Stock on the Move - Kotra Industries

AmInvest

Publish date: Mon, 20 Feb 2023, 10:03 AM

Company Background. Kotra Industries (Kotra) is one of the leading pharmaceutical companies in Malaysia, engaged in developing, manufacturing and supplying pharmaceutical & healthcare products. The group has been offering a wide range of healthcare products of over-the-counter (OTC) supplements, nutritional and pharmaceutical products. Kotra’s main brands are Appeton, Axcel and Vaxcel. As at FYE22, the group has 62 OTC and 134 pharmaceutical products registered in Malaysia.

Prospects. (i) Consistently investing in R&D capabilities to sustain competitive advantage, especially in local generic drug market. In FYE22, Kotra launched 4 new generic drugs in the market. (ii) Upgrading the manufacturing facility to produce large orders of healthcare products with minimal incremental capital expenditure over the next 5 to 10 years. (iii) With a global footprint in over 30 countries, Kotra aims to strengthen its presence in existing export markets by expanding the product portfolio.

Financial Performance. In 1QFY23, Kotra posted a higher revenue of RM64.7mil (+26.7% YoY) with a PAT of RM18.2mil (+22.3% YoY) due to increased pharmaceutical product sales to the local market. In FYE22, group revenue grew to RM207.9mil (+30.3% YoY) with a PAT of RM62.1mil (+1.5x YoY). This was mainly attributable to a surge in demand for medication from local markets, where there were major shortages of various prescription and OTC medications in the country.

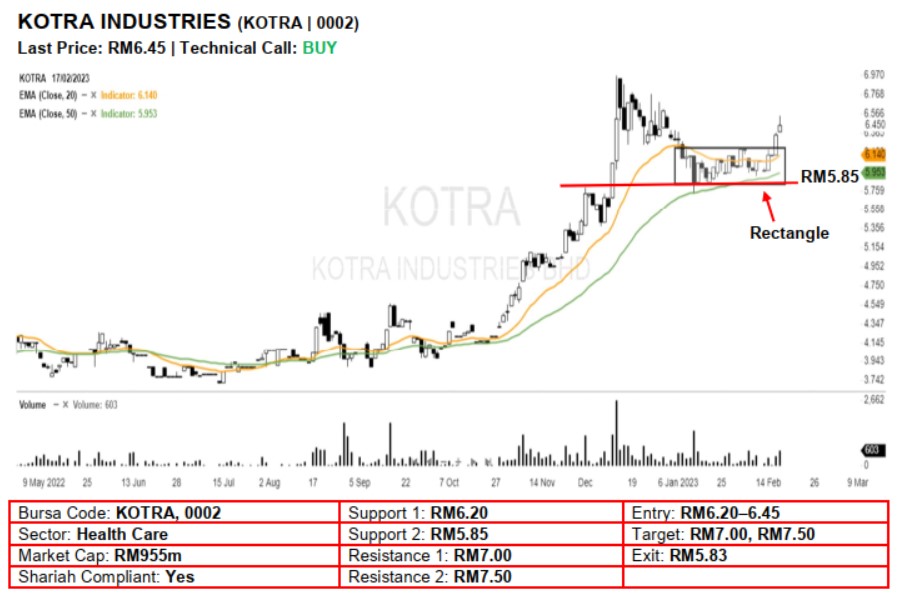

Technical Analysis. Kotra broke out from its 6-week bullish rectangle pattern last Thursday, implying that a bullish reversal sign may have occurred. With the stock posting another white candle and closing near its 52-week high, upward momentum may be present now. A bullish bias may emerge above the RM6.20 level, with a stop-loss set at RM5.83, below the 50-day EMA. Towards the upside, the near-term resistance level is seen at RM7.00, followed by RM7.50.

Source: AmInvest Research - 20 Feb 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024