Stock on The Move - ITMAX System

AmInvest

Publish date: Mon, 17 Apr 2023, 09:15 AM

Company Background. ITMAX System (ITMAX) is a public space networked systems provider - focusing on lighting, video surveillance, traffic management and communications network services. The group’s integrated systems facilitate data sharing and enable customised and localised systems to meet customer needs and specification as well as other value-added features. ITMAX’s systems are in line with the Malaysian Government’s Smart City Initiatives.

Prospects. (i) Network and telecommunication infrastructure expansion to expand connectivity via investments in communication network facilities. (ii) Geographical expansion to provide public space networked systems in other states. (iii) Expand to new target segments to address opportunities in townships, malls, office towers, hospitals and healthcare facilities. (iv) Expansion of R&D capabilities via setting up of township and campus testbeds for smart city applications.

Financial Performance. In 4QFY22, ITMAX reported higher revenue of RM35.8mil (+16.2% QoQ) with a PAT of RM12.8mil (+4.4% QoQ). This was mainly due to the increase in demand for video surveillance/analytics services and telecommunication/network infrastructure services. Prior to listing on 13 Dec 2022, the group’s revenue recorded a CAGR growth of 46% while the group’s PAT registered a CAGR growth of 327% in FY19-FY21.

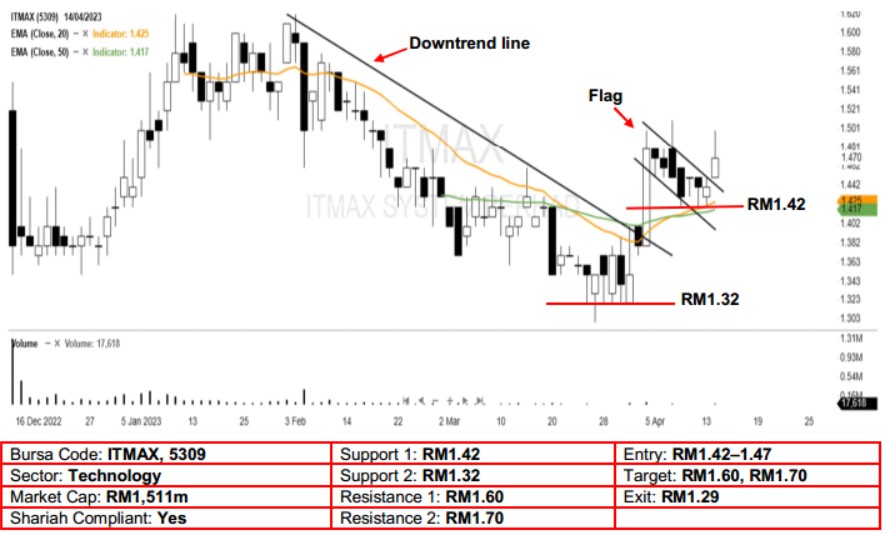

Technical Analysis. We think buying interest for ITMAX may have returned after it broke out from the 2-week bullish flag pattern on Friday. As the stock also broke out of the 2-month downtrend line derived from Feb high, it may see additional strength in the near term. A bullish bias may emerge above the RM1.42 level, with a stop-loss set at RM1.29, below the 27 Mar low. Towards the upside, the near-term resistance level is seen at RM1.60, followed by RM1.70.

Source: AmInvest Research - 17 Apr 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on AmInvest Research Reports

Created by AmInvest | Nov 18, 2024

Created by AmInvest | Nov 15, 2024