Stock on the Move - EG Industries

AmInvest

Publish date: Mon, 20 Mar 2023, 09:00 AM

Company Background. EG Industries is a leading electronics manufacturing services (EMS) and vertical integration provider for world-renowned brand names of electrical & electronics products for several industries including consumer electronics, ICT, automotive and telecommunications. It provides services in original equipment manufacturing and original design manufacturing with full turnkey solutions for completed final products assembly, printed circuit board assembly and modular components assembly.

Prospects. (i) Ventured into 5G module manufacturing by producing 5G routers on box-build basis and providing upstream components for 5G optical module transceiver using photonics and semiconductor technologies. (ii) Expanding its product and customer portfolio by introducing new products such as 5G photonic modular products, new range of 5G wireless and wired accessrelated products. (iii) Building a new Smart 4.0 manufacturing plant to expand its manufacturing capacity to accommodate larger clientele. The new plant is expected to commence operations by early 2024.

Financial Performance. In 1HFY23, EG Industries reported higher revenue of RM754.7mil (+35.9% YoY) with a PAT of RM18.2mil (+84.4% YoY). This was primarily driven by higher sales orders from both new and existing customers for consumer electronic products, 5G wireless access and photonics modular-related products.

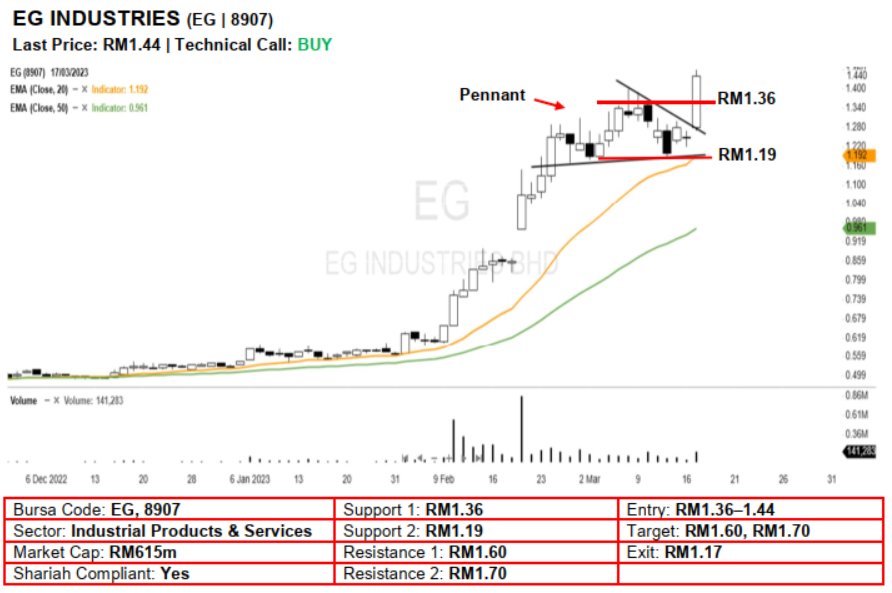

Technical Analysis. EG Industries may trend higher after it formed a long white candle and hit a new multi-year high on Friday. Given that the stock has broken out from the 3-week bullish pennant pattern and supported by its rising EMAs, the near-term bullish trend may still have legs. A bullish bias may emerge above the RM1.36 level, with a stop-loss set at RM1.17, below the 20-day EMA. Towards the upside, the near-term resistance level is seen at RM1.60, followed by RM1.70.

Source: AmInvest Research - 20 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024