Stock On The Move - Nationgate Holdings

AmInvest

Publish date: Mon, 27 Mar 2023, 09:35 AM

Company Background. Nationgate Holdings (NationGate) is an electronic manufacturing services (EMS) provider focusing on the assembly and testing of electronic components & products to produce completed printed circuit boards, semi-finished sub-assemblies and fully-assembled electronic products as well as semiconductor devices. The group’s value-added supporting services include high precision plastic injection moulding, prototyping for manufacturability, supply chain management and packaging.

Prospects. (i) Expanding the group’s EMS service offerings to existing customers which are multinational/international companies with a diversified range of products. (ii) Securing more new customers by leveraging on its track record in the industry. (iii) Riding on the group’s new business collaboration with GoldTek Technology Co. Ltd to further expand its EMS business. (iv) Expansion of its surface mount technology (SMT) assembly capacity to enhance EMS efficiency.

Financial Performance. In 2HFY22, NationGate reported revenue of RM519mil and PAT of RM52.2m. No comparative QoQ figures are available as NationGate is a newly listed company on 12 Jan 2023. Prior to the listing, the group’s revenue recorded a CAGR growth of 53% while the group’s PAT registered a CAGR growth of 235% in FY19-FY21.

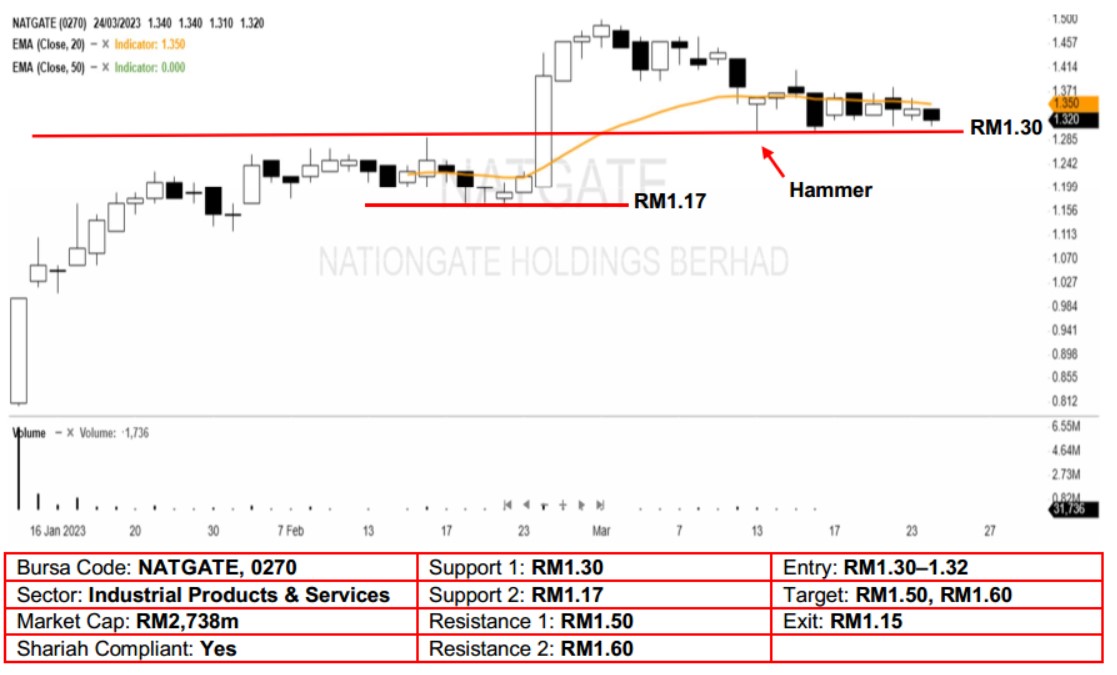

Technical Analysis. We believe buying interest for NationGate is back after it formed a long white candle and pushed above the key RM1.30 resistance a month ago. With the bullish hammer pattern formed on 13 Mar, we expect further upside from here. A bullish bias may emerge above the RM1.30 level, with a stop-loss set at RM1.15, below the 22 Feb low. Towards the upside, the near-term resistance level is seen at RM1.50, followed by RM1.60.

Source: AmInvest Research - 27 Mar 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024