Stock On The Move - Samaiden Group

AmInvest

Publish date: Mon, 03 Apr 2023, 09:44 AM

Company Background. Samaiden Group (Samaiden) is a renewable energy solution provider, principally involved in engineering, procurement, construction and commissioning (EPCC) of solar photovoltaic (PV) systems and power plants. The group’s other business activities include the provision of renewable energy and environmental consulting services, as well as operation and maintenance services.

Prospects. (i) Potential to win more jobs in EPCC of solar PV systems and EPCC for both solar/non-solar power plants due to increasing focus on ESG initiatives by both government and private sectors. (ii) Samaiden expanded regionally by establishing a new company in Vietnam for solar projects and forming a joint venture company in Indonesia for the renewable energy market. (iii) The group collaborated with Chudenko Corporation to expand globally, leveraging on Chudenko's network.

Financial Performance. In 1HFY23, Samaiden reported higher revenue of RM81mil (+52% YoY) with a PAT of RM5mil (+16.4% YoY). This was mainly contributed by progressive EPCC services of projects with higher gross profit margin and increase in number of projects. As at 31 Dec 2022, Samaiden’s total outstanding order book stood at RM270mil, which is expected to contribute positively to the group’s revenue and profit over the next 3 years.

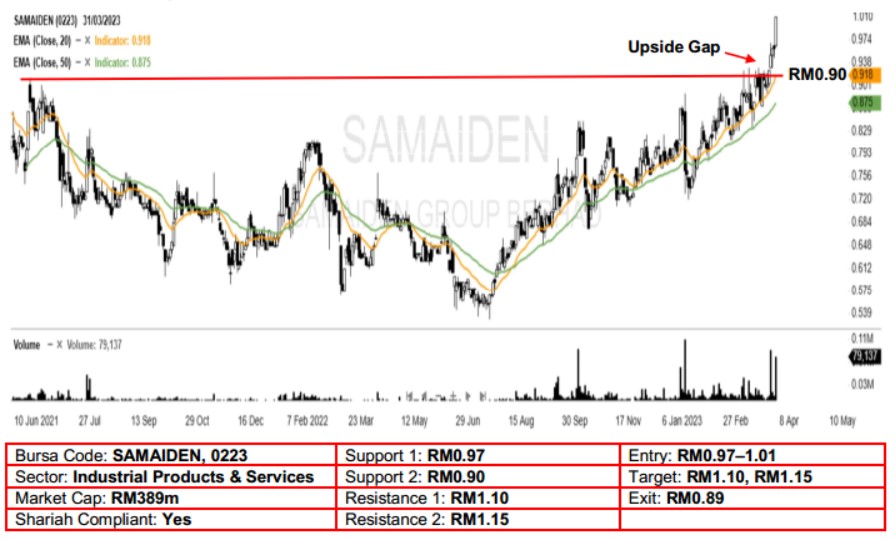

Technical Analysis. Samaiden may rise higher after forming a long white candle and hit a new 52-week high on Friday. In view of the uncovered upside gap formed on 28 Mar and together with its rising EMAs, the upward momentum is likely to pick up further. A bullish bias may emerge above the RM0.97 level, with a stop-loss set at RM0.89, below the 20-day EMA. Towards the upside, nearterm resistance level is seen at RM1.10, followed by RM1.15.

Source: AmInvest Research - 3 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024