.

We have highlighted some of it and here is the interpretation.

Price Earnings to Growth (PEG) is lower for SKPRES. The ideal PEG should be lower as the expectation of growth rate higher in term of PE.

SKPRES has lower Gross Profit Margin but Net Profit Margin. The possible reason could be the general expenses in SKPRES is controlled well.

As SKPRES achieved higher Net Profit, so higher of ROA and ROE are expected.

Despite VS has higher leverage comparing with SKPRES but the leverage ratio is still considered as reasonable. As SKPRES has lower leverage ratio, they have more room to grow if they are more likely to able to fund new business or projects if any.

Lastly, Current ratio indicated both companies do not face any liquidity ratio as the result have more than 1.

This is Stock Comparison in WebPro, our users always can trade easily than non-user.

To find out more, please call 03-7803 1791

or visit http://www.shareinvestor.com/membership/plans_station.html

More articles on ShareInvestor Station

Created by SISFoo | Nov 22, 2017