Stock On The Move - P.I.E. INDUSTRIAL

AmInvest

Publish date: Mon, 06 Mar 2023, 09:23 AM

Company Background. P.I.E. Industrial (PIE) specialises in electronics manufacturing services (EMS) as well as manufacturing of wires and cables for various industrial applications. The group’s core business segment is manufacturing which comprises EMS, raw wire/cable and wire harness divisions. PIE serves MNCs across America, Europe, Asia and Asia Pacific.

Prospects. (i) Aiming to win more new customer orders via its fully built-up vertical integrated manufacturing facilities. (ii) Further upgrade and expand 2 existing plants to engage more new business opportunities. (iii) Growth in raw wire & cable division is expected to continue with consistent profit margin due to increase in demand. (iv) Potential to tap into the electric vehicle (EV) industry as a supplier of EV parts in view of Thailand's rising EV manufacturing industry. (v) Installing solar panels to generate green electric energy to mitigate the surge in electricity cost.

Financial Performance. In 4QFY22, PIE posted a higher revenue of RM341.4mil (+19% YoY) with a PAT of RM27.4mil (+28% YoY), due to higher demand recorded for the EMS division. In FY22, group revenue rose to RM1.16bil (+14% YoY) with a PAT of RM70.8mil (+17% YoY). This was mainly attributable to higher margin product mix, new product orders and increased orders from new & existing customers for EMS activities, raw wire/cable products and wire harness products.

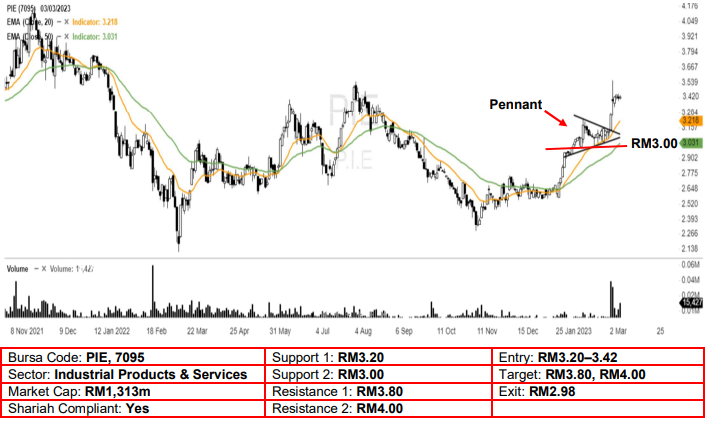

Technical Analysis. We think buying interest for PIE may have returned after it broke out from the 1-month bullish pennant pattern a week ago. With the stock pushing near its 52-week high and together with rising EMAs, the upward momentum may be present now. A bullish bias may emerge above the RM3.20 level, with a stop-loss set at RM2.98, below the 50-day EMA. Towards the upside, near-term resistance level is seen at RM3.80, followed by RM4.00.

Source: AmInvest Research - 6 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024