Stock on The Move - Greatech Technology

AmInvest

Publish date: Tue, 07 Feb 2023, 09:16 AM

Company Background. Greatech Technology (Greatech) is a leading automation solutions provider involved in the design, development and production of systems, machinery and equipment. Greatech offers customised equipment and systems in solar, energy storage, life science and semiconductors. It manages the business into 3 categories - Production Line Systems (PLS), Single Automated Equipment (SAE) and Provision of Parts & Services (PSS) across North America, Europe and Asia.

Prospects. (i) Positive growth prospects in the renewable energy market driven by ambitious climate targets and decarbonisation efforts from governments worldwide (the group’s PLS help to reduce the cost of generating renewable energy). (ii) Expanded as an important supplier to rapidly growing modern automotive production i.e. e-mobility – as the EV market remains encouraging. (iii) Focus on strategic investments such as expanding new production and assembly facilities for large PLS assembly.

Financial Performance. In 3QFY22, Greatech reported revenue of RM156.9m (+64.5% YoY) with a PAT of RM41m (+41.3% YoY). This was mainly attributable to higher revenue recognised from the PLS of solar industry, driven by several orders secured in 4QFY21. As at 17 Nov 2022, the group’s order book stood at RM887.8m, which is expected to last until 1HFY24.

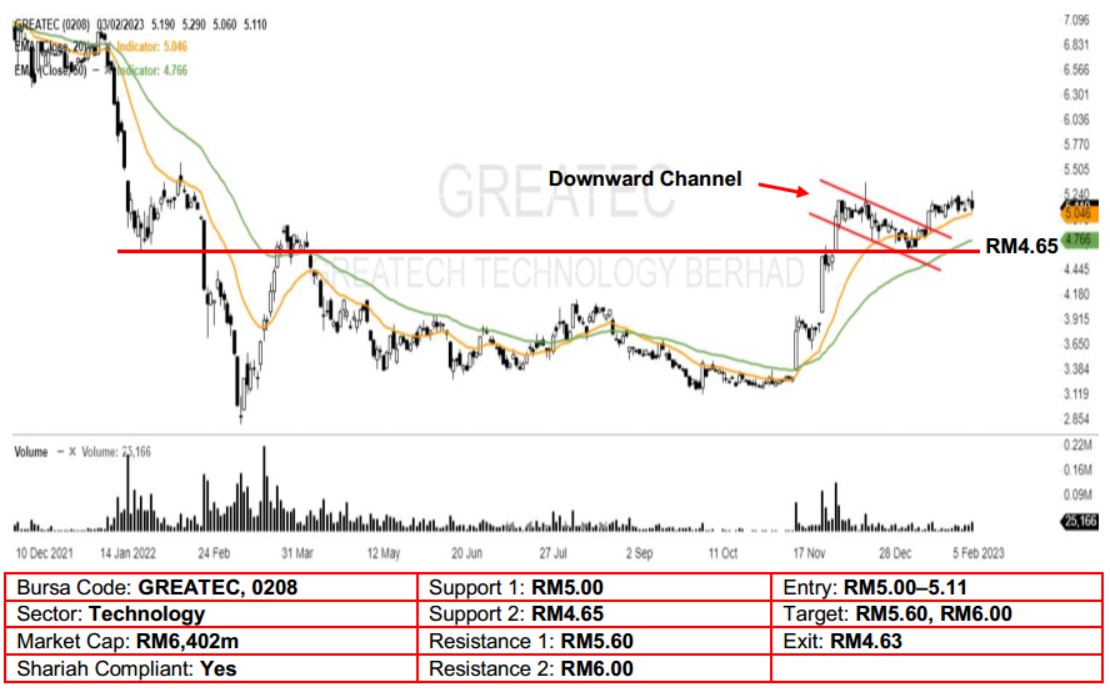

Technical Analysis. We think buying interest for Greatech may have returned after it pushed out from the 1-month downward channel 2 weeks ago. In view that the 20-day and 50-day EMAs are trending upwards, a positive outlook can be expected here. A bullish bias may emerge above the RM5.00 level, with a stop-loss set at RM4.63, below the 4 Jan low. Towards the upside, the near-term resistance level is seen at RM5.60, followed by RM6.00.

Source: AmInvest Research - 7 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024