A glimpse of light for Asia Media ?

â Mr. ACE

Publish date: Mon, 14 Feb 2022, 01:10 AM

A glimpse of light for Asia Media ?

There was an update by Asia Media Group, a company well known for Ricky Wong’s fancy financial gimmick and destruction of shareholder’s value. However, this update might just be the saving grace for the company.

Dated 10th February, Asia Media had an official press, where the board, through Messrs Krish Manium & Co, who are famous for its suit on Khee San against Euro Gain Secta, is requesting a claim as stated as below:

-

Special damages for a sum of RM170.54 million or any other sum that the Honourable Court deems fit and proper.

-

A declaration that Wong is liable to account to Asia Media for the sum of RM170.54 million for the purchase of items.

-

A declaration that Wong holds as constructive trustee for in relation to the said RM170.54 million or any losses arising from the breaches set out above.

-

Equitable compensation if the court finds it fair and proper.

-

Special damages for the sum of RM1.5 million for the refund of the ex gratia payment paid by Asia Media to Wong.

-

Special damages for the sum of RM2.34 million for the outstanding amount owed by DPO Plantations Sdn Bhd waived by Asia Media.

-

Other loss and damages to be assessed by the court.

-

Interest on all sums found to be due to Asia Media at such rate and for such period of time as the court deems just and reasonable.

-

Costs on an indemnity basis against the Wong, and

- Such further or other relief as the court deems fit.

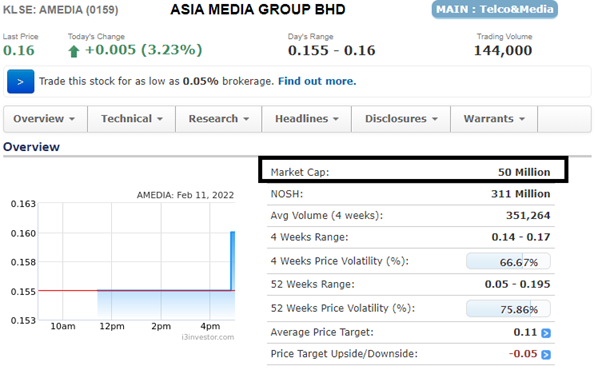

In other words, should AMEDIA release the claimed sum from the frozen Ricky Wong’s account, the company would be, excuse my language, but filthy cash rich based on their market capitalization of merely RM50 million.

That is not all.

The financials of AMEDIA are seemingly improving since 2022Q1, and looks like they are back into the business. We are seeing analysts upbeat on the advertising sector, so I do not see any reason why this company cannot turn themselves around.

As they are releasing another quarterly result this week, I “presume” that it will be fairly good, in the sense that there will be at least a QoQ growth, based on the performance of its peers.

If you are familiar with corporate games, I think you already know that the company is now readying its game plan to pick themselves up from the current PN17 status with their improving results. After all, why bother on securing better results if you are going to sell the company, right?

So, even without the potential claim of RM170.54 million, a turnaround, light weighted asset media player is still worth some salt to invest at the current price level.

And if they, could claim the said amount, then I believe a triple in valuation is not a myth.

Will they able to breakout successfully, at the current price level? Are there value to be seek at the current level?

Stay tuned to our next post.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Value Hunter

Created by â Mr. ACE | Feb 16, 2022