Can this stock double in share price in 2022?

unline

Publish date: Wed, 05 Jan 2022, 12:48 AM

Can this stock double in share price in 2022?

Before we even talk about the company’s name, I would like to first share something from the legendary investor Howard Marks. Many have not heard of the name before, but he had contributed hugely to my 330% total return in 2020 and 2021.

Excluding technical analysis, the market had two different “camps” for investors to choose between value and growth. In the “Something-of-value” study by Oaktree Capital, here’s an excerpt I would like to highlight to all of you.

The False Dichotomy of Value and Growth

At some point, the camps of value and growth developed nearly the same fervent adherence as rival political factions. You pledged allegiance to one or the other, and so went your future investing actions. You believed your way was the only way and looked down on practitioners of the others. I think investors – perhaps based on their emotional makeup, intellectual orientation and understand of things like technological innovation – naturally gravitated towards one side of the stylistic divide or the other. And there are notable differences:

-

Value stocks, anchored by today’s cash flows and asset values, should theoretically be “safer” and more protected, albeit less likely to earn great returns delivered by companies that aspire to rapidly grow sales and earnings into the distant future.

-

Growth investing often entails belief in unproven business models that can suffer serious setbacks from time to time, requiring investors to have deep conviction so as to be able to hang on.

- When they’re rising, growth stocks typically incorporate a level of optimism that can evaporate during corrections, testing even the most steeled investor. And because growth stocks depend for most of their value on cash flows in the distance future that are heavily discounted in a DCF analysis, a given change in interest rates can have meaningfully greater impact on their valuations than it will on companies whose value comes mainly from near-term cash flows.

This passage, to me, is pure gold and in Chinese saying, this is right-out putting cash into your pockets. Each and every investor had been pondering around to seek to outperforming stocks but only a few truly understands how it is done.

This, is the stock chart for company that had the potential to double in 2022. But for most of the time, chart means nothing without referring to the earnings of future cash flow of the company.

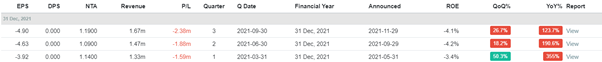

Why, despite the loss-making nature for SENI JAYA CORPORATION BERHAD, the company share price is still triumphing?

You see, the Malaysia stock market is a relatively small one, and funds always have advantage over retail investors like us. The uptrending of SJC is most likely caused by interested parties such as institutional funds buying into the company. The real question here is why are they buying into this company?

We noted that SJC is involved in the out-of-home advertising market, which was of course badly impacted by COVID-19. But moving forward as the traffic recovers, it is very likely for the company to have a huge turnaround in earnings in the coming quarters.

Not to mention, SJC is the only company that is involved in programmatic digital out-of-home market. Although they shy away from the news, but it is obvious that they had collaborated with Grab to advertise via the small screen on the vehicles.

Given that SJC is only less than RM130 million in market capitalization and had over 80% shares held by key investors, I see a huge potential for the share price for the company to spike, heck, even double should they report really good earnings for this financial year.

You can choose to isolate investment method that are different from yours, but I think this might be a really good investment prospect that you should look into.

Cheers.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|