Stock On The Move - Pantech Group Holdings

AmInvest

Publish date: Thu, 24 Nov 2022, 02:37 PM

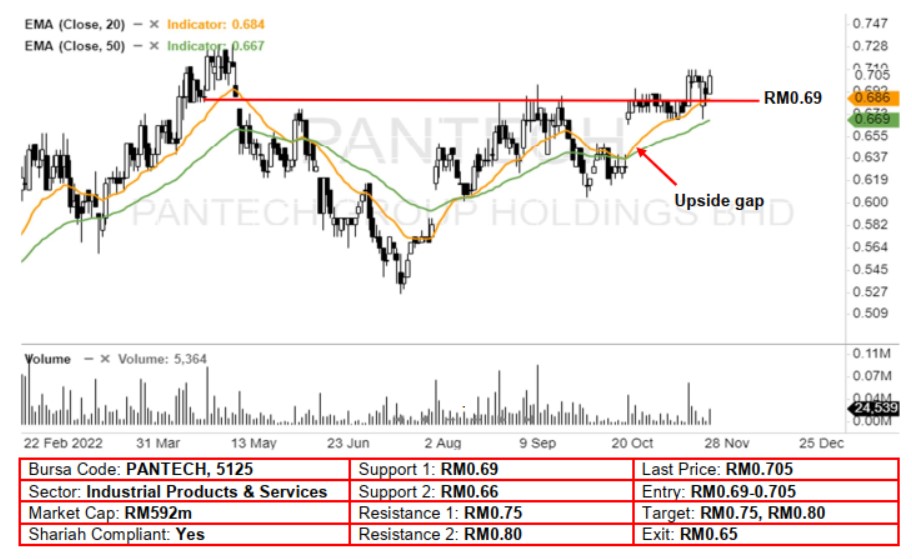

Technical Analysis. Pantech Group may trend higher after pushing above the RM0.69 resistance with a white candle yesterday. In view of the upside gap formed on 19 Oct and coupled with its rising EMAs, this has enhanced its bullish momentum. A bullish bias may emerge above the RM0.69 level, and the bullish momentum should lift it towards the subsequent resistance levels of RM0.75, followed by RM0.80. On the downside, stop-loss is set at RM0.65, below the 50-day EMA.

Company Background. Pantech Group is principally engaged in trading pipes, valves and fittings (PVF) as well as manufacturing pipes, fittings and galvanising. The group serves customers in over 70 countries and operates in 11 locations in Malaysia, Singapore and United Kingdom. Pantech also owns one of the largest galvanising bath in Southern Peninsular Malaysia.

Prospects. (i) One-stop centre for PVF, the group has manufacturing facilities and trading operations to supply over 30,000 types of products - catering to the needs of oil & gas, marine, refinery, palm oil, petrochemical and chemical industries. (ii) Expanding into a wider range of PVF by undertaking continuous research and development to improve manufacturing processes. (iii) In April 2022, the group expanded its manufacturing division with the acquisition of Unity Precision Engineering.

Financial Performance. In 1HFY22, the group recorded a total revenue of RM541m (+90% YoY) with a net profit of RM57m (+88% YoY). This was mainly due to higher deliveries to local oil & gas projects, a better product mix as well as robust export demand for carbon steel and stainless steel manufacturing

Source: AmInvest Research - 24 Nov 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024