Stock On the Move - Optimax Holdings

AmInvest

Publish date: Thu, 03 Nov 2022, 11:40 AM

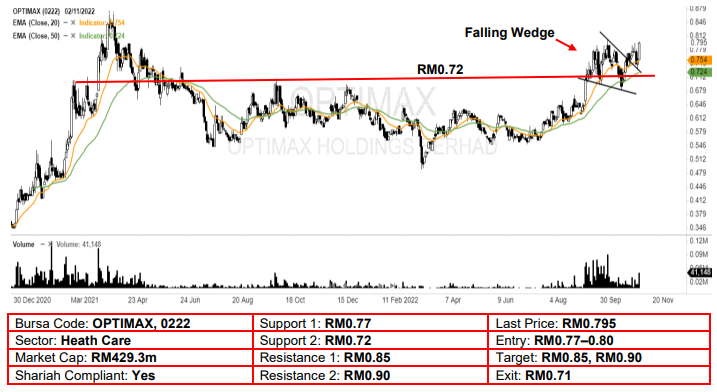

Technical Analysis. We believe the buying interest for Optimax is back after it pushed out from the 7-week bullish falling wedge pattern a few sessions ago. With the stock pushing near its 52-week high, supported by its rising EMAs, likely indicates that the bullish momentum may be picking up. A bullish bias may emerge above the RM0.77 level, with a stop-loss set at RM0.71, below the 50-day EMA. Towards the upside, the near-term resistance level is seen at RM0.85, followed by RM0.90.

Company Background. Optimax Holdings is principally involved in eye specialist services through a network of 13 eye specialist centres in Malaysia comprising a specialist hospital and 12 ambulatory care centres (ACCs). The Company offers eye care services such as cataract surgery, lens exchange, glaucoma, diabetic eye disease treatment, and retinal detachment.

Prospects. (i) Expanding the network of ACCs in Malaysia depend on the location, population, demographics, availability of skilled doctors and the type of business associate arrangement. (ii) Setting up satellite clinics to provide eye examination and consultation services to further improve the market reach. (iii) On 17 December 2021, the group had inked an MoU with Selgate Healthcare Sdn. Bhd. to manage and operate a full-service eye specialist centre at Selgate’s designated hospitals.

Financial Performance. In 1HFY22, the group recorded total revenue of RM50.91m (+56.54% YoY), mainly due to the increase in treatments performed following the easing and relaxation of certain restrictions. The group also recorded net profit of RM7.17m (+116.48% YoY) due to the rise in the number of patients, including those who postponed their refractive and cataract surgeries

Source: AmInvest Research - 3 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024